Business

Core Inflation Hits 2.9% in July Amid Economic Concerns

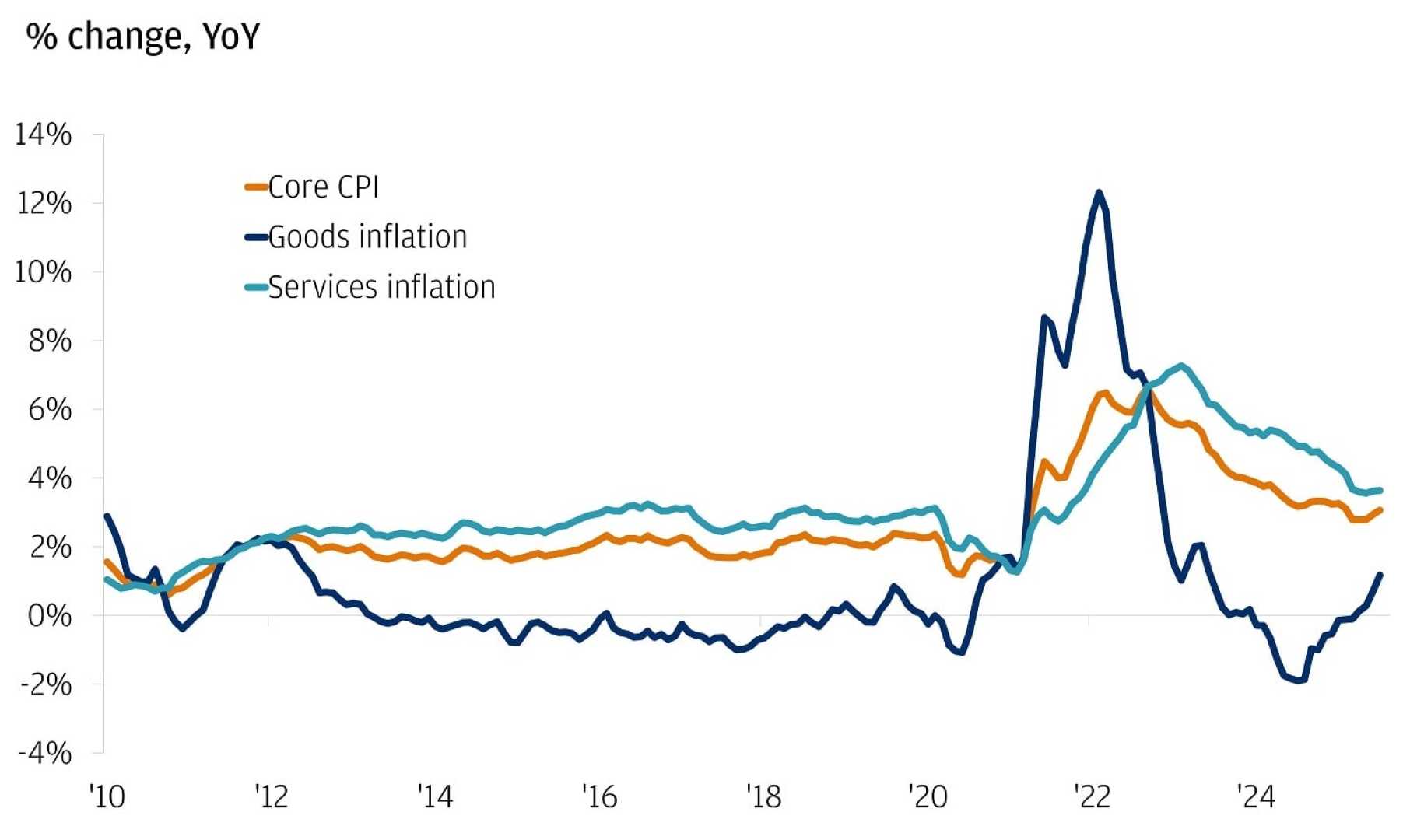

WASHINGTON — Core inflation in the United States rose to 2.9% in July, according to the latest report from the Commerce Department, released Friday. This increase marks a 0.1 percentage point rise from June and is the highest annual rate since February. The Federal Reserve closely monitors this figure, which excludes volatile food and energy prices, as a measure of long-term trends.

The core Personal Consumption Expenditures (PCE) index showed a 0.3% increase on a monthly basis, aligning with economic forecasts. The report also indicated that the overall inflation rate for all items, including food and energy, was 2.6%, maintaining the same annual rate as in June.

Despite the rising inflation, analysts remain optimistic about the potential for the Fed to lower interest rates in the upcoming month. Fed Governor Christopher Waller has expressed support for a rate cut, particularly if labor market statistics continue to show weaknesses. ‘The Fed opened the door to rate cuts, but the size of that opening is going to depend on whether labor-market weakness continues to look like a bigger risk than rising inflation,’ said Ellen Zentner, chief economic strategist at Morgan Stanley Wealth Management.

Additionally, the report revealed a 0.5% rise in consumer spending in July, indicating consumer confidence despite higher prices. Personal income also grew by 0.4%, influenced primarily by wage increases.

Energy prices fell by 2.7% annually, while food prices increased by 1.9%. Services prices surged by 3.6%, comprising the majority of the monthly increase, as goods prices dropped slightly. Overall, inflation remains above the Fed’s 2% target, illustrating persistent economic challenges.