Business

Education Department Halts Key Student Loan Forgiveness Applications

WASHINGTON, D.C. — The U.S. Department of Education on Friday unexpectedly removed essential online applications for student loan forgiveness and repayment options, exacerbating challenges within the federal student loan system. The department’s actions come in the wake of a recent 8th Circuit Court of Appeals ruling that extended a preliminary injunction against several income-driven repayment plans.

The applications affected include the online portal for income-driven repayment (IDR) plans and the application for federal Direct consolidation loans. These programs allow borrowers to adjust their monthly payments based on income and family size, ultimately leading to forgiveness of remaining loan balances after 20 or 25 years. Without access to these applications, millions of borrowers face significant barriers in seeking lower payments and loan forgiveness, particularly those utilizing the related Public Service Loan Forgiveness (PSLF) program.

The 8th Circuit’s ruling last week targeted President Joe Biden‘s new SAVE plan, aimed at providing more affordable repayment options. The court asserted that neither the Secretary of Education nor the Biden administration had the legal authority to implement such comprehensive forgiveness measures without Congressional approval, casting doubt on the viability of multiple IDR options.

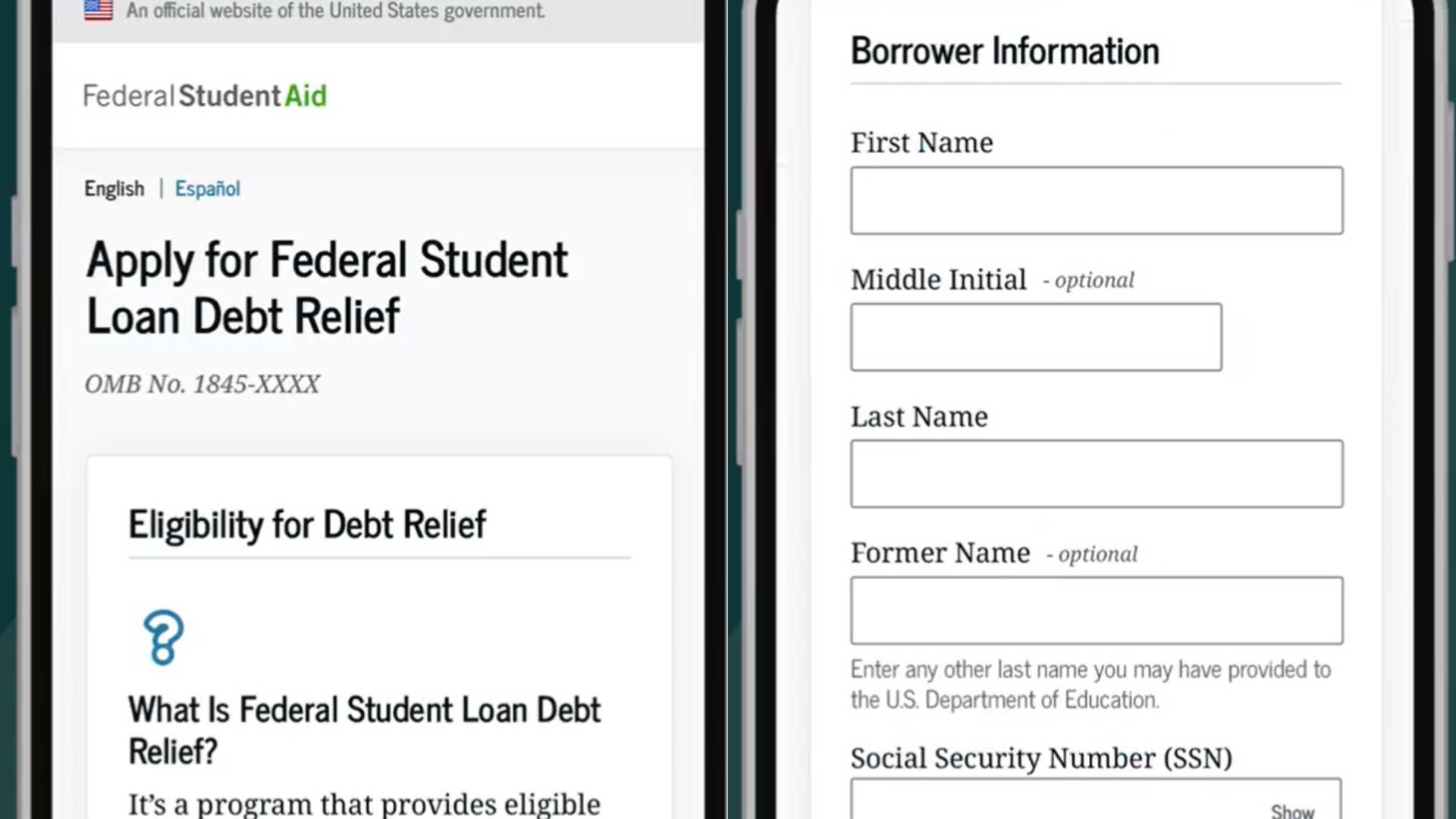

“A federal court issued an injunction preventing the U.S. Department of Education from implementing the Saving on a Valuable Education (SAVE) Plan and other income-driven repayment (IDR) plans,” the department communicated on its website, now displaying grayed-out application buttons for IDR and consolidation loans.

Despite the removal of these online resources, borrowers may still apply via paper forms, but they must provide proof of income, such as recent tax returns or pay stubs. The uncertainty surrounding when online services will resume adds to the anxiety among students amidst an ongoing series of court challenges.

Advocates for borrowers express concern over the lack of communication from the Department of Education regarding the ongoing changes. Persis Yu, deputy executive director of the Student Borrower Protection Center, stated, “This was a choice by the Trump Administration and a cruel one that will inflict massive pain on millions of working families.”

Although affected borrowers can temporarily submit paper applications, the Department of Education’s delays in processing IDR applications could have dire consequences. This follows a multi-month backlog that occurred earlier in the year after the application removal in August. Many borrowers face impending recertification deadlines and may struggle to avoid default on their loans.

Legal experts suggest that the complexities of these ongoing changes may not be fully understood by many borrowers, who are now weighing their options amid higher potential financial burdens under traditional repayment plans. The Department of Education’s guidance confirms that forgiveness under SAVE, along with some IDR plans, remains blocked, further complicating the repayment landscape.

As legal battles over the SAVE plan and other IDR options unfold, advocates remain vigilant. They urge borrowers to stay informed about their options and remain proactive in managing their student loan payments. The ongoing fluidity in the federal student loan system underscores the need for clear communication from officials and assurance for borrowers caught in the crossfire of policy shifts.