Business

European Stocks Mixed Ahead of French Confidence Vote

Zurich, Switzerland – European shares faced mixed outcomes on Thursday as attention turned towards a critical confidence vote in France and the release of various corporate earnings reports.

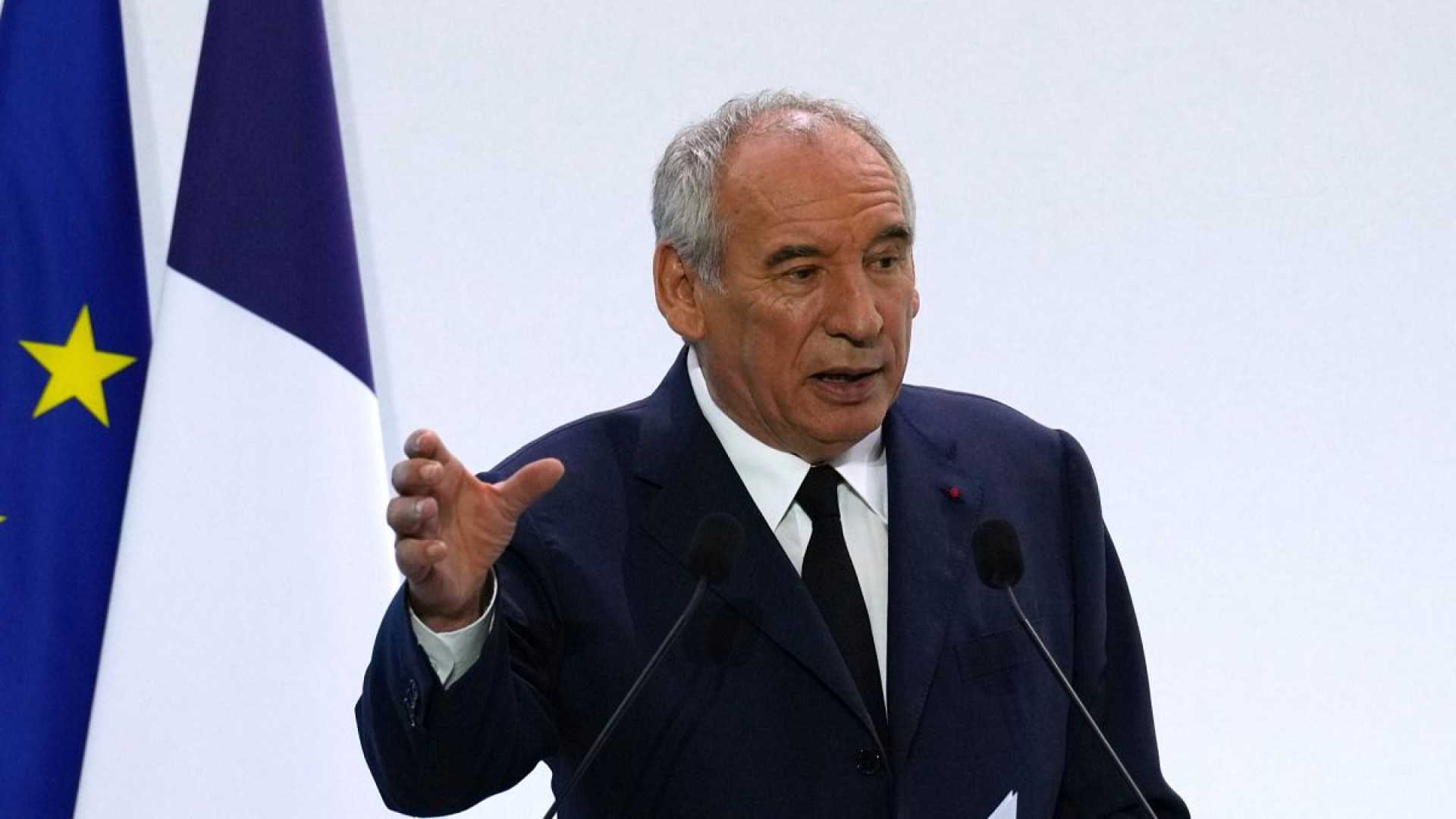

Prime Minister Sebastien Lecornu‘s government is expected to survive the imminent vote after he proposed suspending pension reforms to garner support from left-leaning lawmakers. This move comes amid rising political tension and calls for reform.

The start of earnings season has seen notable contributions from major companies, particularly Nestlé, which announced plans to cut 16,000 jobs, leading to a 7% increase in its stock price. This has provided some upward momentum for the Stoxx 600 index.

Meanwhile, the U.K. economy showed slight growth, indicating a period of slow progress, which analysts attribute to cautious consumer behavior ahead of the upcoming budget on November 26. Mattioli Woods commented that this may predict continued weak growth.

Across the Atlantic, the U.S. government shutdown entered its third week. Escalating trade tensions with China persist, alongside expectations for the Federal Reserve to implement further interest-rate cuts, as indicated by the latest Beige Book report.

Stock futures in the U.S. showed promise, bolstered by a strong performance from banks. Analysts at Evercore ISI suggest the Fed might announce a 25-basis-point rate cut this month, with additional cuts likely in December.

Market observers remain watchful for speeches from Fed officials, including Christopher Waller and Stephen Miran, scheduled for later today.

The euro remained steady ahead of the confidence vote, with expectations of positive short-term outcomes; however, ING warns that the long-term fiscal consolidation may become more challenging.

In commodities, gold prices have reached a new record as investors navigate uncertainty amid the U.S.-China trade situation and continuing government shutdown.

Overall, analysts remain cautious as the market adjusts to these developments, with sentiment fluctuating based on global economic indicators.