Business

Gen X Faces Retirement Crisis: Savings Fall Short of Needs

ORLANDO, Fla. — As Generation X approaches retirement age, this cohort of 65 million Americans born between 1965 and 1980 is confronting a stark financial reality. Known for their independence and adaptability, Gen Xers are now grappling with inadequate retirement savings, with many households having saved only a fraction of the $1.5 million recommended for a comfortable retirement.

Raised as “latchkey kids” and shaped by significant societal changes, Gen Xers developed a strong sense of self-reliance. However, this has not translated into financial security. According to a 2024 study by Natixis Investment Managers, 82% of Gen Xers acknowledge bearing primary responsibility for financing their retirement, yet nearly half (47%) worry they may not be able to work long enough to secure it.

Gen Xers face a unique set of challenges, including high inflation, rising living costs, and the dual burden of supporting aging parents and adult children. Pew Research reports that nearly half of Gen Xers are navigating this “sandwich generation” role, managing medical appointments and financial matters for elderly parents while helping their children with college tuition or living expenses. This juggling act consumes significant time and resources, with many devoting over 24 hours per week to caregiving, according to the National Alliance for Caregiving.

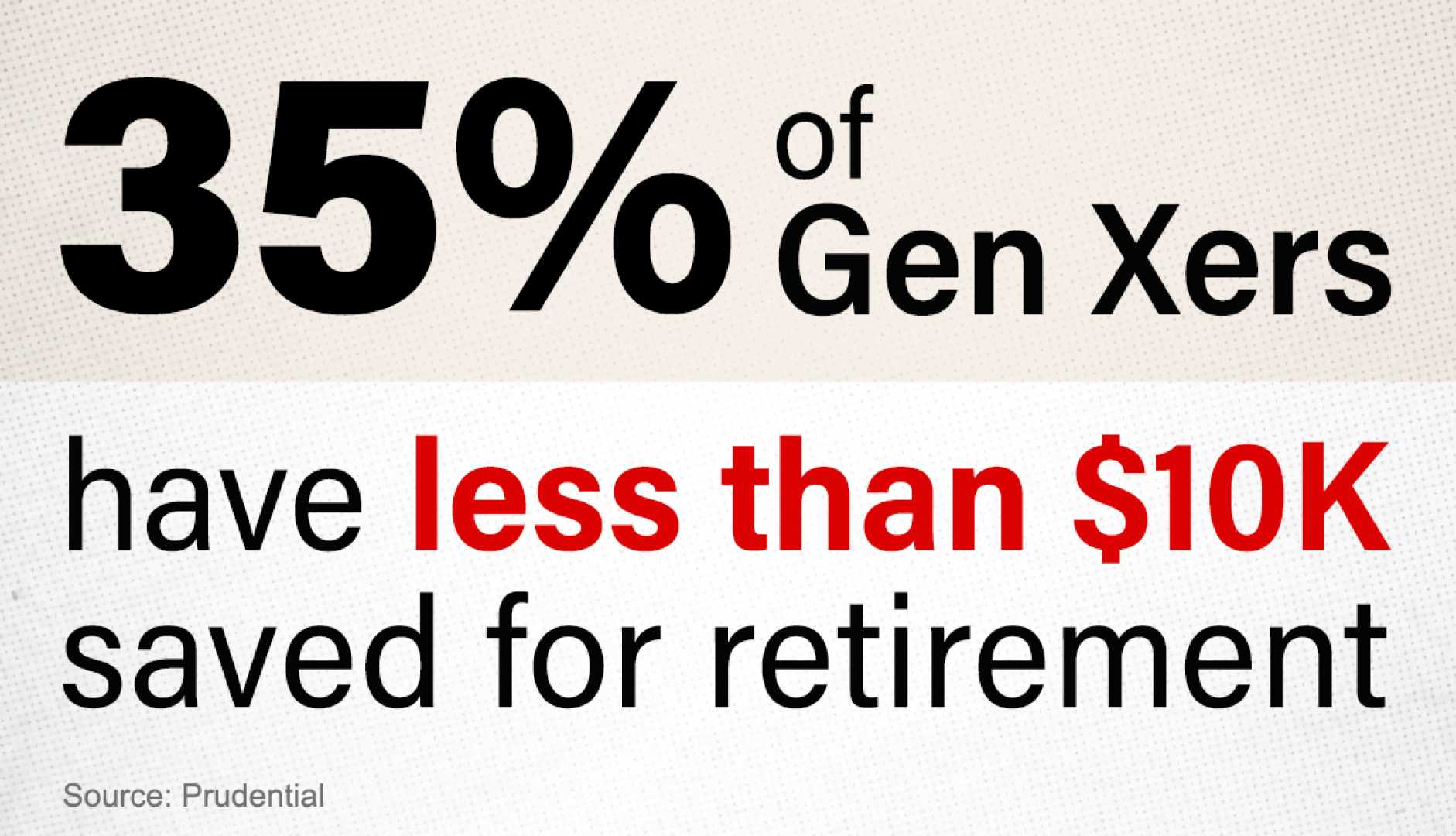

Financial pressures are compounded by stagnant wages and student loan debt from early in their careers. Investopedia reports that Gen X is on track to become the first generation worse off in retirement than their parents. Only 25% are pinning their hopes on Social Security, according to a Transamerica survey, while many have less than $50,000 saved for retirement. Fidelity estimates that a couple retiring today will need approximately $300,000 for healthcare expenses alone—a figure few Gen Xers are prepared to meet.

Despite these challenges, Gen Xers are in their peak earning years and increasingly occupying positions of power in the corporate world. Financial advisors recommend maximizing retirement savings and taking advantage of catch-up contributions to improve their financial prospects. However, with 48% of Gen Xers believing that achieving a secure retirement will require a “miracle,” the road ahead remains uncertain.

Over the next two decades, around $84 trillion of wealth will be transferred from Baby Boomers to younger generations, including Gen X. For many, this inheritance may be crucial to bridging the retirement savings gap. In the meantime, experts urge Gen Xers to prioritize retirement planning and seek professional advice to navigate this critical phase of their financial lives.