Politics

Government Approves Unified Pension Scheme for Employees

On August 24, 2024, the government, led by Prime Minister Narendra Modi, announced the approval of the Unified Pension Scheme (UPS), which is designed to benefit approximately 23 lakh government employees.

This new pension scheme is set to take effect from April 1, 2025. Employees currently enrolled in the National Pension Scheme (NPS) will have the option to continue with the NPS or switch to the new UPS.

Union Minister Ashwini Vaishnaw emphasized that the UPS will have a positive impact on the well-being of 23 lakh government workers. Prime Minister Modi took to social media platform X, expressing his commitment to the welfare and secure future of government employees.

The UPS will be applicable to all central government employees who are scheduled to retire on or before March 31, 2025, and will include provisions for arrears. In a statement on X, PM Modi shared that he had met with representatives from the Joint Consultative Machinery for Central Government employees, who expressed their support for the Cabinet’s decision regarding the UPS.

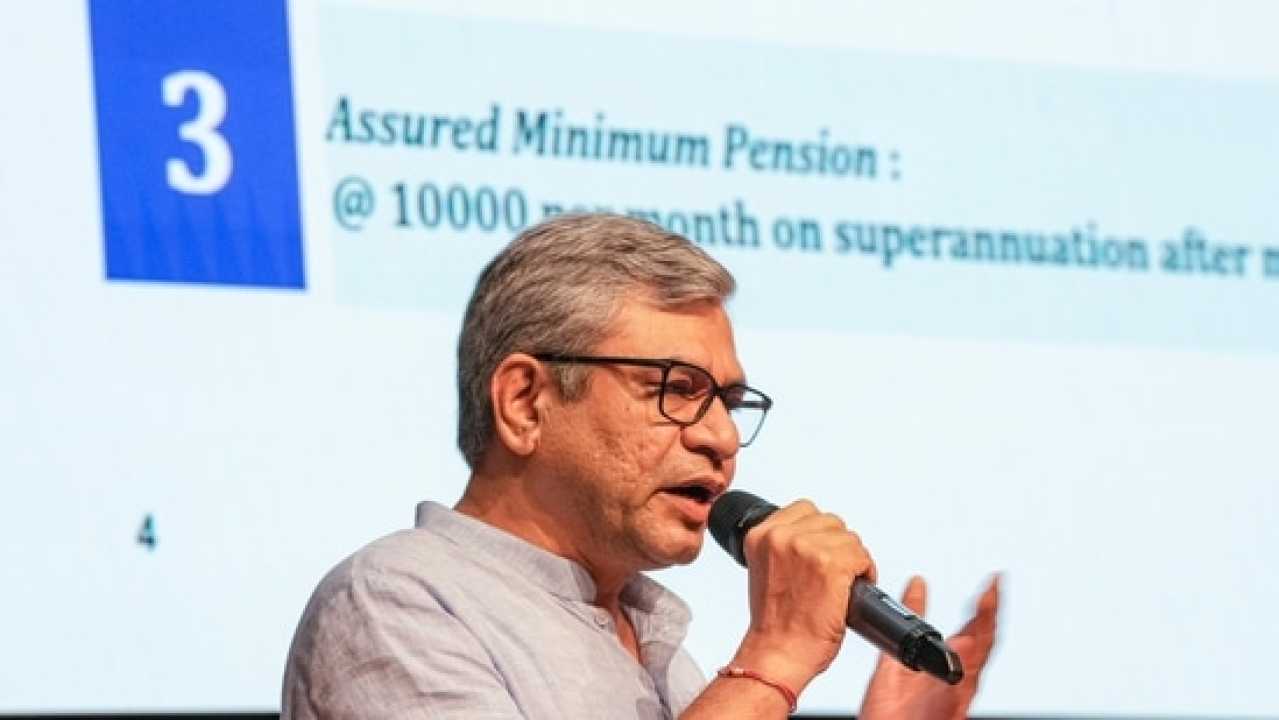

It is important to note that employees who began their service after April 1, 2004, are currently under the NPS. The new UPS scheme offers assured pensions to employees who have served for at least 25 years, while those with a minimum of 10 years of service are entitled to a proportional or minimum pension of Rs. 10,000 per month.

Additively, the UPS will provide an Assured Family Pension in the event of an employee’s death, calculated at 60 percent of the pension amount immediately before their demise, starting from the next financial year. This provision aims to enhance the financial security of government employees and their families.

The UPS also incorporates inflation indexation on assured pensions, family pensions, and minimum pensions, mirroring the current system applicable to service employees. The indexation will be based on the All India Consumer Price Index for Industrial Workers (AICPI-IW).

Moreover, the scheme includes additional benefits such as gratuity and a lump sum payment upon superannuation, thereby broadening the financial support available for retired employees.