Business

UK Inflation Hits 3.6% Amid Rising Food and Fuel Costs

London, UK – Prices in the United Kingdom rose by 3.6% in the 12 months to June 2025, driven primarily by increases in the cost of food and fuel. This marks a continuation of inflation remaining above the Bank of England‘s target of 2%.

The Bank of England adjusts interest rates to manage inflation and has implemented five cuts since August 2024. Inflation represents the overall increase in prices over time, influencing factors such as household expenditures on everyday items, which are tracked by the Office for National Statistics (ONS).

The core inflation rate, which excludes food and energy prices, increased to 3.7%, up from 3.5% in May. The main Consumer Price Index (CPI) measure also rose from 3.4% in May. Despite a decline from a peak of 11.1% in October 2022—reflecting the highest rate in 40 years—prices are not decreasing; they are merely increasing at a slower pace.

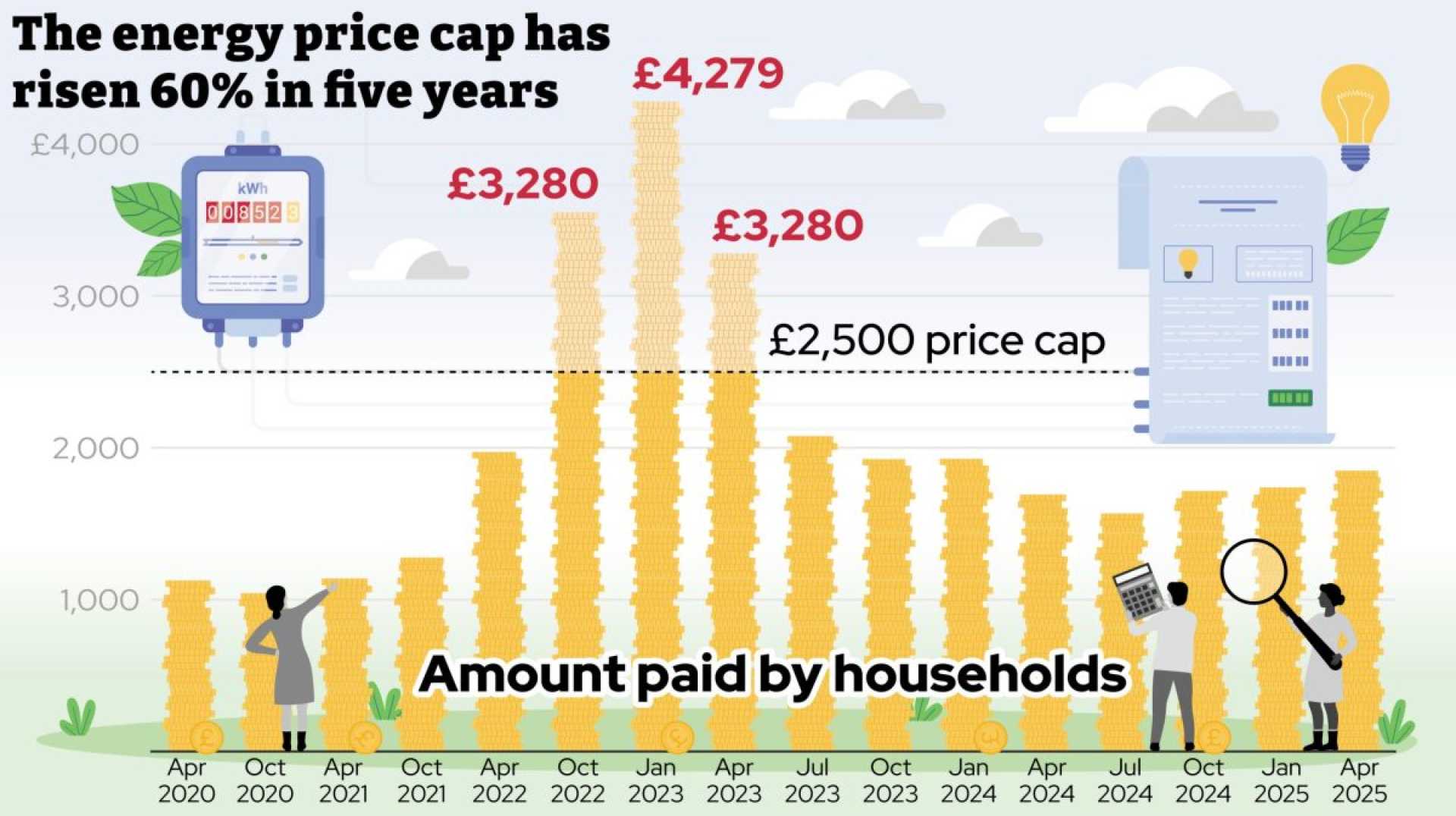

Food prices, a significant contributor to the current inflation rate, jumped by 4.5%, with experts citing rising ingredient costs for items like chocolate, butter, coffee, and meat as contributing factors. Additionally, fuel prices saw only a slight drop between May and June 2025 compared to a more significant decrease in the previous year.

In response to high inflation, the Bank of England raised interest rates to 5.25%, the highest in 16 years. This approach aims to curb spending by making borrowing more expensive, thus reducing demand for goods and helping to cool price increases.

However, higher borrowing costs also pose risks for the economy, potentially leading to reduced consumer spending and job growth. Recent figures indicate a rise in mortgage repayments, putting strain on homeowners, while businesses may limit borrowing, affecting job creation.

Despite inflation remaining above the Bank’s target, the economy has been relatively stagnant, prompting the Bank to lower rates to encourage spending and investment. Recent job market indicators show falling payroll numbers, fewer vacancies, and an increase in the unemployment rate to 4.7% in May 2025.

Bank of England Governor Andrew Bailey stated that future rate cuts will be implemented cautiously. The latest economic projections suggest an inflation peak of 4% in September, double the Bank’s target, and above previous estimates.

In comparison, inflation rates in the Eurozone stood at 2.0% in June, following rate cuts from the European Central Bank, while the Federal Reserve in the United States has maintained its interest rates amid ongoing economic monitoring.