Business

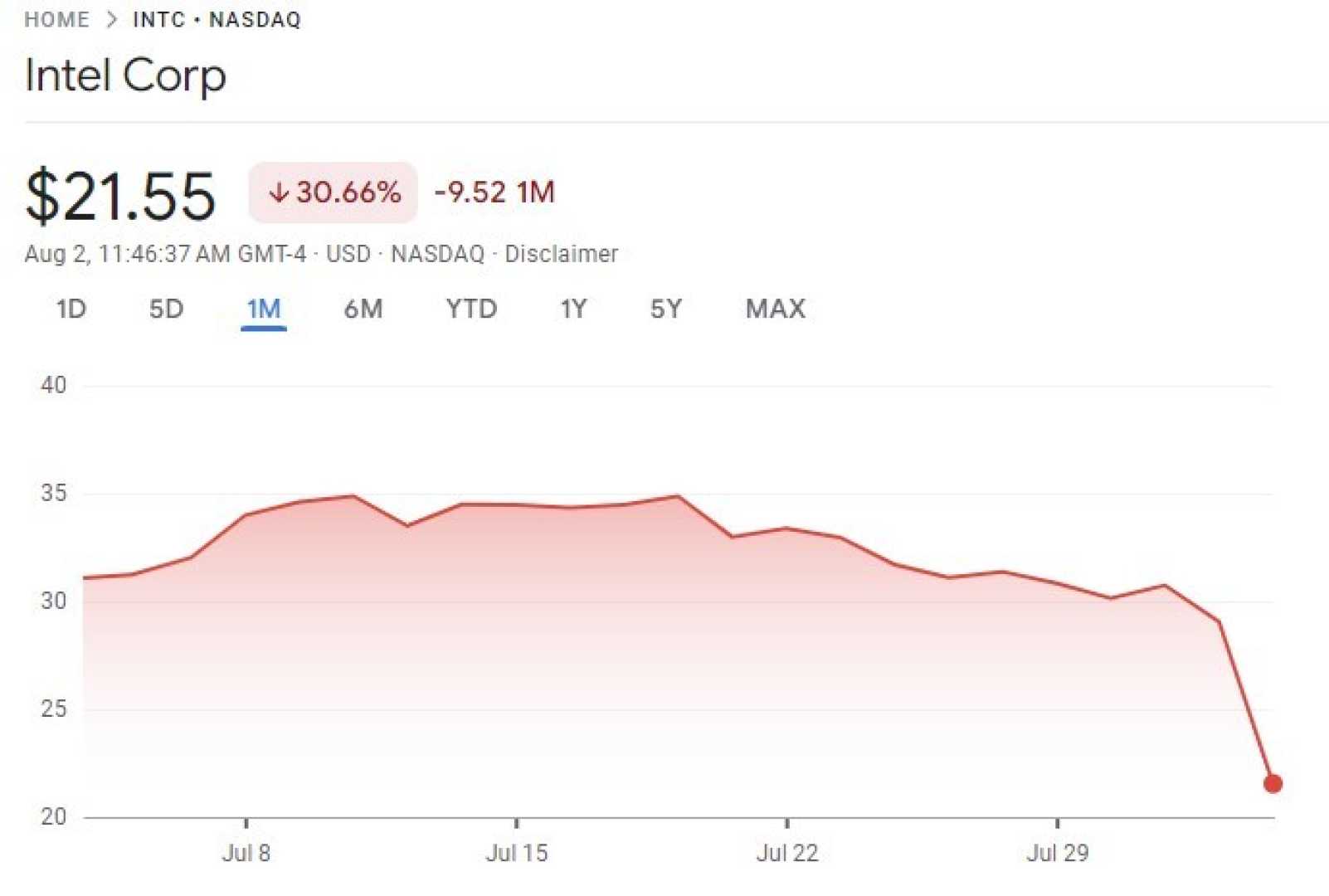

Intel’s Stock Plummets 60% in 2024 Amid Acquisition Rumors

SANTA CLARA, Calif. — Intel Corporation (NASDAQ: INTC) investors faced a challenging year in 2024 as the chipmaker’s stock lost 60% of its value, starkly contrasting with the double- and triple-digit gains of its industry peers. The company, once a dominant force in the semiconductor industry, has been the subject of acquisition rumors, including speculation involving Elon Musk, which briefly boosted its share price.

Despite the downturn, investor Paul Franke sees potential for a turnaround. With Intel’s Q4 2024 earnings report scheduled for January 30, Franke points to the company’s historically low valuation and potential catalysts such as restructuring, takeover offers, and asset spin-offs. “If you want a deep-value Big Tech name to add to your portfolio, Intel may be the only game in town,” Franke stated, highlighting Intel’s trading at a 60% to 70% discount compared to other semiconductor giants.

Intel’s stock saw a 9% increase on January 17 following reports of a mystery buyer’s interest, underscoring the market’s sensitivity to acquisition rumors. The company’s book value multiple, standing at just over 0.9, suggests significant undervaluation, especially when compared to the S&P 500 average of more than 5 times book value.

Intel’s strategic importance is bolstered by its extensive foundry presence in the U.S., a critical factor as the country seeks to reclaim its share of global chip production, which has dwindled from 40% in 1990 to 12% in 2020. The Biden administration‘s CHIPS Act, allocating $53 billion to domestic chip production, could further benefit Intel, despite competition from foreign companies like Samsung and Taiwan Semiconductor Manufacturing Company.

While Intel’s technical lag behind competitors like AMD and Nvidia has been a concern, the company remains a significant player in the semiconductor industry, generating nearly $36 billion in product revenue in the first nine months of 2024. The demand for less technically advanced chips, which still constitutes a substantial market, offers Intel a pathway to recovery and growth.

As the semiconductor industry continues to evolve, Intel’s future remains uncertain. However, its current undervaluation and strategic initiatives present a compelling case for investors seeking value in a volatile market. The potential for acquisition, coupled with industry and political support, could herald a new chapter for the beleaguered chipmaker.