Business

Investor Focus on Inflation Data as Markets Face Political Challenges

LONDON, United Kingdom – Investors are keenly awaiting U.S. inflation data today that may influence the Federal Reserve’s upcoming policy decisions. The anticipated release of the core personal consumption expenditures (PCE) price index, the Fed’s preferred inflation measure, is expected to show a steady monthly increase of 0.3% and an annual rate of 2.9%. This follows prior indications that President Donald Trump‘s tariffs could impact consumer prices.

Despite some uncertainty, markets appear to have priced in a 25-basis-point rate cut from the Fed at its September meeting. Fed Governor Christopher Waller emphasized on Thursday his support for rate cuts to align policy rates closer to neutral levels. Meanwhile, the dollar’s performance is facing downward pressure due to concerns over the Fed’s independence amid Trump’s intensified influence over monetary policy.

Fed Governor Lisa Cook filed a lawsuit this week claiming the President lacks authority to remove her from office following Trump’s announcement of her impending dismissal. This legal battle adds an additional layer of complexity to the Fed’s operating environment.

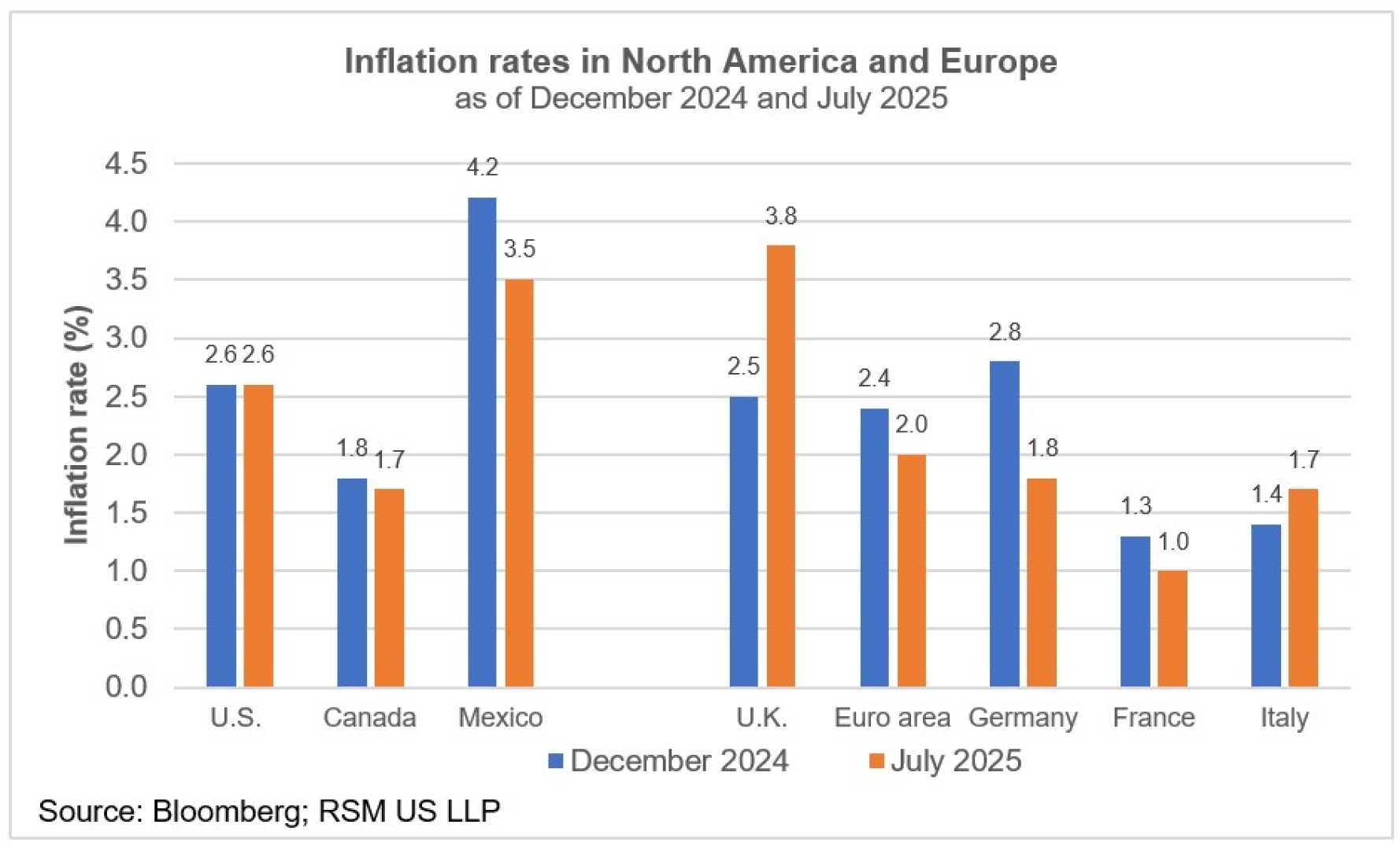

On the European front, inflation data from France and Germany is also expected later today, with expectations that the European Central Bank (ECB) will maintain current rates. ECB discussions on inflation trends are intensifying as policymakers prepare for potential economic adjustments in response to external pressures, notably U.S. tariffs.

Key reports to monitor today include the U.S. PCE price index for July, along with German and French preliminary CPI figures for August. Investor sentiment is cautious as political dynamics in the U.S. and concerns over economic stability in Europe loom large.