Business

IRS Begins Early Refund Issuance; Key Dates Announced for Tax Year 2025

WASHINGTON, D.C. — The Internal Revenue Service (IRS) is set to commence issuing federal tax refunds starting February 18, 2025, signaling the beginning of the tax season for millions of American taxpayers. With more than 140 million income tax returns expected to be filed this year, taxpayers are advised to stay informed about potential refund timelines, which could provide crucial financial relief.

The average federal tax refund for last filing season was approximately $2,825, which serves as an important financial lifeline for many Americans. Recent studies show that 37% of taxpayers rely on their refunds to cover living expenses, a figure that rises to 50% among millennials.

Tax filing methods significantly influence when refunds are disbursed. According to the IRS, those who choose electronic filing (e-filing) coupled with direct deposit can expect to receive their refunds within about three weeks after the IRS accepts their return. In contrast, paper returns generally take longer, with refunds issued anywhere from four to nine weeks after acceptance.

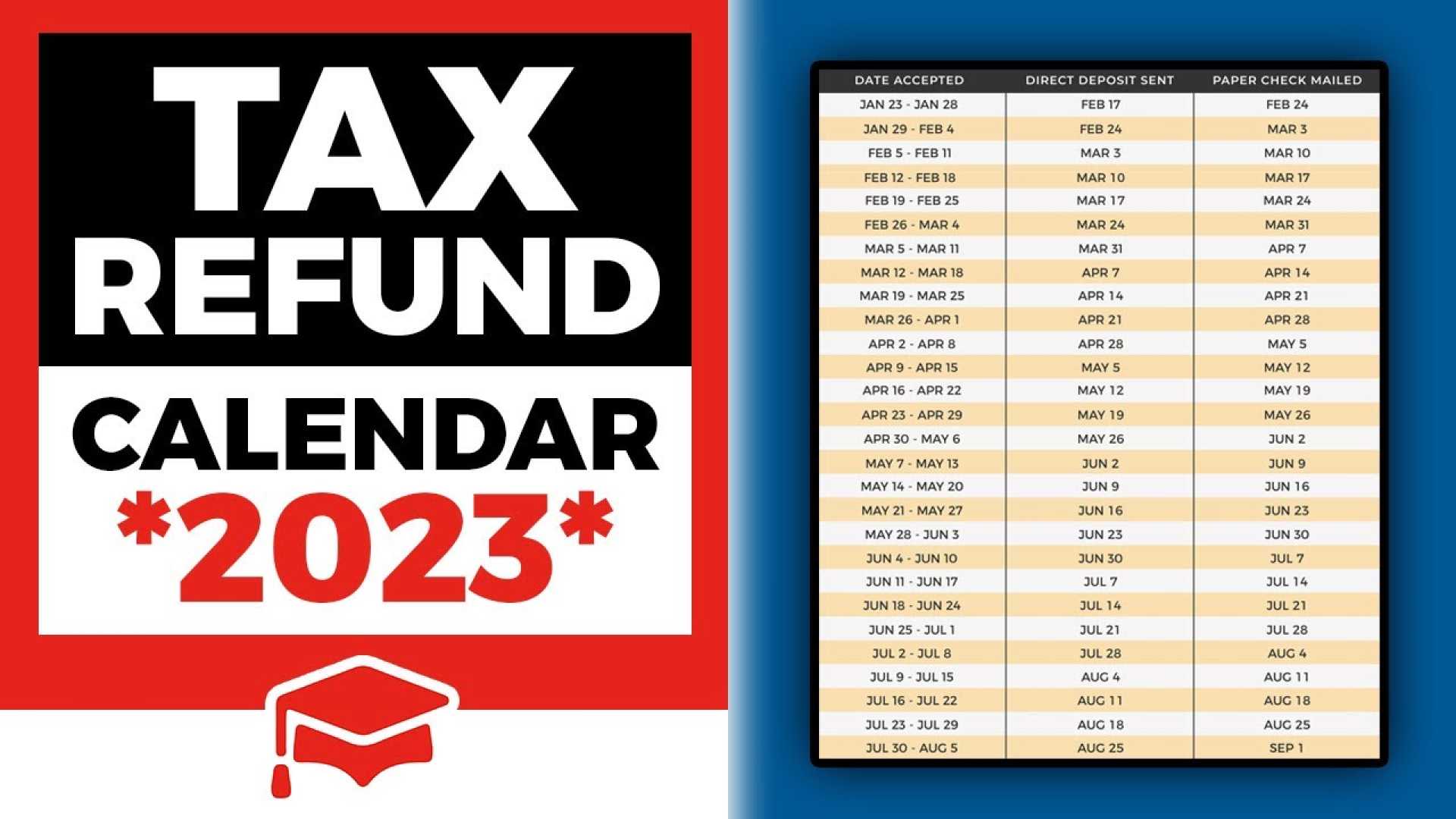

The IRS provided a detailed schedule indicating estimated refund arrival dates based on specific filing dates. For example, returns filed on January 27 could see direct deposits as early as February 17, while those opting for mailed checks may wait until March 28. The IRS noted that these timelines are subject to change, depending on various factors such as processing delays and any claims for certain tax credits.

“The timing of your refund can depend on how you filed and how you prefer to receive it,” said a spokesperson for the IRS. “Errors in tax forms or processing delays can further extend the waiting period.”

Taxpayers are encouraged to monitor their refund statuses through the IRS’s “Where’s My Refund?” tool, which provides updates approximately 24 hours after the IRS has acknowledged the return. Additionally, individuals can call the IRS refund hotline at 800-829-1954 for automated assistance.

While the federal refund process is fairly standardized, states have their own refund schedules, often varying significantly. Paper filers in some states might experience refunds taking up to three months, compared to five to six weeks for electronic submitters. States like California and Georgia allow taxpayers to check their refund statuses online for improved transparency.

The IRS cautions that not all filers will receive refunds, as refunds are typically issued only to those who have overpaid their taxes. Overpayments generally occur when excess amounts are withheld from paychecks throughout the year.

Tax filers should remain proactive in ensuring that their forms are accurate to minimize delays. “If the IRS requires further information to process your return, they will reach out by mail,” the IRS representative added.