News

IRS Sends $2.4 Billion in Unclaimed Stimulus Payments to 1 Million Taxpayers

DETROIT, Mich. — The Internal Revenue Service (IRS) is distributing approximately $2.4 billion in unclaimed stimulus payments to 1 million taxpayers who failed to claim the Recovery Rebate Credit on their 2021 tax returns. The payments, which began in December, are being sent automatically to eligible individuals without requiring them to file amended returns.

The Recovery Rebate Credit was part of the third round of COVID-19 stimulus payments, offering up to $1,400 per person or $2,800 for married couples filing jointly, with additional amounts for qualifying dependents. Many taxpayers overlooked the credit when filing their 2021 returns, either leaving the line blank or entering $0 despite being eligible.

“Looking at our internal data, we realized that 1 million taxpayers overlooked claiming this complex credit when they were actually eligible,” said IRS Commissioner Danny Werfel in a Dec. 20 statement. “To minimize headaches and get this money to eligible taxpayers, we’re making these payments automatic.”

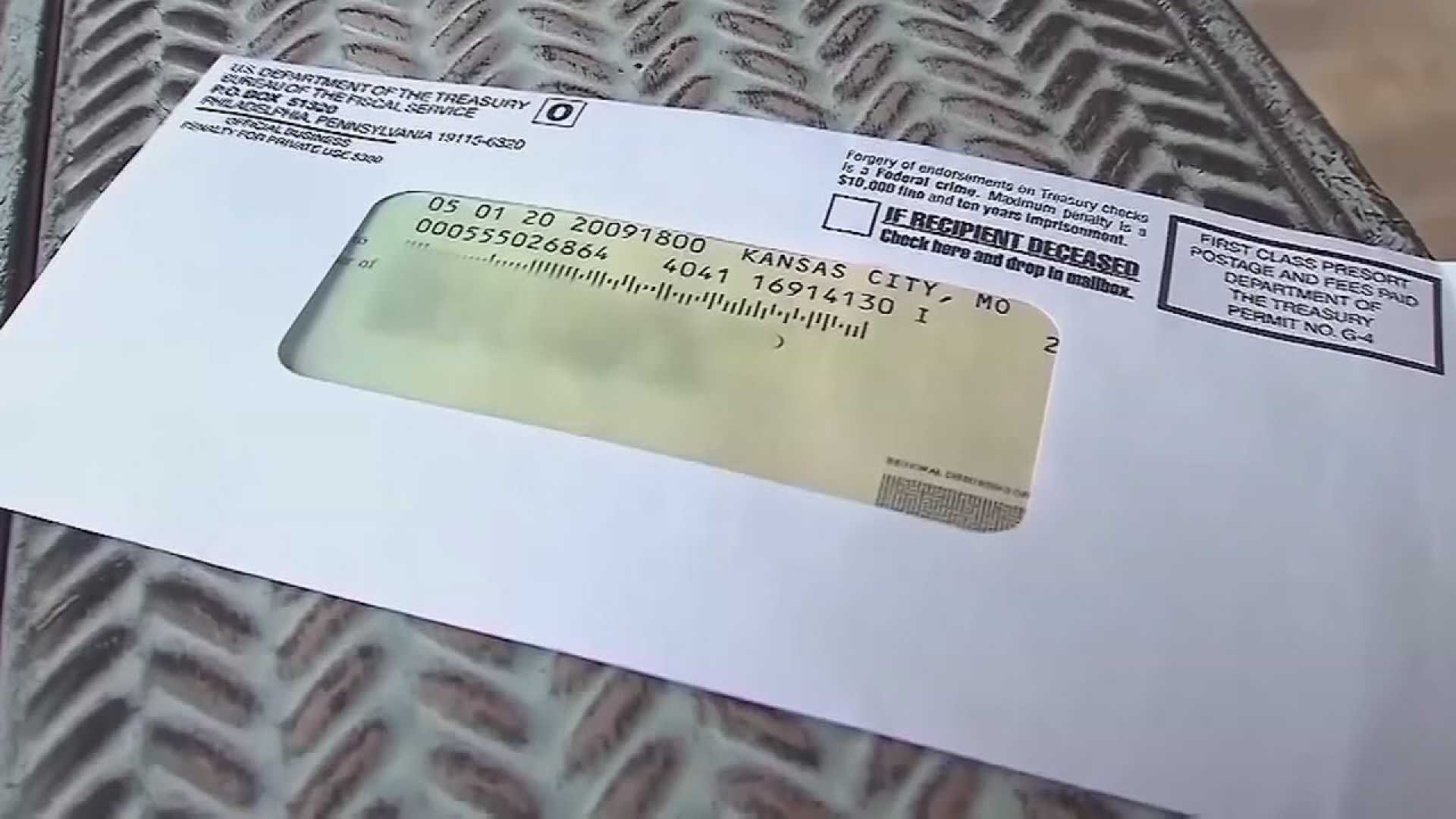

Payments are being issued via direct deposit or paper checks to the bank accounts or addresses on file with the IRS. Taxpayers who closed their accounts will receive reissued checks at their address of record. The IRS is also sending letters to notify recipients of the incoming payments.

The Recovery Rebate Credit was designed to help individuals who did not receive their full stimulus payments in advance during the pandemic. Eligibility was based on 2021 income, with singles earning less than $80,000 and married couples earning less than $160,000 qualifying for the credit. The credit also applied to dependents, including college students, adults with disabilities, and older relatives.

Garrett Watson, a senior policy analyst at the Tax Foundation, explained that the reconciliation process for the credit was always in the taxpayer’s favor. “If the taxpayer saw a fall in their income that year on their next return filing, they could claim some or all of a payment they did not otherwise get earlier,” Watson said.

The IRS estimates that the average payment will be around $2,400 per taxpayer. However, the exact amount varies based on individual circumstances, including income and the number of dependents claimed. Taxpayers who already received their full stimulus payments or did not file a 2021 return are not eligible for this special payment.

For those who have not yet filed a 2021 return, the deadline to claim the Recovery Rebate Credit is April 15, 2025. The IRS emphasizes that even individuals with minimal or no income in 2021 should file a return to claim the credit if eligible.

The special payments come as the IRS continues to address a backlog of amended returns and other paperwork. The agency has faced challenges in recent years, including staffing shortages and a surge in tax filings during the pandemic.

IRS Commissioner Werfel, who announced his resignation effective Jan. 20, 2025, has prioritized resolving outstanding issues and ensuring taxpayers receive the benefits they are owed. Deputy Commissioner Douglas O’Donnell will serve as acting commissioner until a permanent replacement is confirmed.