Business

Market Circuit Breakers: How They Halt Trading and Prevent Panic

NEW YORK, NY — Market circuit breakers serve as vital safety nets in financial trading, designed to halt trading when significant market drops occur. This mechanism helps prevent panic-driven sell-offs that can lead to catastrophic financial crashes.

Circuit breakers are initiated by regulators, aiming to counteract excessive volatility by temporarily halting trades when the market dips below a specified percentage threshold. For instance, the S&P 500 index fell 7% on March 9, 2020, triggering a circuit breaker as fears surrounding the COVID-19 pandemic swept across Wall Street.

The concept, similar to an electrical circuit breaker, was established after the stock market crash on October 19, 1987, known as Black Monday, when the Dow Jones Industrial Average (DJIA) plummeted nearly 23%. Following this crisis, regulators instituted measures that are now standard in exchange operations.

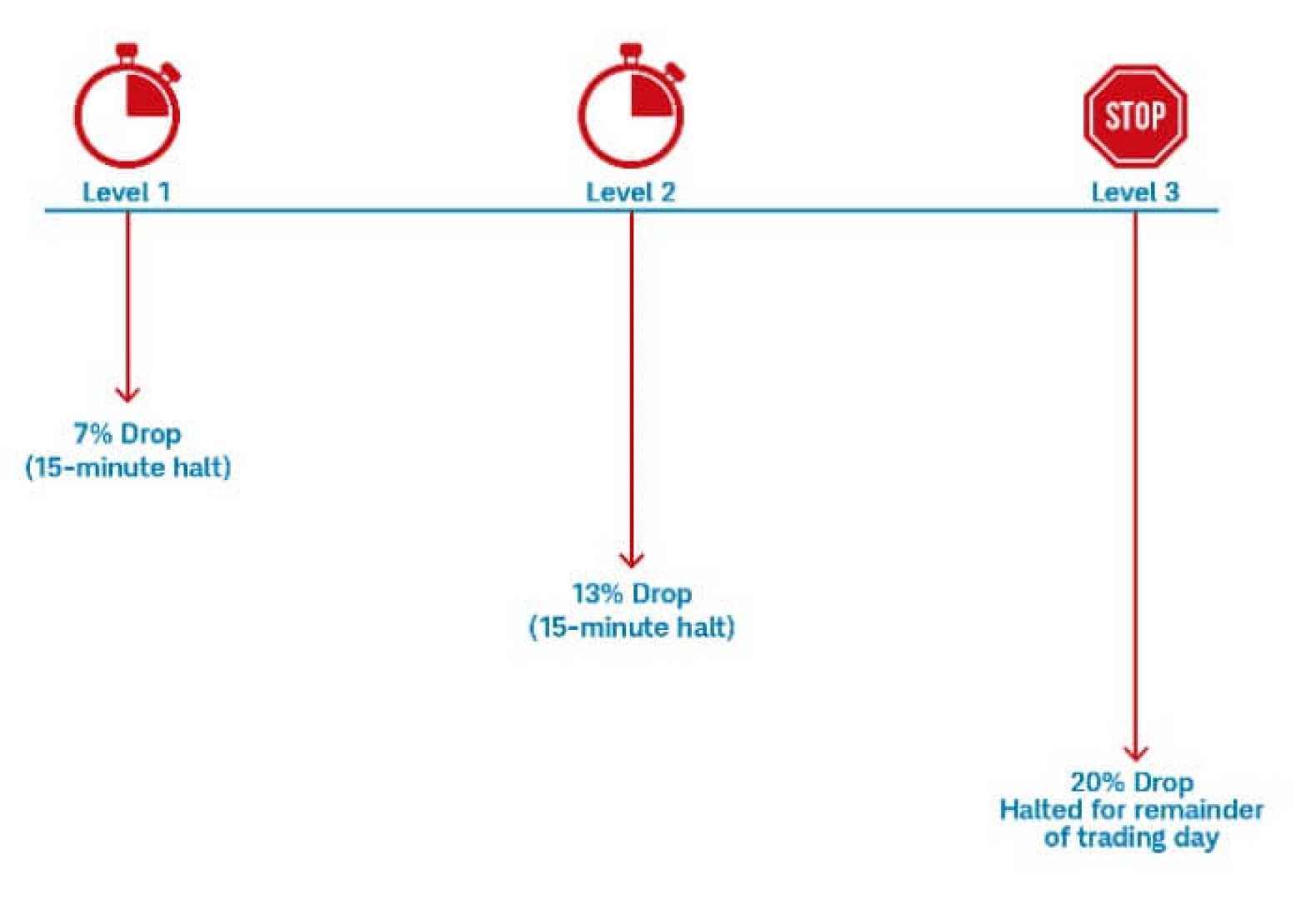

Circuit breakers are categorized into three levels based on the percentage declines of the S&P 500 from its previous closing value. A Level 1 breaker is set at a 7% drop, Level 2 at 13%, and Level 3 at a 20% drop. Level 1 and Level 2 breakers result in a 15-minute trading halt, while a Level 3 breaker suspends trading for the remainder of the day.

Exchanges also have individual security circuit breakers, activated based on the specific price movements of stocks and exchange-traded funds (ETFs). Individual securities may have stricter movement thresholds compared to larger, more stable companies, taking into consideration their typical price volatility. The thresholds are adjusted in the closing minutes of trading to manage end-of-day market issues.

Despite their integral role, circuit breakers have faced criticism. Some market experts argue that they can unintentionally heighten volatility rather than mitigate it. For instance, a 2021 study found that the existence of a circuit breaker may prompt market participants to push prices toward trigger points, thus exacerbating rapid price declines.

Critics reflect concerns that circuit breakers can impede a market’s natural adjustment process, delaying the attainment of equilibrium prices. This apprehension stems from the belief that regulation in the market could lead to unforeseen complications.

Yet, proponents of circuit breakers emphasize their effectiveness in preventing severe market crashes. Historical evidence shows that since their implementation following Black Monday, major market downturns have been less frequent. Instances such as the 2008 financial crisis and the market turmoil during the COVID-19 pandemic highlight these measures’ role in maintaining stability.

On August 5, 2024, Japan’s Nikkei index fell more than 12% in a single day, triggering sell-offs in other markets including the S&P 500. Despite the drop, the S&P 500 failed to trigger a circuit breaker, as the losses did not reach the necessary threshold of a 7% fall.

Overall, while circuit breakers play a critical part in managing market volatility, the ongoing debate surrounding their impact raises important questions about the balance between regulation and market efficiency. As market dynamics evolve, the effectiveness and design of circuit breakers will undoubtedly continue to be scrutinized.