Business

Market Valuation Dilemma: Walmart vs. Amazon’s Future Potential

NEW YORK, NY — As competition among major retailers escalates, Walmart and Amazon have established themselves as industry giants, boasting market capitalizations of approximately $737 billion and over $2 trillion respectively. However, as of March 10, 2025, investors are weighing which company could deliver better long-term returns amid fluctuating stock prices and ongoing investments in innovation.

Walmart, known for its low-price strategy, has effectively maintained its lead in the market for over six decades, with a focus on reducing costs to offer lower prices. Recent investments in technology have strengthened its e-commerce capabilities, enabling services such as same-day delivery. In the latest fiscal fourth quarter, Walmart’s U.S. business reported a notable sales increase of 4.6%, aided by higher customer traffic and spending.

Despite a drop in stock prices — Walmart shares fell 3.29% to $88.70 — management’s cautious sales guidance of 3% to 4% growth and an expected operating income increase of 3.5% to 5.5% for the year raised some investor concerns. Historical data suggests that Walmart often exceeds its projections, indicating potential for upside surprises.

Over the past year, Walmart shares appreciated by 58%, significantly outpacing the S&P 500’s growth of nearly 13%. However, the stock’s price-to-earnings (P/E) ratio is now at 39, up from about 30 a year ago, which raises questions about valuation sustainability.

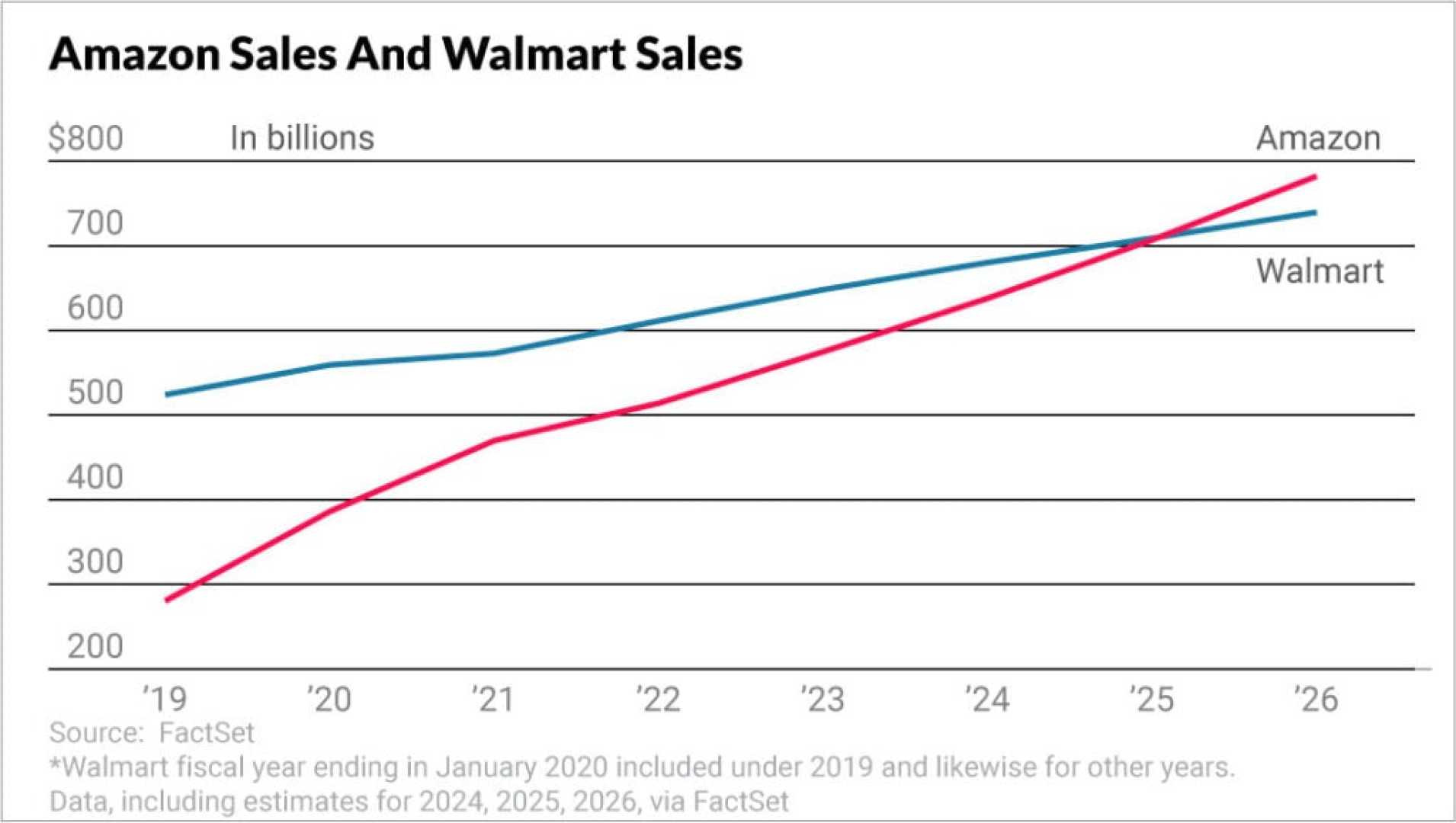

On the other hand, Amazon has evolved from its roots as an online book retailer to a multi-faceted tech giant, offering various products and services, including Alexa devices and Amazon Prime subscriptions. Last year, Amazon reported sales of $638 billion, predominantly from its North American and international operations.

A significant component of Amazon’s profitability stems from Amazon Web Services (AWS), which, despite only contributing a smaller fraction of total sales, generated 58% of the company’s profits. With cloud computing demand soaring, AWS has become the market leader with a 30% share. For the fourth quarter, AWS revenue surged by 18.5%, reflecting robust growth in cloud infrastructure spending.

Amazon shares have increased by 15.3% over the same period, but its P/E ratio remains higher than Walmart’s at about 36, compared to the S&P 500’s average of 29. Investors are evaluating the long-term viability of these valuations in light of ongoing economic pressures.

John Mackey, former CEO of Whole Foods, an Amazon subsidiary, commented on how the companies’ evolving business models provide unique growth opportunities. Both firms are investing heavily in technology to enhance customer experiences, but the question remains: Which one is better positioned for sustainable growth?

Market analyst insights indicate a challenging decision for investors. While both companies show promising prospects, Amazon could seem more attractive given its position within the fast-growing cloud market as compared to Walmart’s traditional retail focus.

The discussion around Walmart’s high valuation compared to its peers continues as analysts express mixed opinions on future performance. Despite Walmart’s operational successes — including a 5.2% sales growth last quarter — investor sentiment has soured due to cautious forward guidance. Some analysts have issued a cautious hold recommendation on Walmart, especially as the current P/E ratio approaches election-year highs.

While Walmart is praised for its resilient market position and expanding appeal to higher-income shoppers, questions about achieving growth in a competitive landscape remain. The retail giant has diversified its customer base, seeing an uptick in purchases from households earning over $100,000, a notable shift from past consumer demographics.

Investors will need to consider market dynamics and future forecasts as they navigate these investments. As many analysts still recommend Walmart as a strong buy, higher valuations versus historical levels may challenge investor confidence as both companies continue to adapt to changing consumer preferences.