Politics

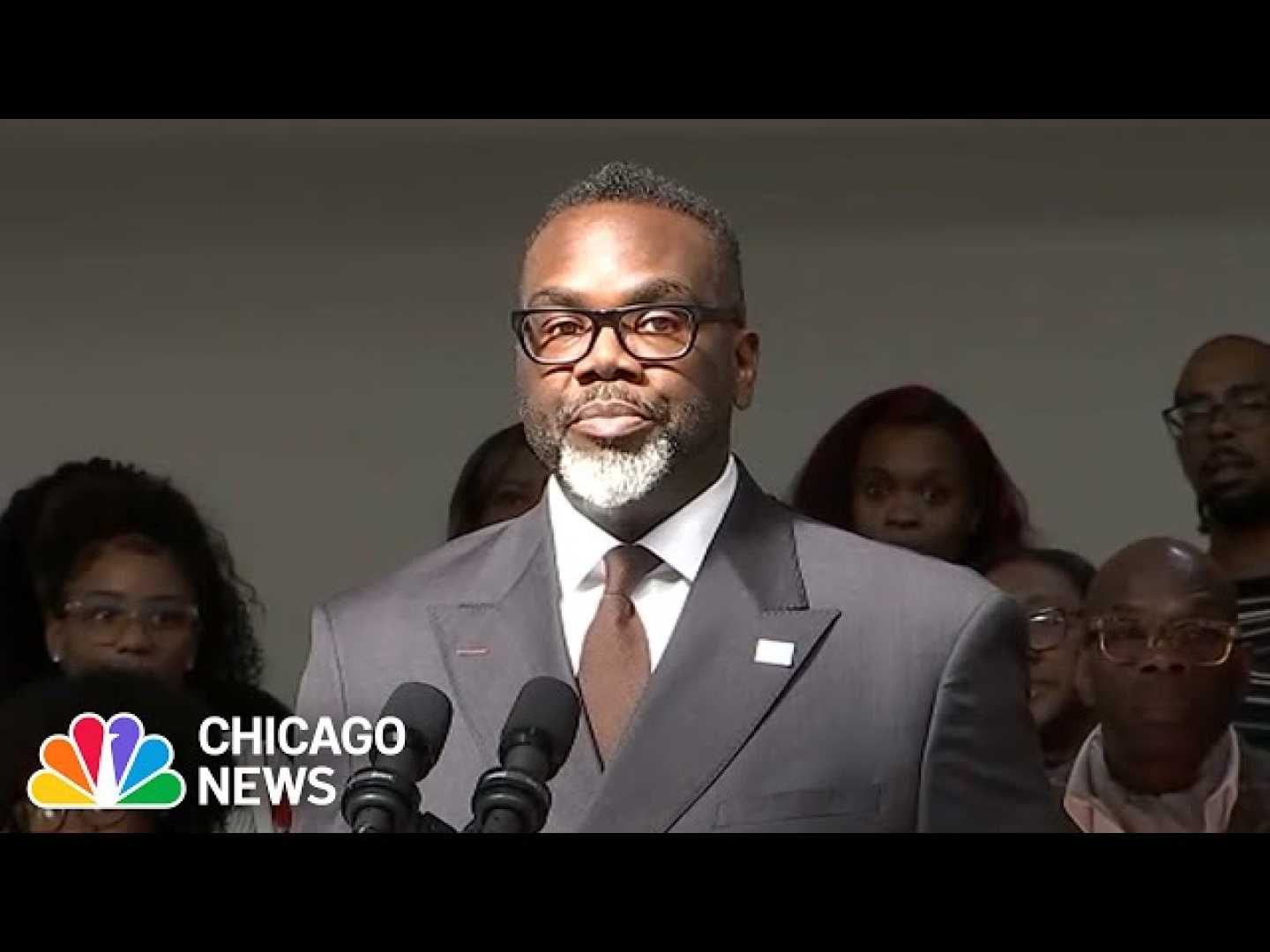

Mayor Johnson Seeks $830 Million Bond Amid Credit Downgrade

CHICAGO, Ill. — Chicago Mayor Brandon Johnson is proposing to borrow $830 million from the city’s bond market, just one day after the city’s credit rating fell to near-junk status, as reported by Standard & Poor’s Global.

The mayor asserts that the funds will primarily focus on infrastructure and capital improvements. However, the proposal includes flexible language that could allow for the funds to be allocated toward a contract with the Chicago Teachers Union (CTU), where Johnson is a former employee. This has raised concerns among city officials regarding potential conflicts of interest.

According to documentation, acceptable uses for the proposed funds include “loans or grants to assist individuals, not-for-profit organizations, or educational or cultural institutions, or for-profit organizations, or to assist other municipal corporations, units of local government, school districts, the State, or the United States of America.” With CTU currently negotiating a contract with Chicago Public Schools, the mayor could employ the borrowed money for those negotiations.

In response to the ratings downgrade from BBB+ to BBB, which suggests increasing fiscal stress, critics, including Illinois Comptroller Susana Mendoza, have urged the City Council to reject the borrowing request. “Meantime, I strongly urge the members of the Chicago City Council to vote ‘no’ on the additional $830 million in borrowing,” Mendoza stated. “If Johnson insists on pursuing a path leading Chicago over a fiscal cliff, you should choose to avoid that cliff dive.”

Many experts argue that while borrowing might be necessary for infrastructure projects that yield long-term benefits, utilizing funds for immediate labor contracts like those for CTU could place taxpayers and students at greater financial risk.

Poll results have shown mixed reactions among residents regarding the city’s financial management and priorities, illustrating a growing unease about the direction the administration is taking in light of the recent credit rating issue.