Business

Memecoins Pressure Solana’s Price Amid Market Uncertainty

NEW YORK, N.Y. — Solana‘s price continues to face downward pressure as investor interest in memecoins grows, industry experts told Cointelegraph. Despite a significant token unlock on March 1, which marked the largest in Solana’s history, the digital asset’s value has decreased sharply.

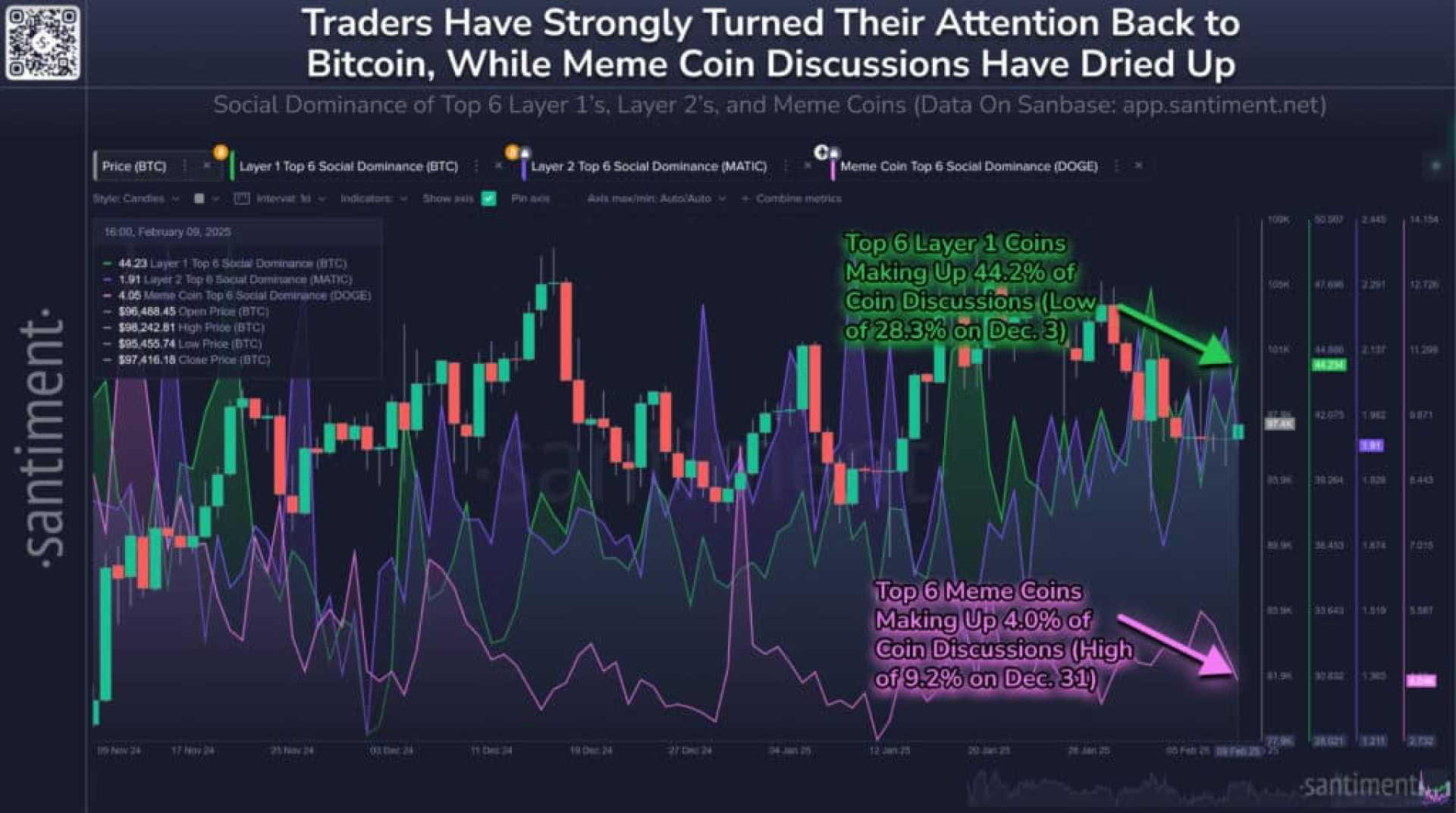

Data indicates that Solana’s price dropped over 45%, falling from more than $261 on January 18 to approximately $143 by March 2. Dan Hughes, founder of the decentralized finance platform Radix, highlighted that the increasing popularity of memecoins is drawing investment capital away from established assets like Solana.

“Memecoins don’t tend to draw in much external capital flow; instead, existing ecosystem capital ’round-robins’ from one meme to the next,” Hughes remarked. He exemplified this behavior with the memecoin TRUMP, noting that most of its liquidity came from investors selling other crypto assets. “You can see the effect in the market, where for a few days everything was red except TRUMP and Solana, and it was amusingly labeled the liquidity vampire,” he said.

In a striking contrast, Circle has minted over $8.75 billion worth of USDC since the beginning of the year. Yet, despite this surge in liquidity, Solana’s price has still dropped more than 24% during the same period.

On March 1, Solana managed to rebound above $140, even after approximately 11.2 million SOL tokens were released into circulation due to the token unlock. Concerns had been raised among industry watchers regarding potential downside risks, particularly since a substantial portion of these unlocked tokens were acquired at $64 per SOL in FTX’s auctions by notable firms such as Galaxy Digital, Pantera Capital, and Figure.

Hughes pointed out that external macroeconomic influences and recent security incidents are continuing to hinder the overall crypto market. He explained, “Events on the world stage are having a greater impact than in previous cycles. A much larger ratio of invested capital is institutional, who are much more cautious, having to consider a wider set of markets, factors, and variables when making decisions.”

Investor sentiment has also been adversely affected by the Bybit hack that took place on February 21, contributing to a cautious market atmosphere. Hughes added, “Couple that with the exhaustion of continued rug pulls, hacks, and losses, it will take some time for the remaining dust to settle and the mojo to come back.”