Business

Mexican Peso Plummets Amid Escalating US-China Trade Tensions

NEW YORK, NY – The Mexican peso closed down 0.92% against the dollar on Monday, marking a significant reaction to heightened tensions surrounding tariffs between the United States and China. The exchange rate settled at 20.77 pesos per dollar, compared to 20.58 pesos at the previous close.

Analysts labeled the day a “black Monday” for financial markets, as concerns escalated over the potential for additional tariffs. Washington’s threat to impose a 50% tariff on Chinese goods starting April 9 unless Beijing rescinded recent tariff hikes has increased global risk perception.

Felipe Mendoza, a financial markets analyst at ATFX LATAM, commented, “Despite Mexico’s exclusion from new tariffs under the US-Mexico-Canada Agreement (T-MEC), it isn’t immune to the impacts of a fragmented global economy.” This sentiment reflects the widespread market apprehension.

In a volatile trading environment, the peso exhibited significant fluctuations, moving between 20.47 and 20.80 pesos per dollar. The VIX index, which measures market volatility, surpassed 60 points, a sign of considerable investor anxiety.

According to an analysis report by Monex, the dollar-peso exchange rate may exhibit lateral movement during the first half of the week due to uncertainty surrounding the trade conflict. The report warned that further retaliatory measures on U.S. exports could challenge global economic dynamism and elevate market risks, thereby increasing demand for safe-haven assets.

The market is keenly awaiting inflation data scheduled for Wednesday and industrial production figures on Friday, although analysts suggest external developments will likely dominate attention.

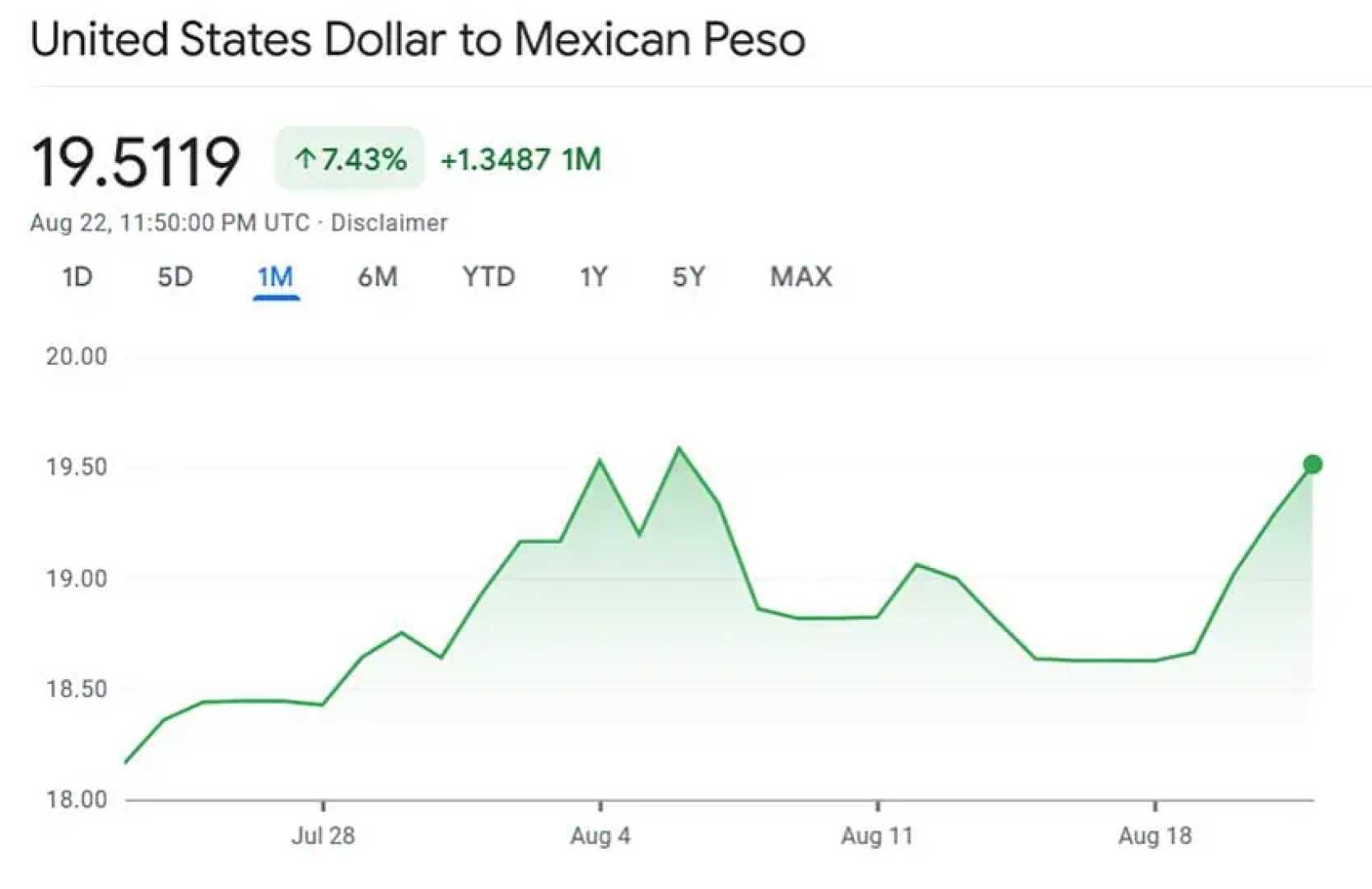

In a broader context, the exchange rate dynamics in 2024 painted a mixed picture. The year began with the peso gaining strength against the dollar, with the greenback trading at just 16 pesos—the lowest level in nearly a decade. The “superpeso” moniker emerged during this period.

However, the peso’s depreciation ensued later due to a series of political decisions, including the controversial Judicial Reform and the elimination of autonomous bodies. The currency’s decline intensified following Donald Trump’s electoral victory and his threats to impose tariffs on all Mexican and Canadian goods unless security improvements were made at the border.

As a result, the dollar returned to the 20 peso mark, significantly diverging from predictions made by Banco de México (Banxico). For 2025, Banxico forecasts that the dollar will average between 20.24 and 20.69 pesos, a conservative estimate given the unpredictable implications of Trump’s policies.

Despite a relatively stable inflation rate around 4% in 2024—except for a rise to nearly 6% in June—Banxico expects inflation to remain below four points this year, with a target of 3.8%. The central bank maintains low growth expectations for the gross domestic product (GDP), projecting only a 1.2% increase.

The peso, the official currency of Mexico, is historically notable as the first currency globally to utilize the dollar sign ($). It ranks as the 15th most traded currency worldwide and is the most traded in Latin America, standing third on the continent after the U.S. and Canadian dollars. The currency abbreviation is currently MXN, having changed from MXP prior to 1993.