Business

Morgan Stanley Boosts Miami International Holdings With Strong Price Target

Princeton, New Jersey — Morgan Stanley is optimistic about Miami International Holdings, initiating research coverage with an outperform rating on Monday. The investment bank set a price target of $42 per share, which suggests more than a 20% increase from Friday’s closing price of $34.95.

The bank’s bullish scenario includes a price target of $60 per share, indicating more than 70% upside potential. Morgan Stanley also served as one of three lead underwriters for Miami International’s initial public offering in August, where shares were priced at $23 each.

CEO Thomas Gallagher founded Miami International in 2007. Morgan Stanley analyst Michael Cyprys highlighted the stock’s favorable risk/reward profile, stating it operates as a pure-play options exchange benefiting from both cyclical and secular growth trends. Cyprys emphasized that the exchange has a history of acquiring market share.

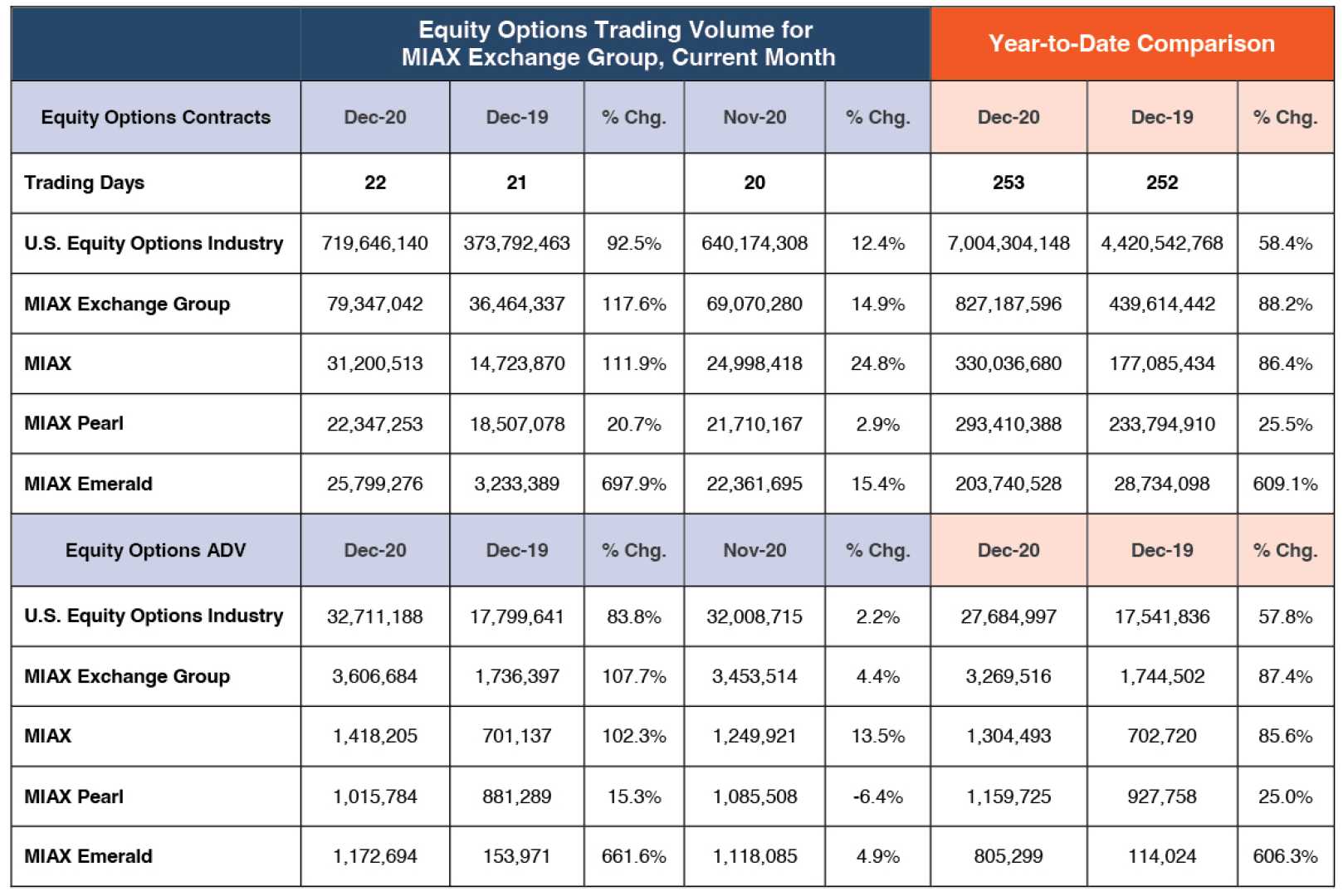

He noted that Miami International has gained 960 basis points in market share since 2016, now accounting for 16.7% of the multi-list options market. Cyprys predicts that annual revenue growth could reach nearly 15%, partly due to Miami’s exclusive access to a customized version of the S&P 500 for index options and futures trading.

In his base case forecast, Cyprys anticipates sustained growth with the market share increasing to 18.3%. However, the bear case presents slower growth in options volume, which could limit annual revenue expansion to approximately 5.7%.

Since its IPO, Miami International shares have surged nearly 60%, indicating strong market enthusiasm.