Business

Mortgage Rates Dip, Affordability Remains Housing Market’s Top Concern

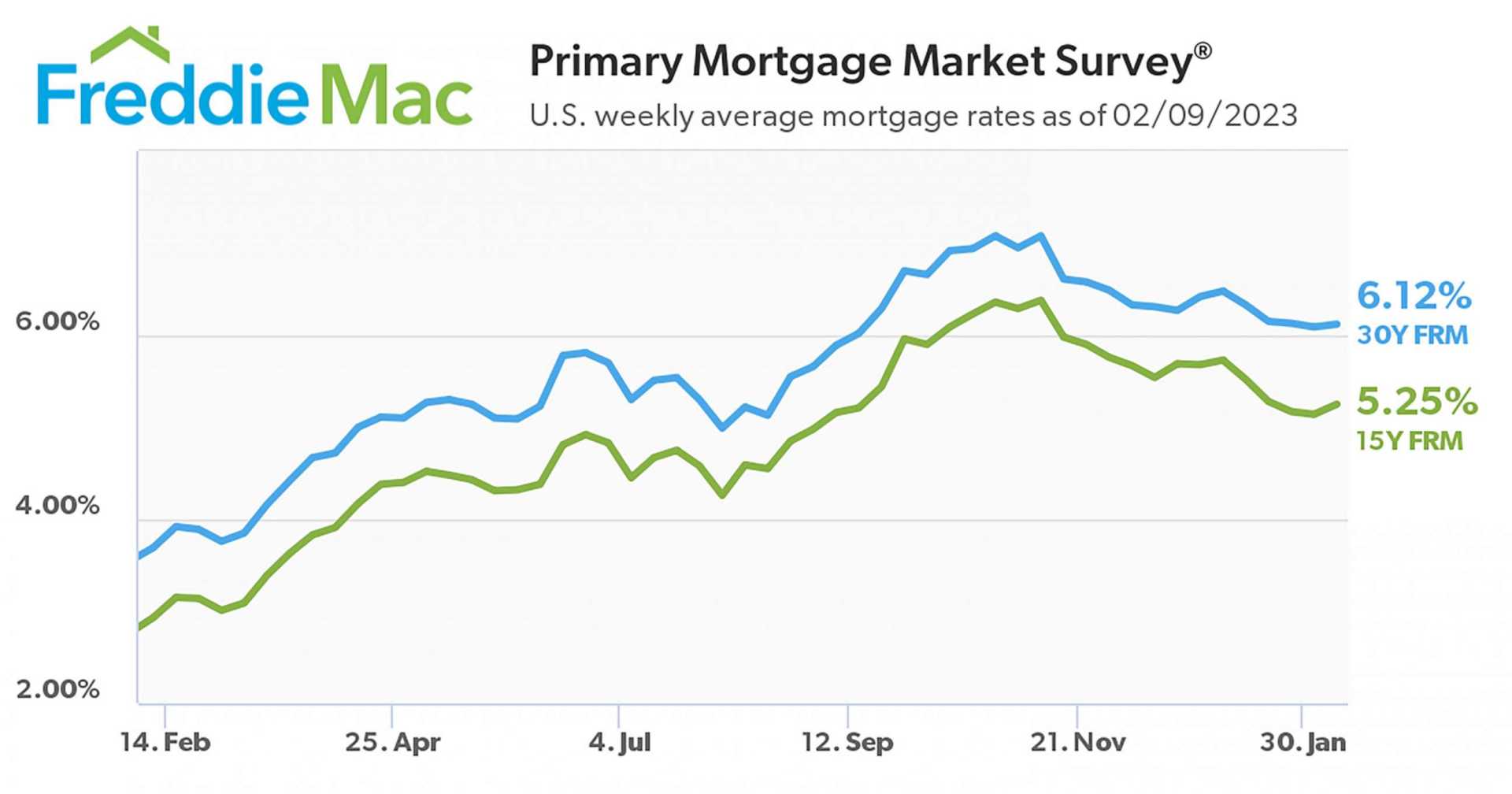

ARLINGTON, Va. — Century 21 Real Estate CEO Mike Miedler highlighted the critical role of mortgage rates in the housing market, stating affordability remains the primary issue as rates fell for the sixth consecutive week. On Thursday, Freddie Mac reported the average rate on a benchmark 30-year fixed mortgage decreased to 6.76%, down from 6.85% last week.

According to Freddie Mac’s latest Primary Mortgage Market Survey, this decline reflects a significant drop from a year ago when the average was 6.94%. “The drop in mortgage rates, combined with modestly improving inventory, is an encouraging sign for consumers in the market to buy a home,” said Sam Khater, Freddie Mac’s chief economist.

The average rate on a 15-year fixed mortgage also saw a decrease, dropping to 5.94% from 6.04% last week, compared to 6.26% a year prior. This trend follows a month where mortgage rates ranged from 6.91% to 7.04% in January, making the monthly payment on a $300,000 home have increased by $50 to $1,590, as noted by the National Association of Realtors (NAR).

Also released Thursday, NAR’s report revealed that pending home sales fell to the lowest level on record in January, influenced by high mortgage rates and elevated home prices. “It is unclear if the coldest January in 25 years contributed to fewer buyers in the market, and if so, expect greater sales activity in the upcoming months,” said Lawrence Yun, NAR chief economist. “However, it’s evident that elevated home prices and higher mortgages strained affordability.”

The rates on new 30-year purchase mortgages slid by four basis points Thursday, marking the third time in the year the average hit 6.79%. Rates were seen at a two-year low of 5.89% last September, but surged nearly 1.25 percentage points before experiencing recent declines.

Looking back at the past year, today’s rates show significant improvement compared to the high of 7.37% recorded last spring and are about 1.2 percentage points lower than the historic peak of 8.01% observed in October 2023.

Additionally, the average rate on 15-year mortgages dropped back under 6% to 5.97%. Like the 30-year average, it previously hit a low of 4.97% in September. This is notable as the current average remains over a percentage point lower than October’s high of 7.08%, the highest since 2000.

Jumbo 30-year mortgage rates also decreased, falling to an average of 6.78%. This remains slightly above January’s seven-week low of 6.75%, while the peak of 8.14% in October was reported as the most expensive average jumbo 30-year rate in over 20 years.

Freddie Mac publishes its weekly average of 30-year mortgage rates every Thursday, reporting a slight dip of two basis points to 6.85%. In contrast, the Investopedia daily 30-year average provides a more precise indicator of rate movements due to its different calculation parameters.

The fluctuation of mortgage rates is influenced by a series of macroeconomic conditions and industry factors. Historically, the Federal Reserve’s actions, including substantial bond purchases due to pandemic pressures, have significantly impacted these rates. Since November 2021, the Fed has reduced its bond purchases and subsequently raised the federal funds rate to combat inflation, indirectly affecting mortgage rates.

Despite a brief reduction in rates beginning in September with a 0.50% cut followed by smaller adjustments, experts suggest potential for sustained rate holds in the future as the Fed manages its monetary policy.

The national and state averages presented are based on an assumed down payment of at least 20% and a credit score range of 680–739, providing a general idea of what borrowers might expect when seeking rates from lenders.