Business

Mortgage Rates Drop to Lowest Level in Nine Months

WASHINGTON, D.C. — Mortgage rates have fallen this week, with the average rate for a 30-year fixed mortgage at 6.63 percent, down from 6.75 percent last week, according to a new survey by Bankrate.

The survey also shows that other types of loans have experienced similar declines. The 15-year fixed mortgage rate dropped to 5.79 percent, while jumbo 30-year mortgages are down to 6.66 percent. These reductions reflect a broader trend in mortgage rates over the past several months.

Current mortgage rates are significantly lower compared to the recent past. For instance, just four weeks ago, the average 30-year fixed mortgage was at 6.79 percent, and one year ago, it stood at 6.59 percent. The lowest average in the past 52 weeks was 6.20 percent.

The average loan in this week’s survey included about 0.33 discount points, which can help borrowers reduce their mortgage rates. Discount points are different from origination points, which lenders charge to create and process loans.

Despite this drop in mortgage rates, affordability remains a significant issue for many potential homebuyers. With the national median family income projected at $104,200 for 2025, the median home price reached $435,300 in June. A typical monthly payment of $2,231 would use about 26 percent of a family’s monthly income.

Lisa Sturtevant, chief economist at Bright MLS, highlighted the ongoing challenges of affordability, stating, ‘Some buyers are waiting both for rates and prices to come down before they get into the market.’ This sentiment reflects the cautious approach many consumers are taking amidst fluctuating economic conditions.

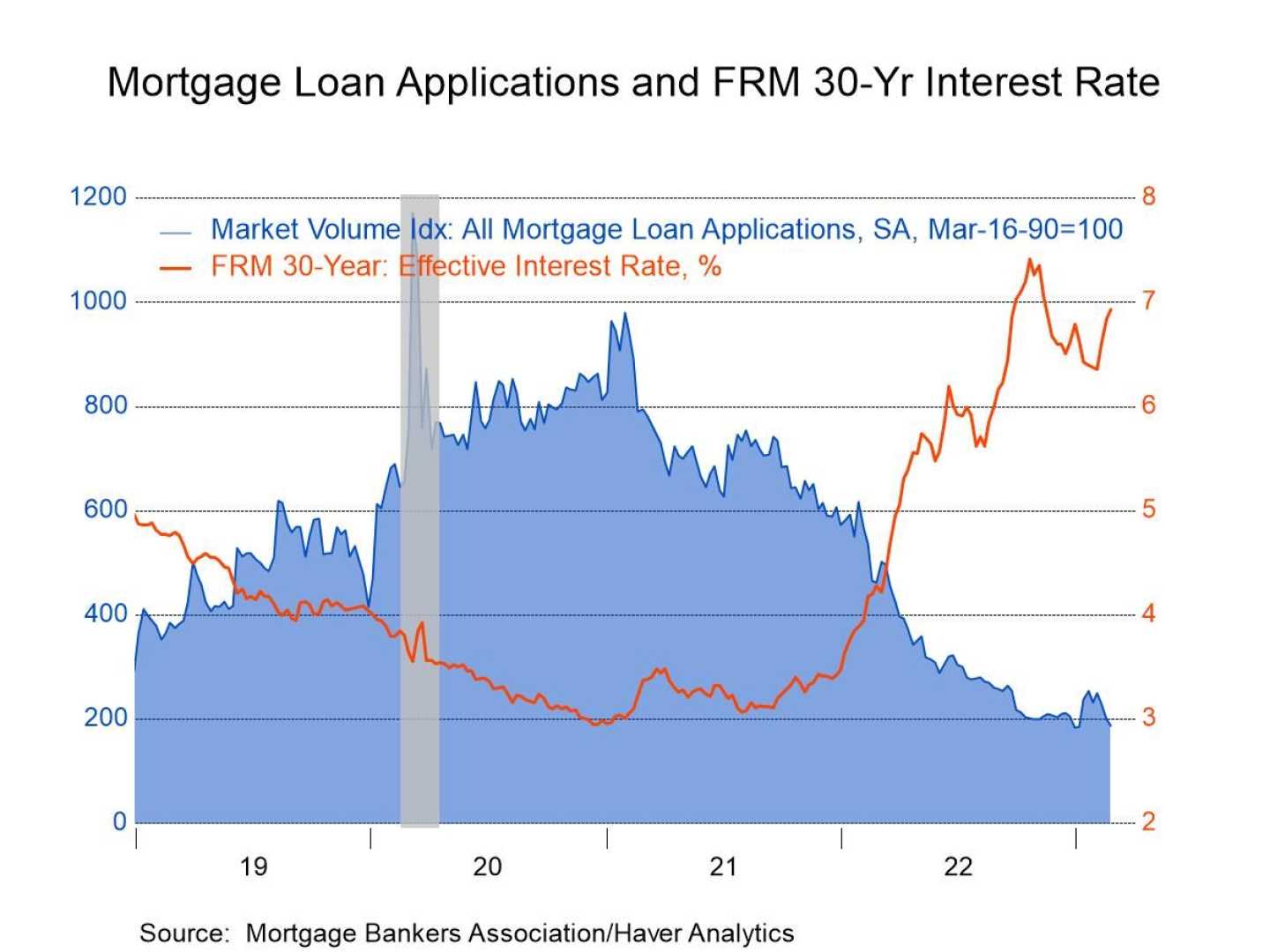

Mortgage rates have not been this low since mid-October 2024. However, it is important to note that rates have fluctuated within a narrow range over the last nine months. This recent decline differs from the drastic falls experienced during the early pandemic period, when rates dropped quickly.

Meanwhile, the U.S. Federal Reserve’s decision last week to maintain its federal funds rate could influence future mortgage rates. Fixed mortgage rates are often determined by investor demand for 10-year Treasury bonds, which react to market uncertainties.

In conclusion, while mortgage rates are at their lowest point in recent months, economic factors such as inflation and market conditions will continue to affect buyer sentiment and borrowing decisions in the near future.