Business

Mortgage Rates Face Gradual Decline in 2025 Amid Economic Uncertainties

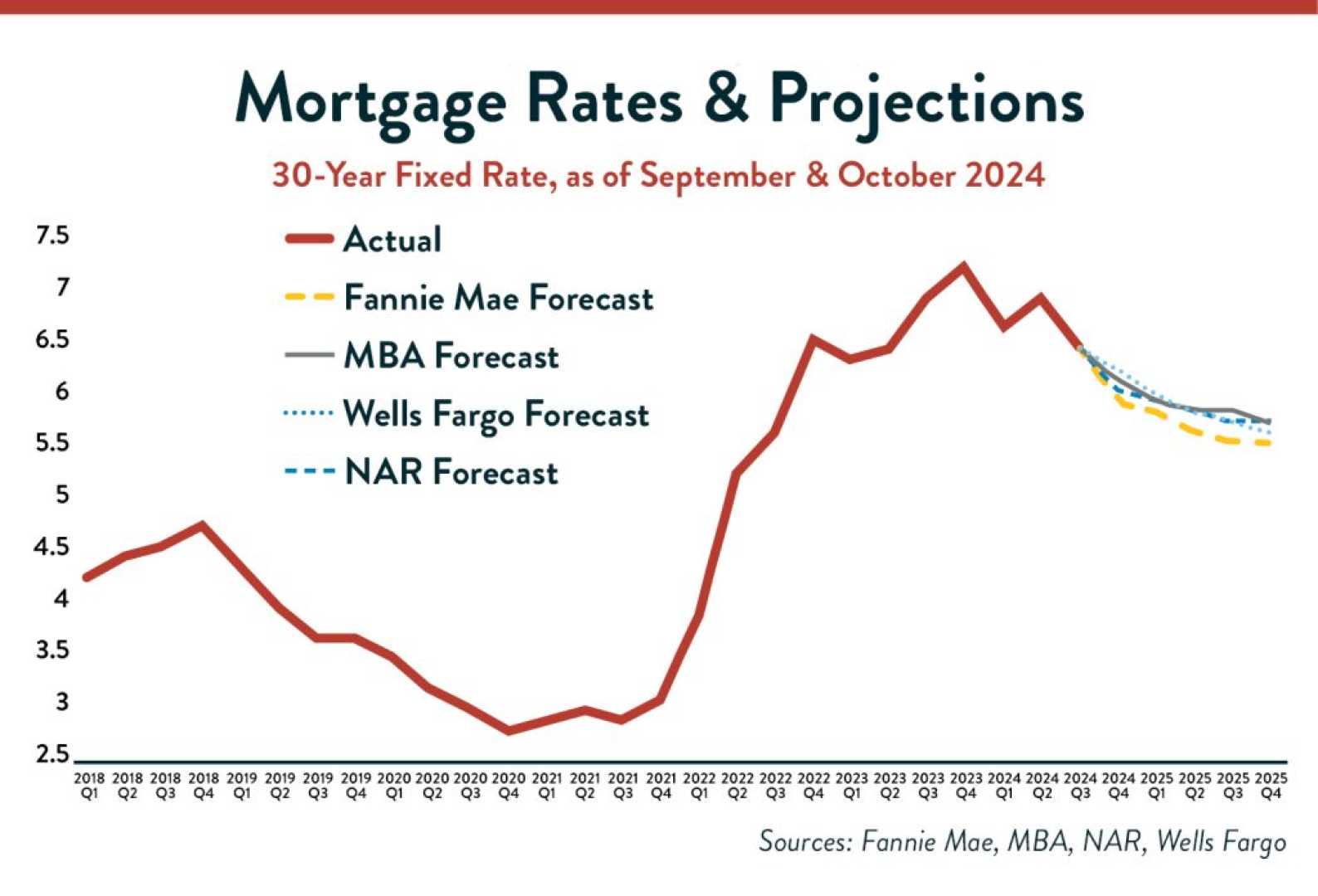

WASHINGTON, D.C. — After a notable drop to 6.08% in September 2024, the average rate for the benchmark 30-year mortgage has reversed direction as the spring buying season approaches. However, recent trends still indicate relief for prospective buyers, with rates decreasing by 13 basis points from 6.89% to 6.76% in February 2025 according to Freddie Mac.

Experts in the housing market suggest the current volatility in mortgage rates stems from inflation apprehensions and the potential impacts of the new Trump Administration’s economic policies. As the Federal Reserve shifts its monetary approach, mortgage rates are anticipated to remain elevated gradually easing throughout the year.

In January, the Federal Open Market Committee (FOMC) paused cuts to the federal funds rate after three reductions late in 2024. The current target range for the federal funds rate stands at 4.25% to 4.50%—the highest level seen in 23 years. This halt followed a series of rate cuts aimed at combating inflation, which has significantly impacted the housing market with soaring mortgage rates and elevated home prices.

Sam Williamson, a senior economist at First American, stated, “As 2025 kicks off, the housing market is predicted to remain subdued, with mortgage rates hovering between the upper-6% and low-7% range.” This sentiment reflects widespread expectations that many current homeowners will remain in place due to high rates, while first-time buyers continue to be sidelined.

Concerns regarding the ever-changing economic landscape persist as the Federal Reserve indicates only two potential rate cuts for the year, diverging from earlier forecasts of four. This labor and material cost increase could further strain home construction amidst already high demand.

“The risks associated with waiting for a further drop in rates could be significant,” warns Fred Bolstad of U.S. Bank. “If financially viable now, purchasing a home may not require waiting.”

The FOMC’s next meeting is scheduled for March 18-19, however, analysts predict limited action on cuts as policymakers gauge the economic fallout from the Trump Administration’s proposed policies.

Forecasts from institutions such as the National Association of Home Builders indicate potential for rates to dip below 6.5% by mid-2025, with further declines to below 6% by the end of 2026 if economic indicators align favorably.

Jesse Wade, an economist at the NAHB, remarked, “Unless inflationary pressures ease substantially, we will likely continue to experience mortgage rate fluctuations.” Meanwhile, Freddie Mac maintains its opinion that rates will remain “higher for longer” in 2025 while acknowledging some potential for increasing refinancing activity.

As rates reflect ongoing economic conditions, borrowers are encouraged to compare offers from multiple lenders. Consumer Mortgage Association projections suggest a rebound in refinancing activity as the market realigns within lower rate brackets—possibly averaging around 6.7% by the latter half of 2025.

Experts agree that securing a competitive mortgage rate is crucial for potential buyers, emphasizing the advisability of locking in rates that seem manageable. The urgency to act on real estate decisions might outweigh concerns about potential future rate declines, especially in the current economic climate.