Business

Mortgage Rates Plummet to Lowest Levels Since October 2024

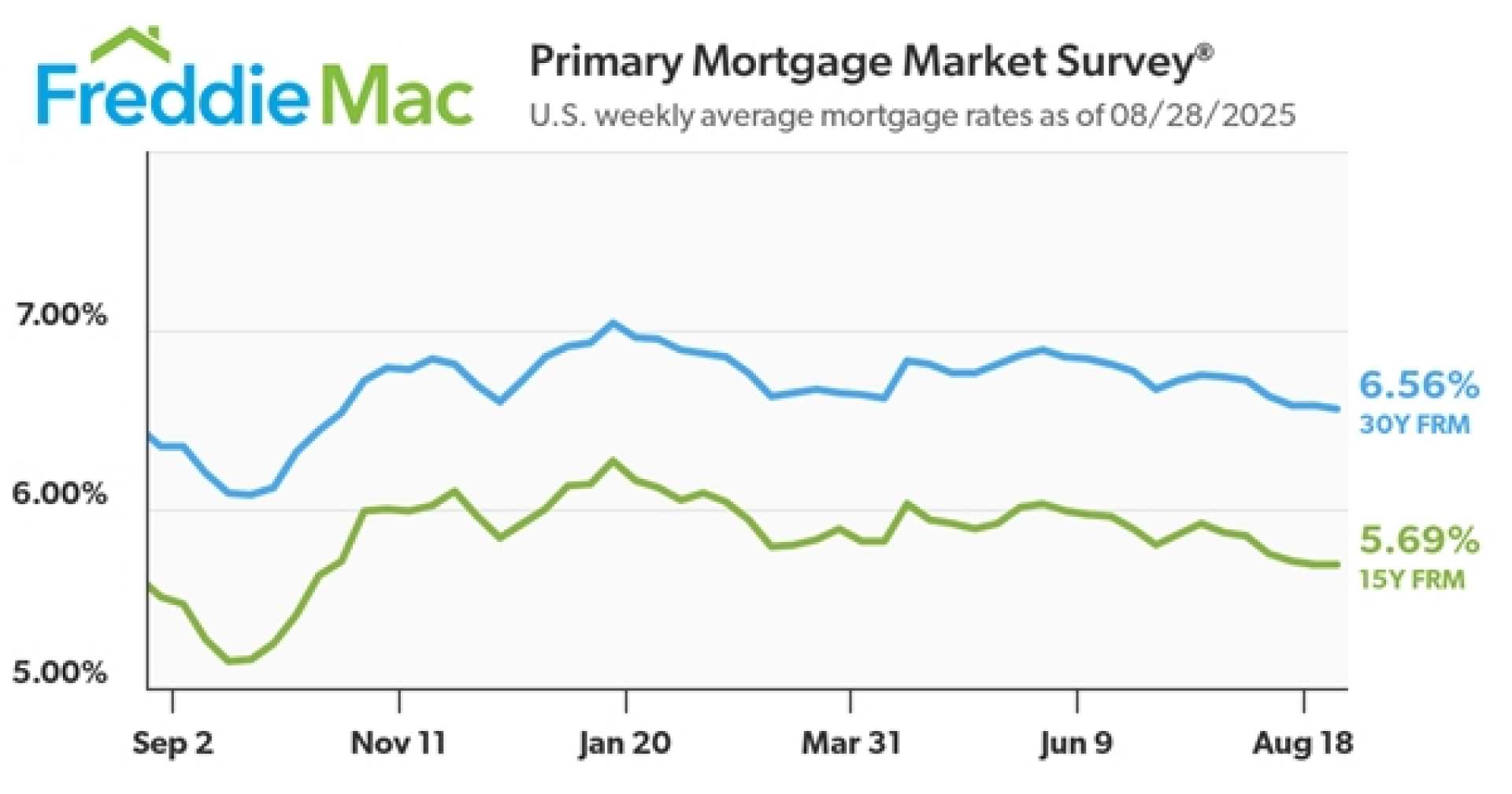

MCLEAN, Va. — Mortgage rates have fallen to their lowest levels since October 2024, according to Freddie Mac’s latest Primary Mortgage Market Survey released on Thursday. The average rate on a 30-year fixed mortgage dropped to 6.5%, down from 6.56% the previous week.

This week’s rate is the lowest recorded since Oct. 17, 2024, when it averaged 6.44%. A year ago, the 30-year fixed mortgage rate was significantly lower at 6.35%.

Sam Khater, Freddie Mac’s chief economist, commented on the trend, saying, “Mortgage rates continue to trend down, increasing optimism for new buyers and current owners alike. As rates continue to drop, the number of homeowners who have the opportunity to refinance is expanding.” He noted that nearly 47% of mortgage applications last week were for refinancing, marking the highest level since October 2024.

The average rate for a 15-year fixed mortgage also saw a decline, falling from 5.69% to 5.6% in the same report. One year ago, the 15-year rate stood at 5.47%.

However, rising home prices are concerning for many potential buyers. A recent report from Realtor.com found that less than 30% of homes on the market are affordable for the average household. As of August, only 28% of homes were priced within reach for a typical household, with the maximum affordable price down to $298,000, compared to $325,000 in 2019.

Danielle Hale, chief economist at Realtor.com, explained, “Even as incomes grow, higher interest rates have eroded the real-world purchasing power of the typical American household.” This situation has forced many prospective buyers to adjust their homeownership expectations, such as seeking smaller homes or delaying purchases entirely.

As Freddie Mac continues to monitor the mortgage market, the fluctuations in rates alongside ongoing affordability issues will remain critical factors for both homeowners and potential buyers.