Business

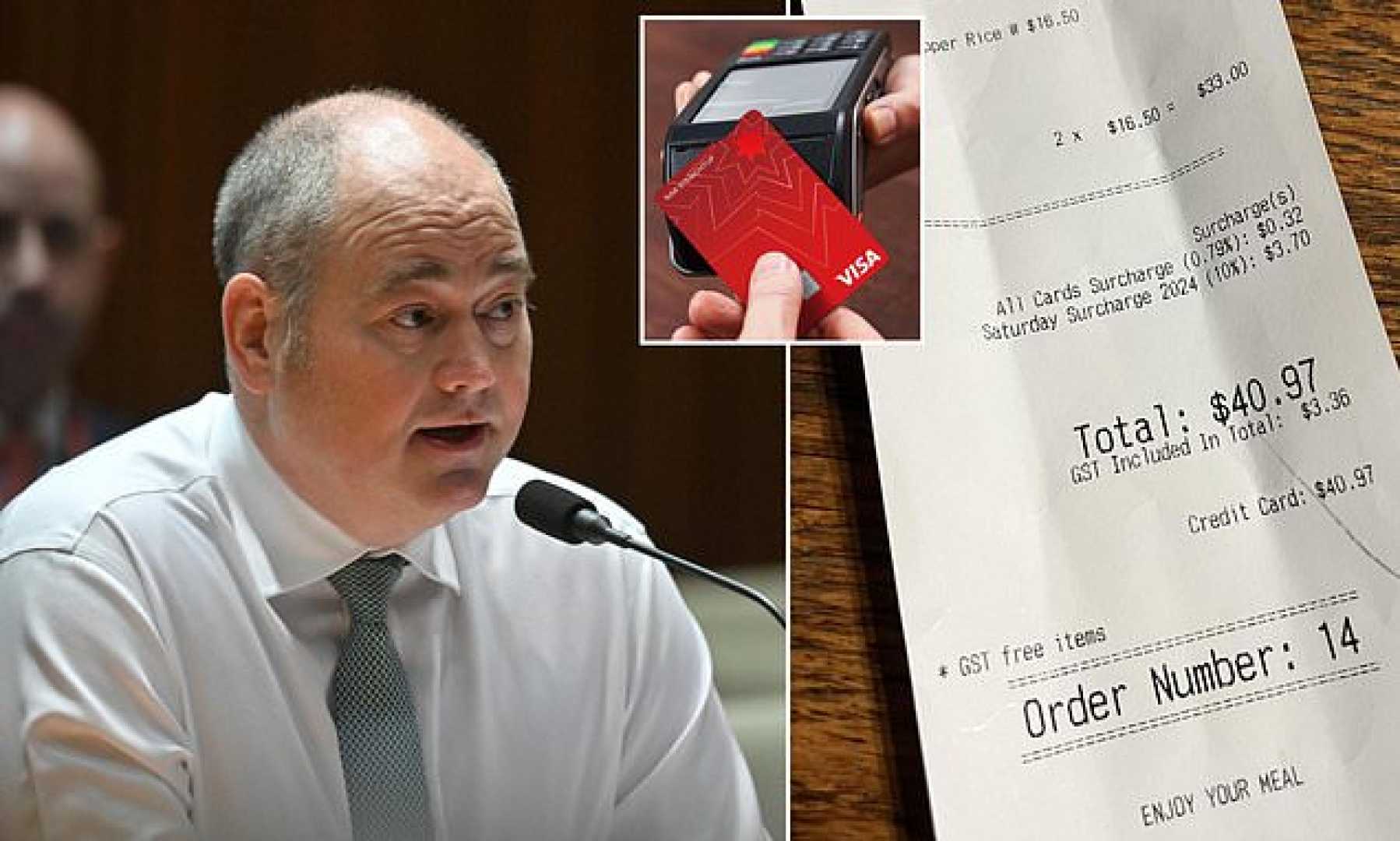

NAB CEO Andrew Irvine Faces Media Scrutiny Over Drinking Allegations

SYDNEY, Australia — National Australia Bank chief executive Andrew Irvine is facing intense media scrutiny following allegations concerning his drinking and management style. The controversy escalated ahead of the Australian Banking Association conference, which Irvine was required to attend as chair.

Shareholders voiced their concerns last week, igniting discussions and informal audits about Irvine’s behavior. Despite not reaching the headlines of other recent controversies, the attention on Irvine has become a defining moment in his leadership.

Irvine recognized the difficulty of the situation, admitting in a statement that the negative attention has been challenging. “I would rather be anywhere else right now,” he reportedly said. Nevertheless, he affirmed his commitment to improve the bank’s performance amidst the backlash.

In light of the allegations, NAB’s board convened a meeting to discuss their strategy moving forward. While they expressed support for Irvine, he was notably absent due to his overseas vacation. The meeting raised questions, as no board members, including chairman Phil Chronican, have publicly addressed the drinking allegations.

Banking analyst Brian Johnson, who works at MST Marquee, defended Irvine, stating, “Every bank has its management issues. NAB’s current situation is not particularly noteworthy.” He argued that shareholders should focus on the bank’s performance rather than personal conduct.

However, concerns about Irvine’s management style persist among some shareholders. These issues are expected to be a focal point at the bank’s annual meeting in December, where Irvine’s executive compensation package will be up for a vote. Currently, his salary totals $2.5 million, along with incentives tied to performance.

As Irvine navigates this difficult period, he will also face upcoming market pressures, including the release of NAB’s third-quarter results next month. With the scrutiny that comes from leading a $115 billion bank, Irvine’s ability to maintain focus on the bank’s challenges may be crucial in the coming months.