Business

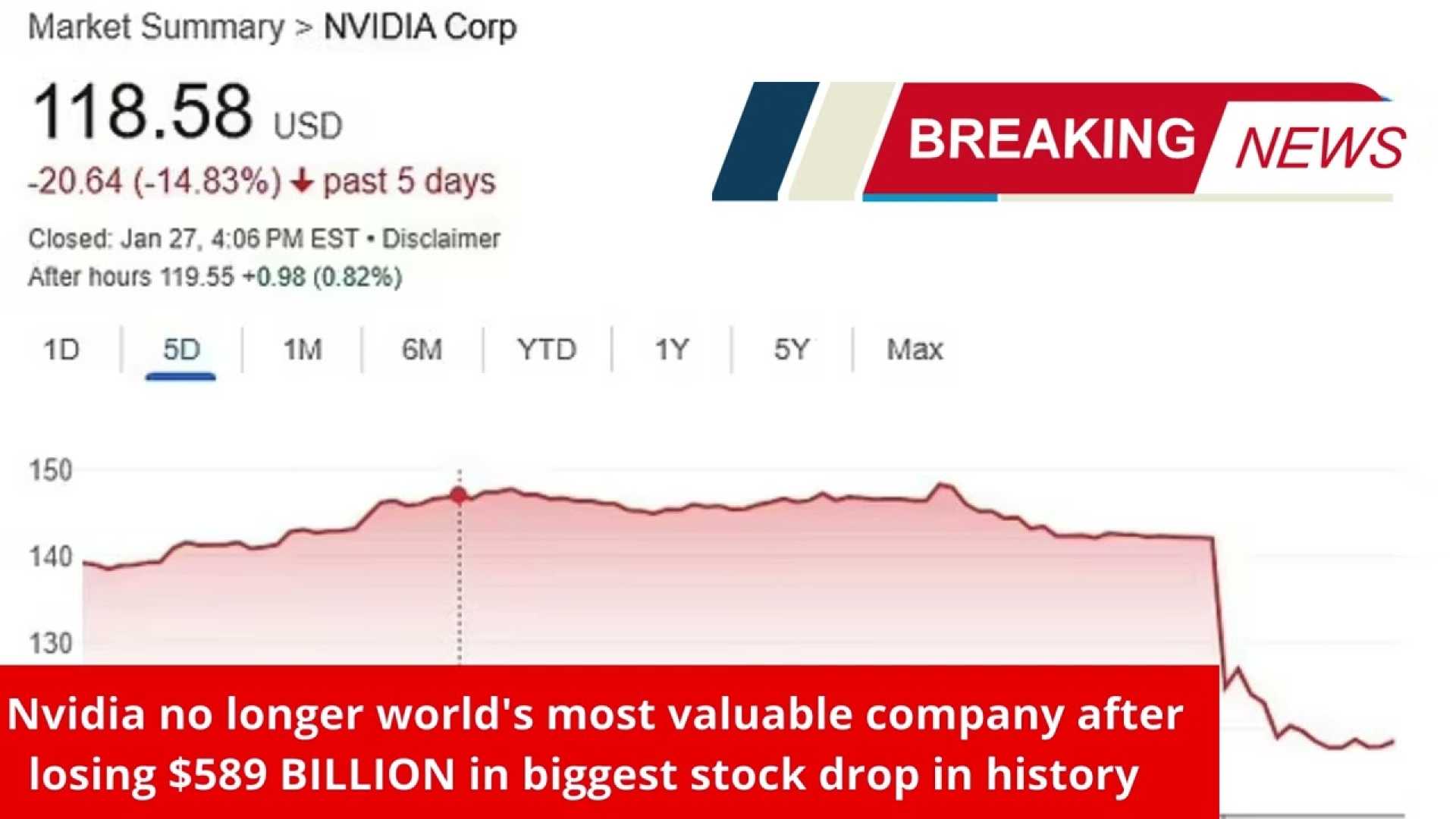

Nvidia Faces Market Turmoil Amid Tariff Concerns and Stock Decline

SAN FRANCISCO, Calif. — Nvidia Corporation is grappling with significant stock market turmoil, experiencing a decline of over 25% from its peak earlier this year. As of April 7, 2025, the company’s market value has shed nearly $183 billion following President Donald Trump’s recent announcement of “reciprocal tariffs” on numerous countries.

The tariffs, set at a minimum of 10%, were disclosed on April 2, which contributed to a sharp 10% drop in the S&P 500 index within just two days. The tech-focused Nasdaq composite also plummeted 11%. Ashish Shah, chief investment officer of public investing at Goldman Sachs, commented on the likely impact of these tariffs on U.S. consumers.

While semiconductors are reportedly exempt from the tariffs, their downstream effects on electronics manufacturing could diminish the demand for chips. On April 3, the Philadelphia Semiconductor Index experienced a decline of nearly 10%, with another 7.6% drop the following day. Nvidia, closely watched as a bellwether for AI chip demand, suffered a loss of more than 14% over these two sessions.

Even prior to the tariffs, Nvidia was facing challenges. The chipmaker, renowned for its stronghold in artificial intelligence, registered a nearly 20% decline in stock during the first quarter of 2025. Contributing factors include the introduction of DeepSeek, a cheaper AI model from China, disappointing earnings reports, and a broader sell-off within the tech sector amid economic uncertainties.

Nvidia’s revenue growth slowed to 78% year-over-year in the fourth quarter of 2024. Although still impressive, it fell short of investor expectations. The company also reported a non-GAAP gross margin of 73.5%, a drop of 3.2 points from the previous year. CEO Jensen Huang has consistently highlighted the demand for Nvidia’s Blackwell architecture, but keeping pace has begun to erode the company’s profit margins.

The escalating situation has amplified pressures on Nvidia’s production strategy, primarily concentrated in the Asia-Pacific region. The U.S. recently imposed tariffs of 32% and 34% on imports due to the firm’s dependence on Taiwan and China. In a retaliatory measure, China has also instituted a 34% tariff on U.S. imports, exacerbating the strain on Nvidia’s operations in vital markets.

Investor Vladimir Dimitrov expressed his concerns regarding the potential long-term effects of mounting tariffs on Nvidia’s stock performance. He noted that the company’s incorporation into the Dow Jones Industrial Average could signal a shift in analyst sentiment, which may lead to downgrades. “Prior to NVDA’s index inclusion, I highlighted significant risks for shareholder returns. Since that time, NVDA has lost roughly 30% of its value,” Dimitrov stated.

Despite ongoing challenges, Wall Street analysts continue to favor Nvidia, underscoring a Strong Buy consensus rating, consisting of 38 Buy and 4 Hold ratings. Analysts assert that while no entity is impervious to the ramifications of tariffs, those with robust balance sheets and a strong foothold in AI, cloud, and complex computing are likely to navigate the economic fluctuations more successfully.

Bank of America has marked Nvidia as one of its top semiconductor picks, with Broadcom, Lam Research, and Cadence Design Systems also on the list. Analysts led by Vivek Arya contend that AI spending is expected to remain steady among leading U.S. cloud providers such as Meta and Microsoft, who are equipped to invest significantly in critical AI implementations. Arya pointed out that companies with U.S.-based manufacturing assets may benefit from evolving supply chains.

Nvidia currently trades at a forward price-to-earnings (P/E) ratio of 24.5, with its price/earnings-to-growth (PEG) ratio below 0.5, indicating potential undervaluation given its growth prospects. The company has reported a staggering revenue increase of 383% over the last two years, escalating from $27 billion in fiscal 2023 to $130.5 billion in fiscal 2025. Analysts project a further 54% revenue growth to $204.4 billion in the upcoming year, followed by 24% growth to $252.4 billion in 2026.

Looking forward, Nvidia anticipates that AI data center infrastructure spending could exceed $1 trillion by 2028, potentially positioning the company for remarkable growth if these forecasts materialize. The ongoing demand for AI infrastructure is expected to grow, particularly as cloud computing firms enhance their capabilities to satisfy increasing AI workload requirements.

In conclusion, while Nvidia navigates substantial short-term obstacles stemming from tariffs and market volatility, its long-term growth trajectory remains promising. Investors are left to carefully assess the associated risks and opportunities as they ponder their positions in this critical player in the technology sector.