Business

Palantir’s Stock Plummets: Should Investors Buy the Dip?

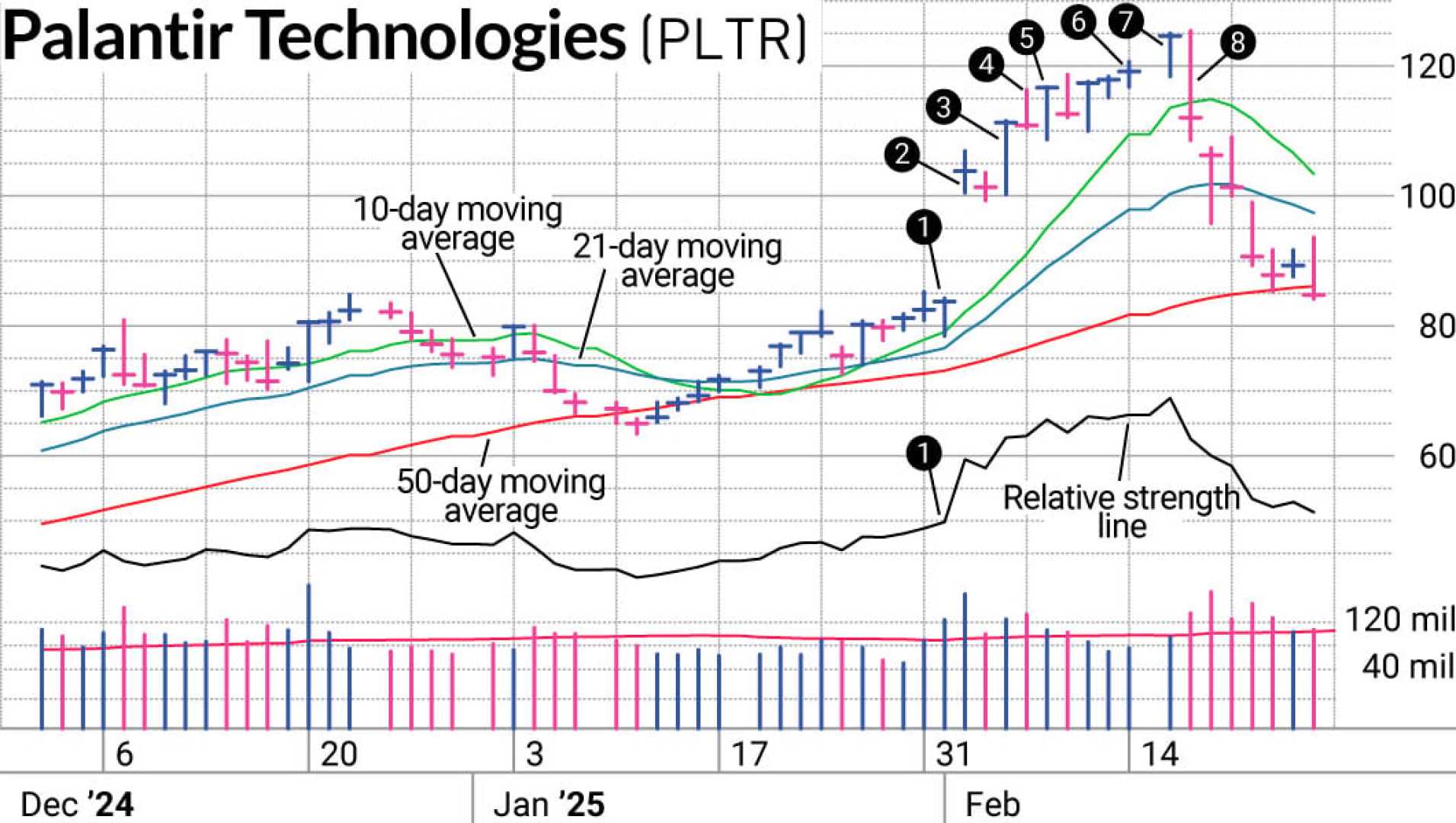

DENVER, Colo. — Palantir Technologies has seen its stock fall sharply, reflecting market volatility and investor jitters. As of April 4, 2025, shares of Palantir traded at $73.99, down 11.49% for the day, and have dipped over 30% from their recent highs.

Despite the current drop, Palantir’s stock has soared 274% over the past year, a figure that suggests that while recent events might feel severe, the bigger picture still offers optimism. Investors are now questioning whether this is the right moment to buy into one of the most talked-about artificial intelligence (AI) stocks, or if further declines are on the horizon.

Palantir, which specializes in custom software built upon its technologies like Gotham, Foundry, and AIP, has positioned itself as a leader in AI. The company’s applications incorporate AI, data analytics, and machine learning to provide real-time insights, aiding organizations with tasks ranging from fraud detection to military mission coordination.

Founded with roots in government contract work, Palantir still derives over half of its revenue from the public sector. However, its rapid expansion into the commercial market has captured Wall Street’s attention. After launching its AIP platform in mid-2023, Palantir reported a consistent increase in revenue, ending 2024 with 382 U.S. commercial customers, a small fraction compared to the 20,000 large corporations in the U.S.

Financially, Palantir boasts a robust position, with $5.2 billion in cash and no debt. Analysts project the company will grow earnings per share by 25% annually over the long term, making its prior stock performance more understandable.

However, past performance raises questions about the stock’s future sustainability. While Palantir’s revenue has increased by 40% over the last three years and earnings per share have jumped by 216%, it does not seem to align with its stock price which has surged over 900%, even including recent losses.

In comparison, the S&P 500 index trades at 21 times its earnings estimates. With Palantir’s stock currently at a staggering 157 times forward earnings estimates, it faces significant pressure to meet heightened expectations.

“A high valuation means the company must perform exceptionally well to justify it,” said one financial analyst. “Investors might be cautious because excessive valuations make stocks riskier, especially in a volatile market.”

Until the stock price aligns more closely with its business performance or if the company can significantly enhance its growth metrics, analysts suggest caution for potential investors. “The moment for a reevaluation hasn’t arrived yet,” the analyst concluded. “Until then, it may be wise to steer clear of Palantir Technologies.”

As of the article’s publication, The Motley Fool holds a position in Palantir Technologies but has cautioned its readers about investing decisions. Investors are advised to proceed with diligence and consider the potential risks and rewards of any investments in high-volatility stocks.