Politics

Potential Capital Gains Tax Increase in Autumn Budget

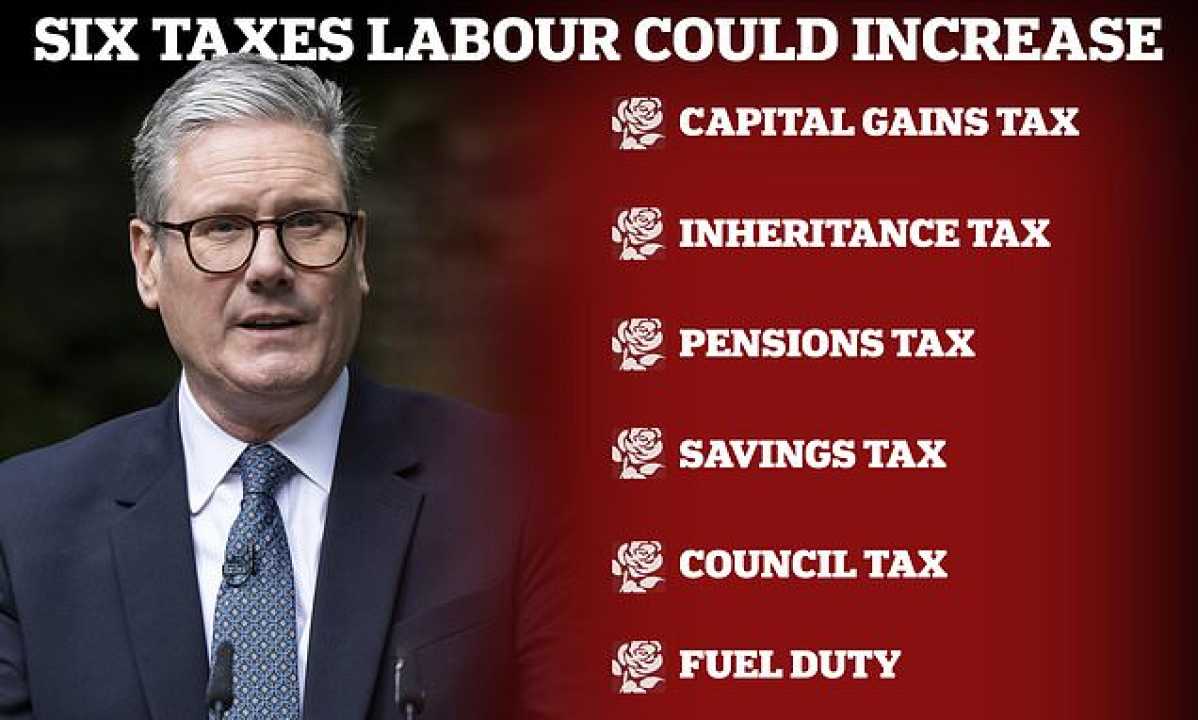

Tax experts are advising taxpayers to prepare for a possible increase in capital gains tax (CGT) in the impending autumn budget proposed by the Labour government. Nimesh Shah, chief executive of Blick Rothenberg, stated that Labour leader Sir Keir Starmer has indicated a move towards higher tax rates for affluent individuals and wealthier taxpayers.

This warning follows recent comments by Prime Minister Rachel Reeves, who criticized the previous administration for creating a £22 billion ‘black hole’ in the economy. Mr. Shah noted that raising CGT could be a viable option to bridge this financial gap without violating Labour’s election commitments.

He highlighted that increasing the current CGT rate from its existing levels to between 25% and 30% could significantly boost tax revenues, which currently account for less than 2% of the overall tax intake. In the 2022-23 fiscal year, CGT raised £14.5 billion, a decrease of £2.5 billion from the previous year.

Additionally, Mr. Shah cautioned that such tax hikes might incentivize affluent individuals to leave the UK for non-residency status to avoid the increased financial burden. He also suggested that a lower CGT rate could be implemented for business asset sales to promote entrepreneurial activity.

As the Labour government prepares for its autumn budget, stakeholders in finance and business are closely monitoring developments regarding potential tax reforms and their implications on the economy and investment climate.