Business

Private Payroll Growth Slows Amid Economic Uncertainty

NEW YORK, NY — Private sector payroll growth in the United States slowed significantly in April, increasing by just 62,000 jobs, according to the ADP report released Wednesday. This increase is the smallest since July 2024 and falls well below the Dow Jones consensus expectation of 120,000 jobs.

Employers are cautiously navigating heightened uncertainty due to potential impacts from President Donald Trump‘s tariffs against U.S. trading partners, ADP Chief Economist Nela Richardson said. “Unease is the word of the day. Employers are trying to reconcile policy and consumer uncertainty with a run of mostly positive economic data. It can be difficult to make hiring decisions in such an environment,” she added.

Wage growth also showed signs of retreat, with wages rising only 4.5% from the previous year for those remaining in their positions, down from 4.6% in March. However, job changers experienced a boost, seeing wage gains of 6.9%.

Among the sectors, leisure and hospitality added the most jobs, increasing by 27,000 positions, followed by trade, transportation, and utilities, which added 21,000 jobs. Meanwhile, education and health services saw a drop of 23,000 jobs, contributing to the overall slowdown.

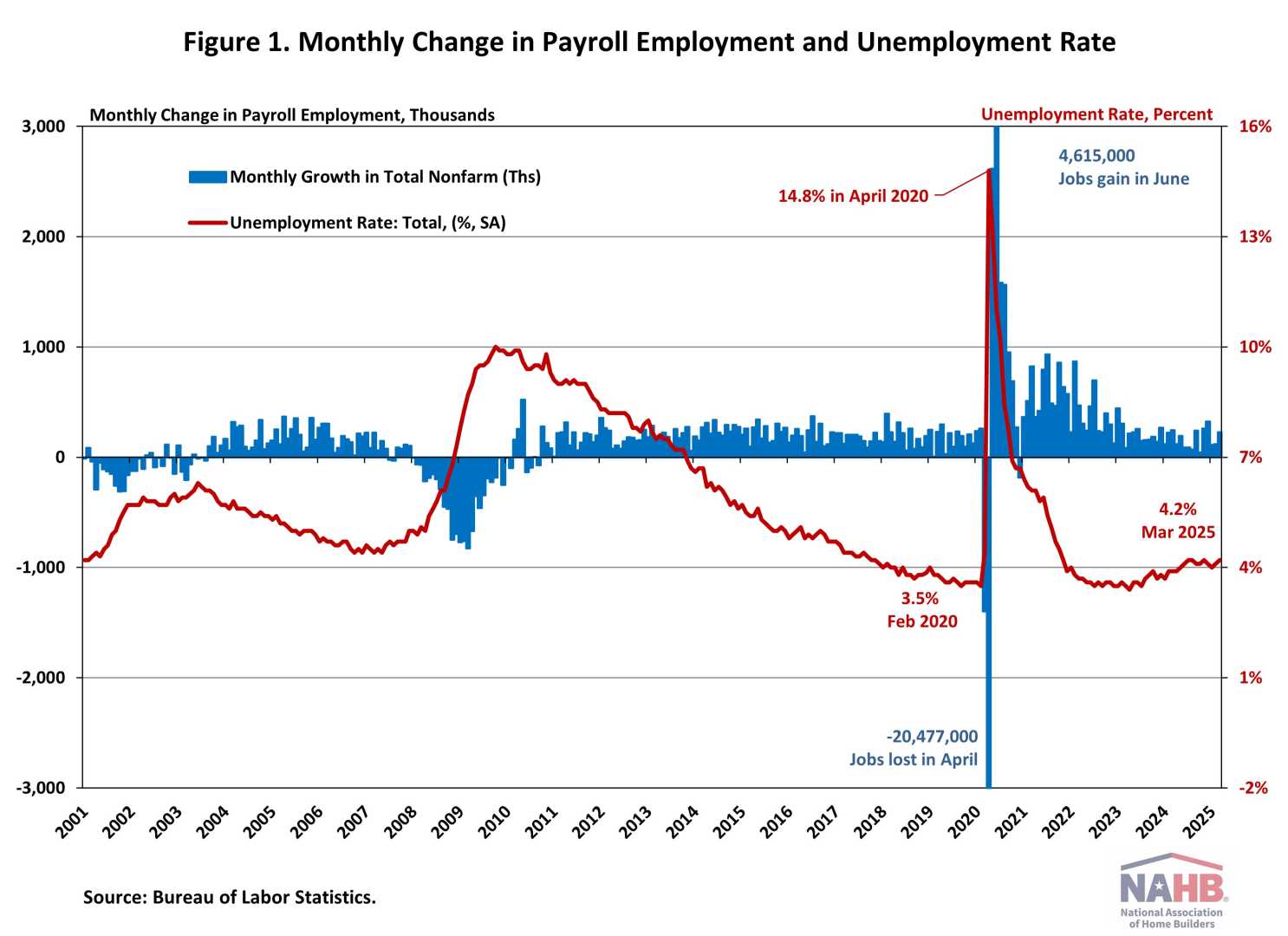

These findings precede Friday’s Bureau of Labor Statistics report, which is expected to show job growth of 133,000, including government hiring. The unemployment rate is anticipated to remain steady at 4.2%.

Concerns also arise as the U.S. economy contracted by 0.3% in the first quarter of 2025, according to a separate report from the Commerce Department. Economists had previously predicted growth of 0.4%, but imports surged by 41.3%, driven by businesses stocking up ahead of the tariffs. Imports significantly impacted GDP calculations, reducing the figure considerably.

The economic slowdown has sparked recession fears as Trump’s trade policies begin to take effect. Chris Rupkey, chief economist at Fwdbonds, commented, “Maybe some of this negativity is due to a rush to bring in imports before the tariffs go up, but there is simply no way for policy advisors to sugar-coat this. Growth has simply vanished.”

As markets reacted to the news, stock futures fell, highlighting a volatile month for U.S. equities. Many analysts remain watchful for any upcoming data that may indicate a stabilization of the labor market or further weakening in economic indicators.