Business

Pure Storage and NetApp Report Quarterly Earnings, Stocks Diverge

Mountain View, California – Pure Storage and NetApp released their quarterly earnings late Wednesday, showcasing differing market responses despite both reporting results ahead of expectations.

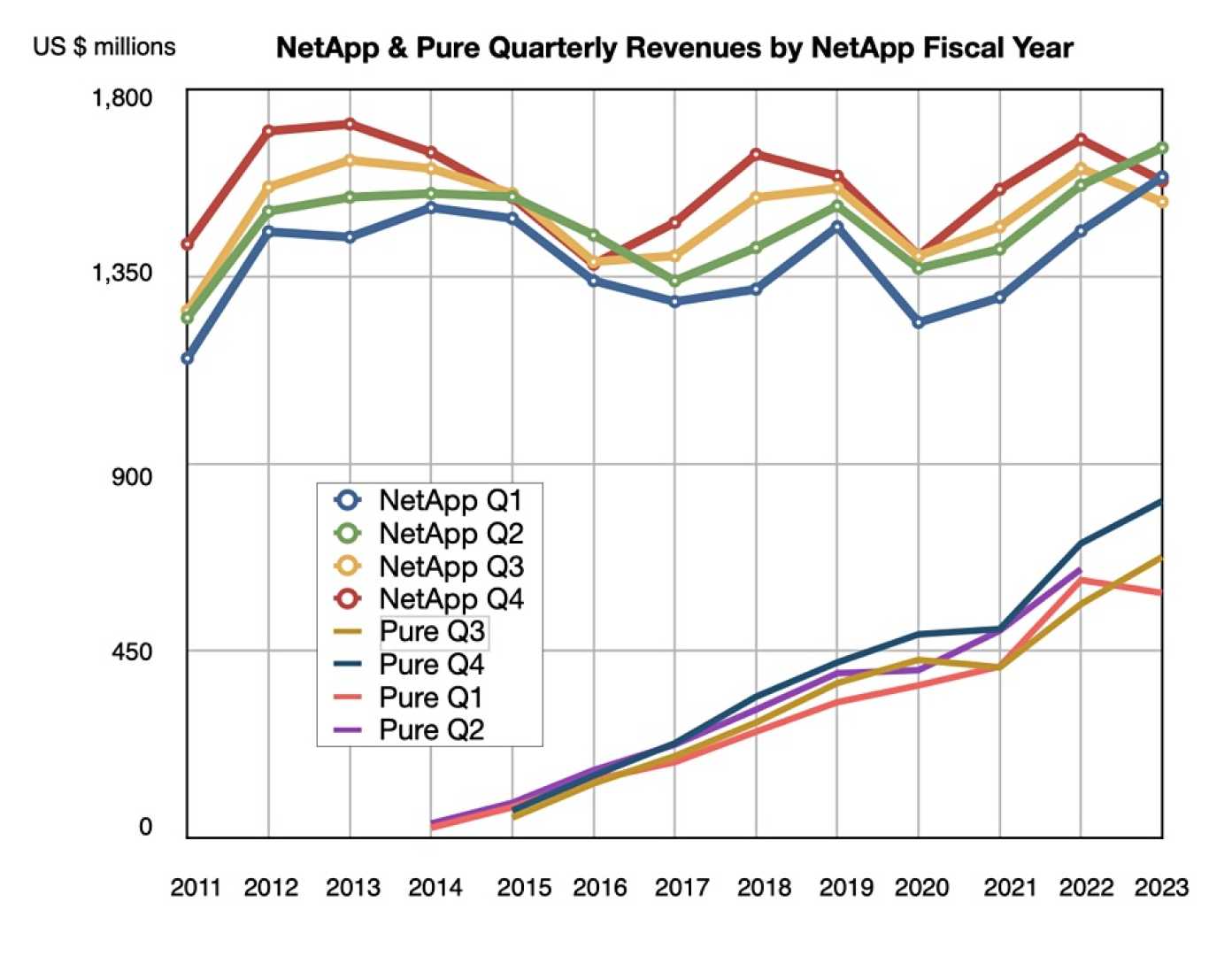

Pure Storage reported adjusted earnings of 43 cents per share on sales of $861 million for its fiscal second quarter ended August 3. Analysts were expecting earnings of 39 cents per share and sales of $846 million, according to FactSet. The company’s stock surged by more than 14% in after-hours trading.

In contrast, NetApp, based in San Jose, California, posted adjusted earnings of $1.55 per share on sales of $1.56 billion for its fiscal first quarter, which ended July 25. NetApp’s results slightly exceeded analysts’ expectations of earnings of $1.54 per share, but its stock fell over 6% in late trading.

Looking ahead, Pure Storage forecasted sales of around $955 million for the current quarter, surpassing previous estimates of $913 million. Meanwhile, NetApp guided for a midpoint of $1.69 billion in sales, slightly above analyst expectations of $1.68 billion.

The performance of both companies’ stocks has been inconsistent in recent years. Pure Storage shares rallied nearly 80% last year, while NetApp shares gained over 30% in 2024. However, both stocks faced challenges this year, experiencing declines of 1% and 2% year-to-date, respectively.

NetApp had an IBD Composite Rating of 66 out of 99 before the earnings report, indicating it falls short of the ideal benchmark for growth stocks, which require a rating of 90 or better. Pure Storage has a Composite Rating of 77.

Investors now turn their focus to how both companies will navigate competition and market pressures in the data storage sector moving forward.