Business

Realty Income Rises Amid Robust Dividend Announcement and Market Interest

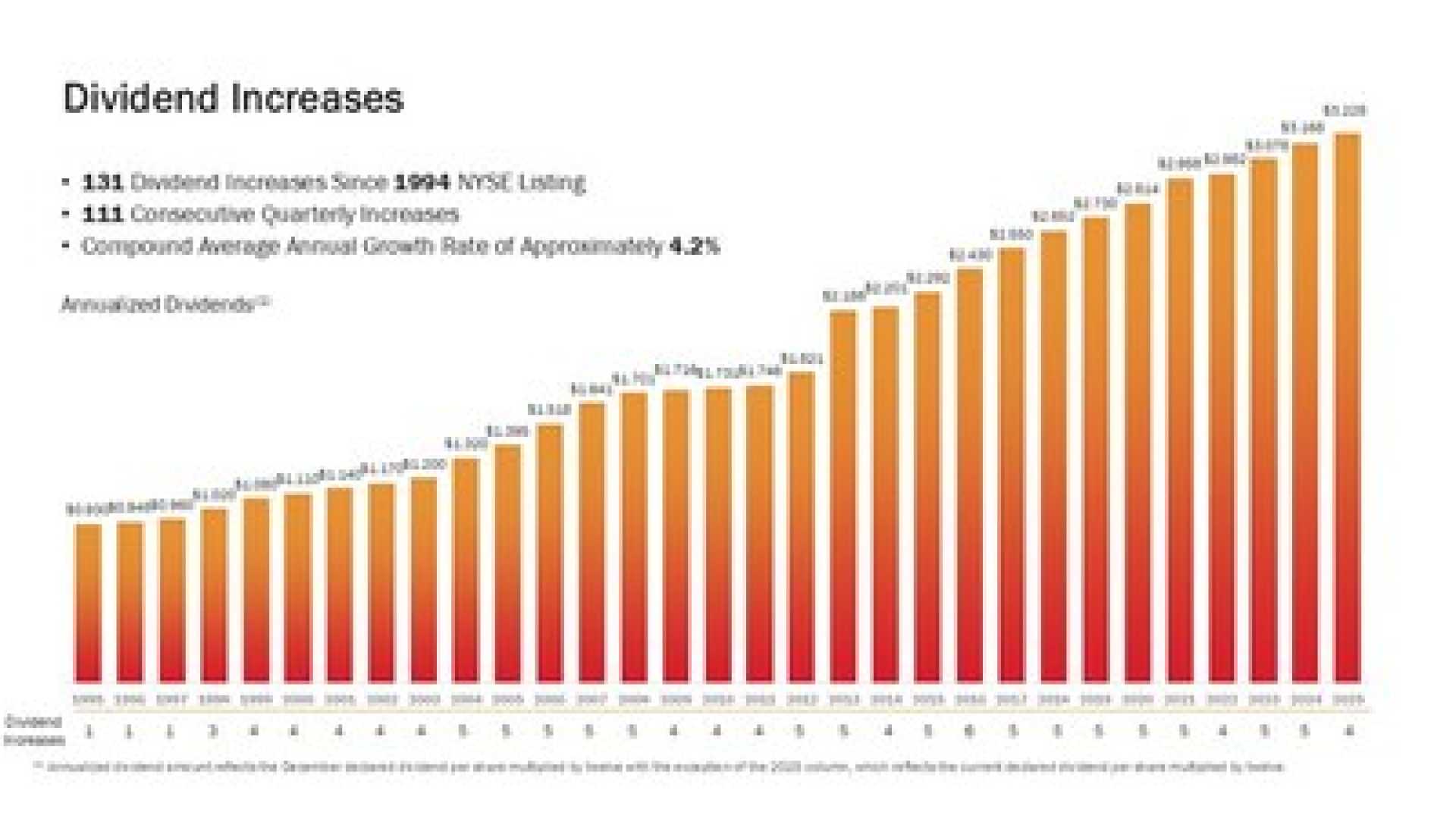

NEW YORK, NY — Realty Income Corp. (O) saw its stock price rise to $58.80 on Monday, July 14, 2025, representing a 2.87% increase intraday. This surge comes after the company declared its 661st consecutive monthly dividend, a move that continues to bolster its reputation as a ‘Monthly Dividend Company.’ The current yield at this price is approximately 4.7%.

Despite a sector-wide decline of 1.47% among retail real estate investment trusts (REITs), Realty Income outperformed its peers, reaching a 58.85-day high. The trading volume hit 7.47 million shares, indicating significant investor interest. Analysts believe the rise is linked to the certainty of dividend payments and the company’s strategic positioning amidst market volatility.

The announcement of the latest dividend, made on July 8, was a key catalyst for this momentum. Analysts emphasize Realty Income’s triple-net lease model and diversified tenant base as defensive qualities that protect the company against prevailing headwinds in the real estate market.

While 14 brokers have set a ‘Hold’ rating on the stock, projections suggest a 3.3% upside to a price target of $60.71. The stock currently carries a price-to-earnings (PE) ratio of 53.14, indicative of its premium valuation driven by reliability in dividend payments.

Other retail REITs fell sharply; for instance, Simon Property Group (SPG) gained only 0.32%, while its competitors saw larger declines of -4.77% and -4.40%. This highlights Realty Income’s unique appeal as it stands firm against a struggling sector.

Investors are also eyeing options contracts like O20250815C60 and O20250815P57.5, with the former representing bullish calls. Market indicators such as a Neutral Relative Strength Index (RSI) of 49.79 and a bearish MACD signal present traders with a mixed picture for decision-making.

With strong risk management and impressive historical returns, Realty Income’s strategy during an intraday surge has shown significant potential. Traders are advised to keep an eye on sector trends, particularly the performance of Simon Property Group, as it may affect future movements in Realty Income’s stock.

As Realty Income strives to maintain its yield advantage, market watchers anticipate a potential pullback at its 30-day resistance of $58.26. Investors are encouraged to consider long positions for steady income while monitoring options for volatility opportunities in the coming weeks.