Business

Rivian and Lucid Face Earnings Struggles Amid Market Disruptions

BENGALURU, India — Rivian and Lucid Motors reported disappointing quarterly earnings on August 5, 2023, and offered a grim outlook for the remainder of the year. Both electric vehicle makers experienced declines in their share prices, with Rivian falling about 4% and Lucid dropping 7% shortly after the announcement.

The challenges for these companies stem from significant policy shifts and ongoing trade tensions that have disrupted the automotive industry, particularly under the administration of President Donald Trump. Changes include scaling back consumer tax credits, imposing tariffs on auto parts, and halting emission fines for gas vehicle manufacturers.

Compounding these issues, China’s restrictions on the export of heavy rare earth metals, crucial components for electric vehicle motors, have severely disrupted supply chains and production lines in the United States.

Rivian CEO RJ Scaringe highlighted the company’s struggles with higher production costs, attributing the increase to disruptions in rare earth metal supplies. The company’s cost of revenue per vehicle rose to $118,375, an 8% increase from the previous year. Scaringe remarked, ‘That’s really reflecting a much lower production volume which was largely driven because of challenges we had within our supply base as a result of a lot of the changes in policy.’

Lower production in the second quarter led to a $14,000 impact per vehicle sold, according to Rivian’s CFO Claire McDonough during an analyst call. Rivian plans to halt production for three weeks in September to integrate components for its upcoming R2 SUV, seen as essential for its future success.

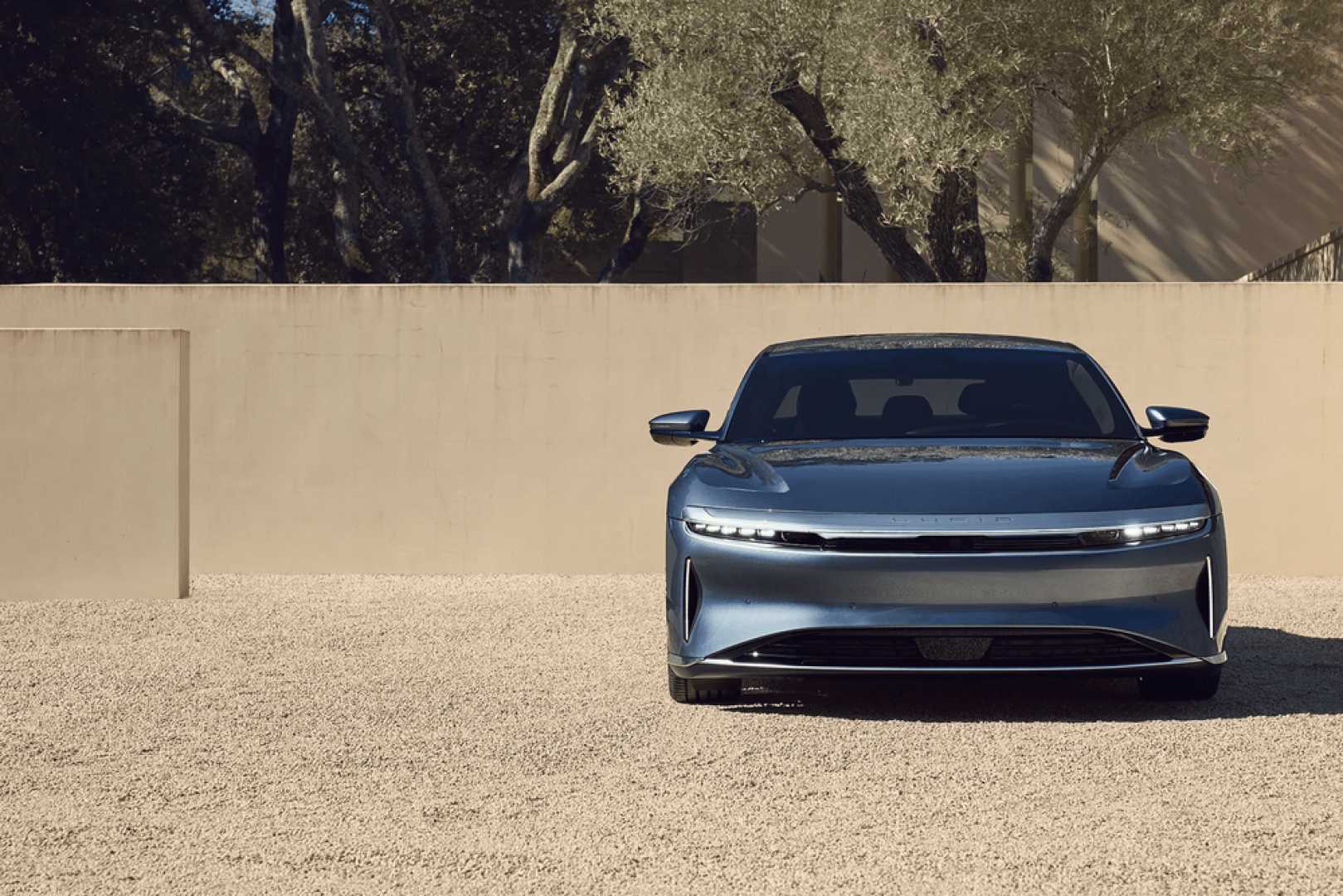

While Lucid managed to mitigate some supply disruptions by using existing inventory, its profit margins were still adversely affected by tariff costs in the same quarter. The company expressed concerns about a potential decrease in demand come the fourth quarter, with interim CEO Marc Winterhoff stating they are taking steps to retain customer interest as the $7,500 federal EV tax credit nears expiration.

The elimination of penalties for automakers not meeting fuel economy standards has significantly impacted the demand for regulatory credits, which both companies rely on selling to traditional automakers. Rivian has estimated a significant reduction in value for these credits, expecting its adjusted core losses to be between $2 billion and $2.25 billion for the year, up from previous forecasts.

Despite these challenges, Rivian anticipates record deliveries in the third quarter, driven by consumer and commercial demand, including its electric delivery vans for clients like Amazon, its largest shareholder. Reporting by Akash Sriram, Zaheer Kachwala, and Abhirup Roy; Editing by Sriraj Kalluvila and Stephen Coates.