Business

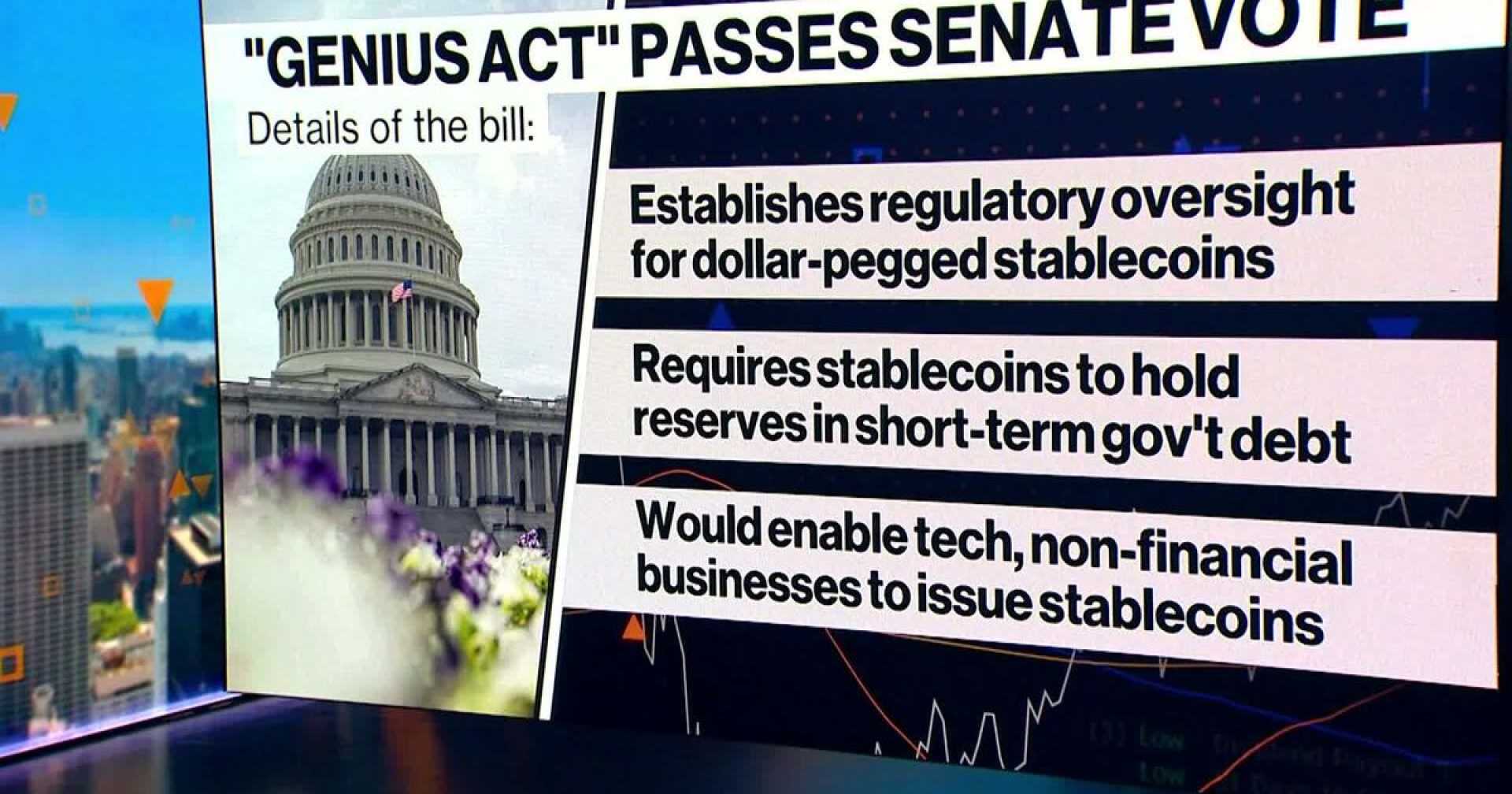

U.S. Senate Passes Landmark GENIUS Act for Stablecoins Regulation

Washington, D.C. — The U.S. Senate passed the Guiding and Establishing National Innovation for U.S. Stablecoins Act, known as the GENIUS Act, by a decisive 68-30 vote on June 17. This significant legislation aims to regulate digital assets with a focus on stablecoins, which are cryptocurrencies pegged to traditional assets like the U.S. dollar.

The GENIUS Act requires stablecoin issuers to maintain full reserves and undergo monthly audits to comply with anti-money laundering (AML) rules. This measure is intended to ensure that every stablecoin issued is backed by real assets, helping to reduce the risk of sudden market collapses or fraudulent practices.

Once enacted, the law is expected to facilitate the issuance of stablecoins by a variety of entities, including banks, fintech companies, and potentially large retailers. Consumers may benefit from clear redemption policies, allowing them to exchange stablecoins for U.S. dollars at predictable rates.

However, the bill has faced criticism from some senators, including Elizabeth Warren, who argue that it opens the door for major tech firms and retailers to issue their own private currencies. These critics raise concerns about market dominance, data privacy, and the risk of surveillance.

The GENIUS Act does prevent non-financial tech companies from directly issuing stablecoins, mandating that they partner with regulated financial entities. Advocacy groups like Better Markets warn that stablecoins remain vulnerable to financial instability, which could jeopardize consumer safety and the broader financial system.

Despite the controversies, the bill illustrates a growing recognition of the need for regulation in the rapidly evolving cryptocurrency landscape. The legislation’s next hurdle is the House of Representatives, where further debate and possible amendments are anticipated.

Former President Donald Trump‘s involvement in the cryptocurrency sector has also stirred concerns. Critics allege that conflicts of interest have not been adequately addressed in the bill, especially given Trump’s financial ties to World Liberty Financial, a platform he and his family partially own that has launched its stablecoin.