Business

SoundHound AI Stock Surges After Impressive Quarterly Performance

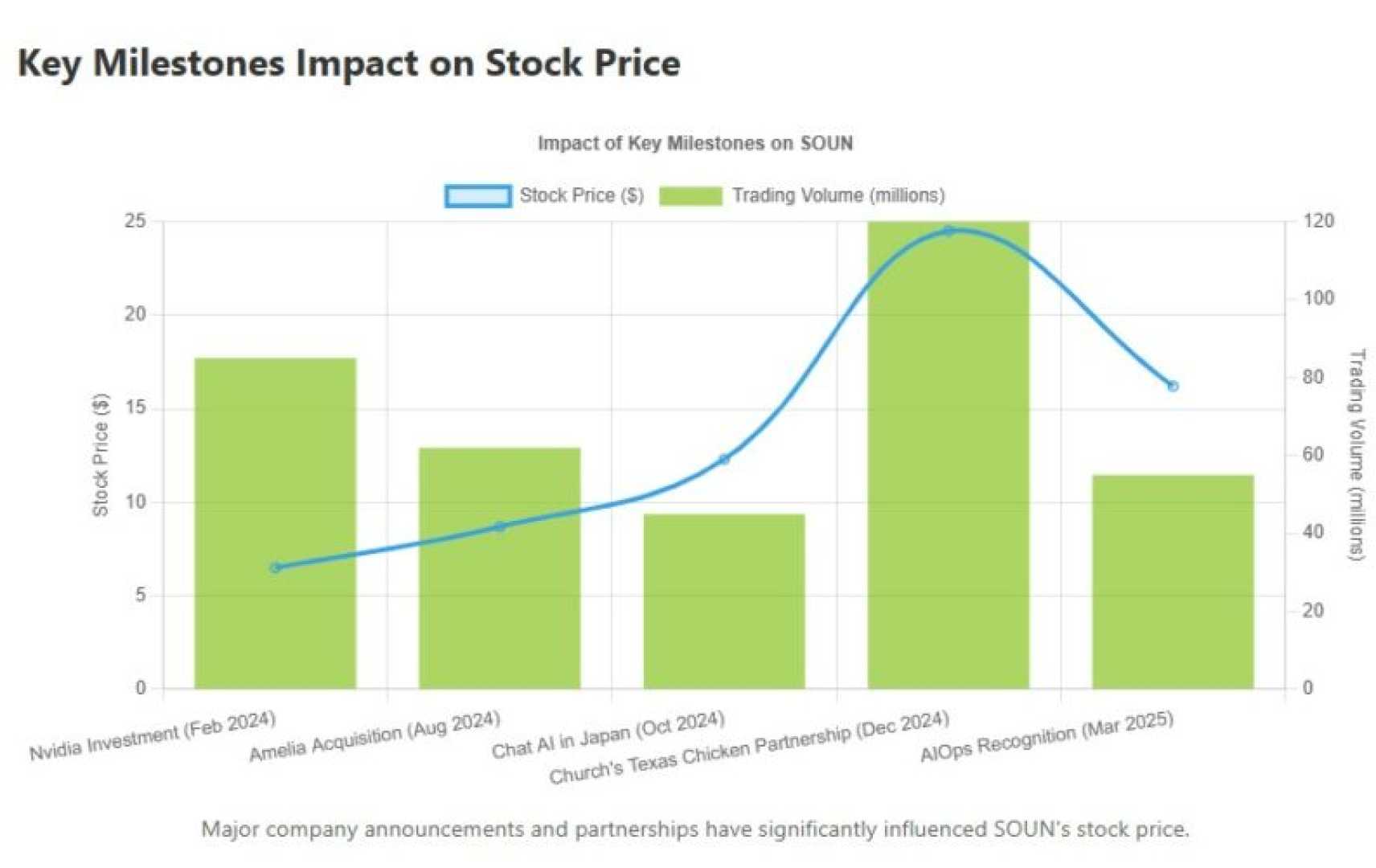

NEW YORK, NY — SoundHound AI, a voice AI platform that enables businesses to deliver conversational AI experiences, saw its stock surge 31% in just one week. This rally was fueled by the company’s impressive quarterly performance that saw revenue skyrocket 217% year-over-year to $42.7 million.

The main question for investors is whether the stock remains a good buy after such a significant run-up. Currently, the company’s valuation appears high, leading some to believe investing in it could be a risky bet. However, the massive revenue growth helps explain why investors are willing to pay a premium for the stock.

An analysis of SoundHound AI indicates moderate operational results and questions about financial stability. Key areas like growth, profitability, and resilience during downturns were evaluated, highlighting concerns about the stock’s attractiveness at its present price. For risk-tolerant investors, the stock could still present a rewarding opportunity.

Compared to the broader market, SoundHound AI’s stock price relative to its sales appears very expensive. The company’s profitability metrics trail behind most companies in the technology sector. Although SoundHound AI’s financial condition seems strong, it has underperformed the S&P 500 during recent downturns.

With hopes for a soft landing in the U.S. economy, questions arise about what may happen if another recession occurs. Recent analyses have shown how key stocks performed in past downturns, providing crucial insight into future risks.

Looking ahead, SoundHound AI’s revenue is projected to more than double in the coming years, potentially reaching over $250 million. This growth trajectory could justify its current high price-to-sales ratio, despite a decline expected over time. Nonetheless, significant risks remain, including a high cash burn rate and increasing competition.

Investors are encouraged to consider their long-term investment strategy and risk tolerance. A stock like SoundHound AI may yield high rewards, but it comes with a meaningful risk of substantial loss. Therefore, investors should proceed carefully and consider broader investment options for potentially lower volatility.