Business

Student Loan Delinquency Hits Credit Scores Hard Amid Payment Resumption

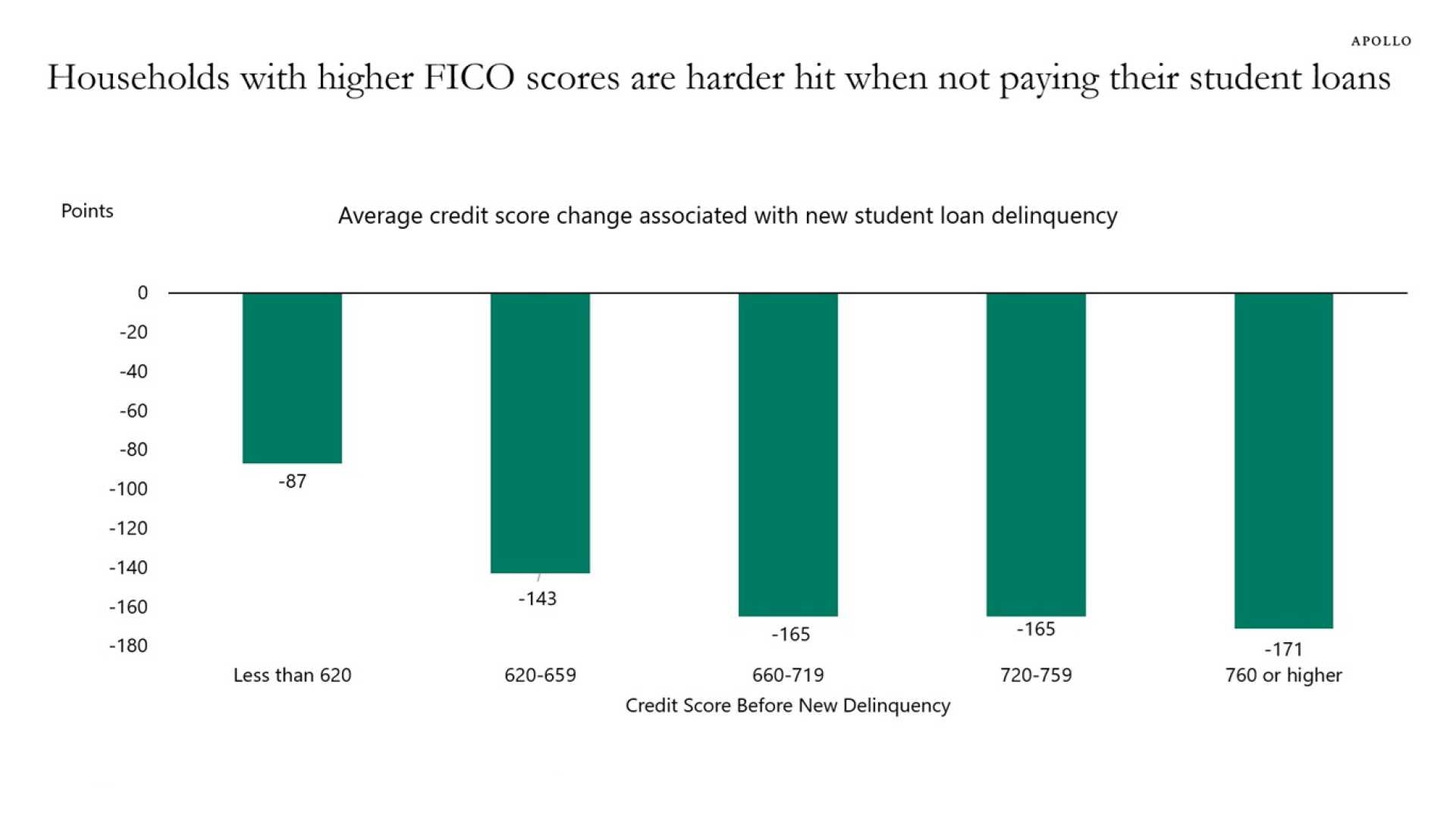

Washington, D.C. – Millions of federal student loan borrowers are struggling to keep up with payments, causing significant impacts on their credit scores. A recent report from Apollo Chief Economist Torsten Sløk notes that households with a FICO score above 760 can expect an average decline of 171 points with a new student loan delinquency.

Approximately 45 million Americans hold student loans, and about 11 million of them are more than 90 days delinquent or in default. The surge in delinquencies coincides with the recent resumption of loan payments, which had been paused during the COVID-19 pandemic.

Recent data from the Department of Education shows that around 4.12 million borrowers were between 181 to 270 days delinquent last quarter. If these borrowers do not catch up with their payments soon, nearly 10% of all student loan borrowers could potentially fall into default.

Before the pandemic, only about 500,000 borrowers experienced such serious delinquencies. The previous payment pause from 2020 to 2023 allowed borrowers to skip payments without penalty. This situation changed in February when the grace period ended, leaving many borrowers unable to resume payments due to various economic challenges.

Students who start missing payments after resuming could see their credit scores plummet anywhere from 87 to 171 points, Sløk emphasized. As collections on defaulted loans increase, impacted borrowers face difficulties in paying off their loans and other debts.

The situation illustrates the heightened pressure on U.S. consumers as these loan repayments restart. Experts are concerned about the potential for mass defaults, which could further entrench financial difficulties for millions.

“Those who opt-in to the reinstated payment plans face serious financial headwinds,” Sløk explained. “It’s critical to navigate this transition with care to avoid severe credit score impacts.”

The ongoing struggle with student loans raises significant questions about the future of credit scores and financial health for millions of Americans.