Business

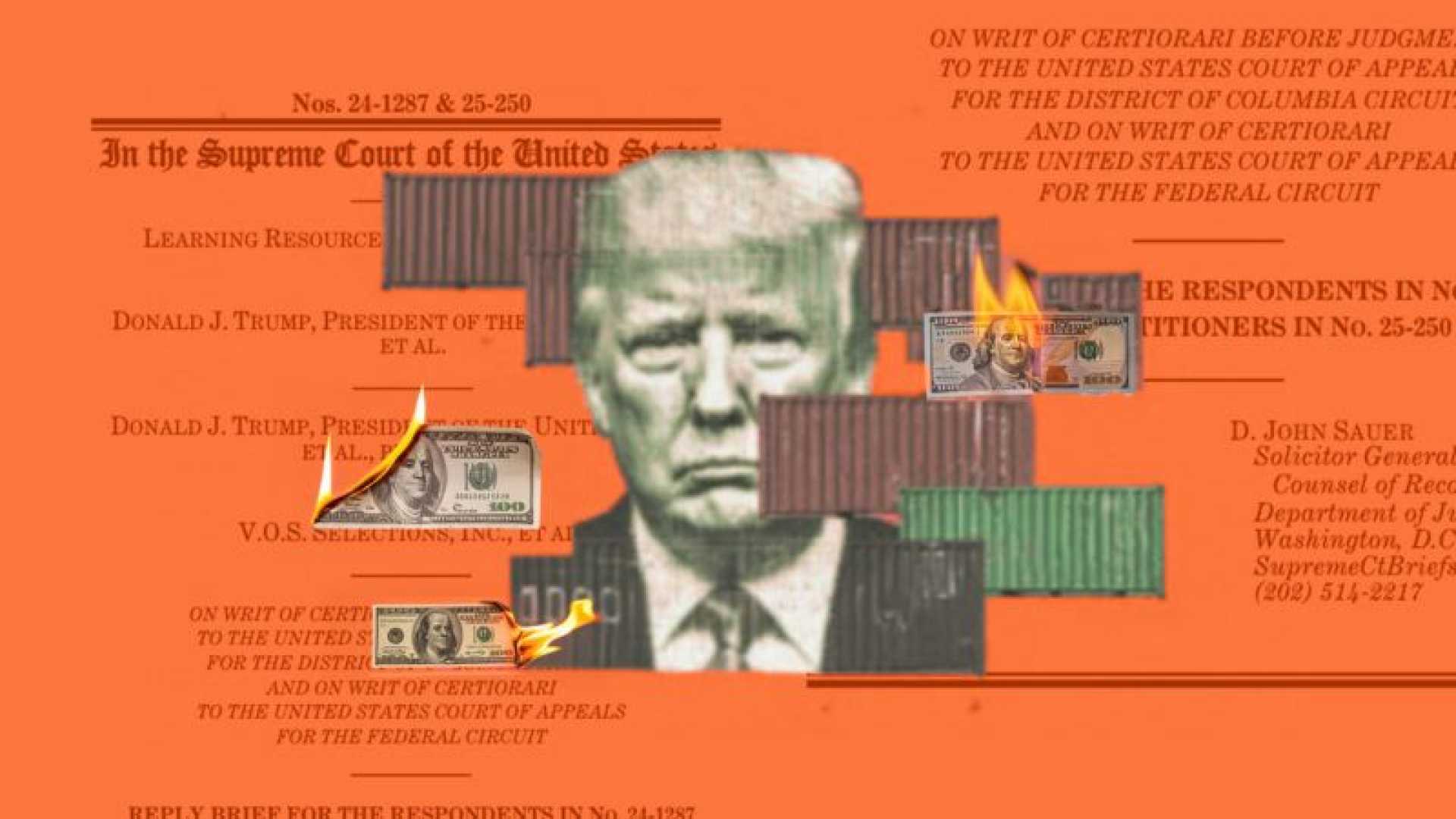

Supreme Court Hears Tariff Refund Case with Potential Billions at Stake

Washington, D.C. — The Supreme Court listened to oral arguments on Wednesday in a crucial tariff case that could lead to billions of dollars in refunds for businesses. The case questions the validity of tariffs imposed during the Trump administration, with justices from both conservative and liberal backgrounds expressing skepticism about the administration’s stance.

The federal government has generated nearly $90 billion in revenue from these tariffs, according to U.S. Customs and Border Protection data as of September 23. This figure may rise until a verdict is reached, which could take several months.

Justice Amy Coney Barrett, a Trump nominee, questioned Neal Katyal, who represented small and medium-sized businesses challenging the tariffs. “If you win, tell me how the reimbursement process would work. Would it be a complete mess?” Barrett asked. Katyal acknowledged the complexity of the refund process, stating that only his five clients would likely receive a refund directly.

Thomas Beline, a trade attorney, noted that businesses outside those represented by Katyal would likely be required to pursue separate appeals if they want refunds, making the process potentially complicated.

Katyal referenced a 1998 Supreme Court case on harbor maintenance fees when discussing the administrative hurdles involved. He stressed the importance of creating a feasible reimbursement process.

Ashley Akers, a senior counsel at Holland & Knight, speculated that customs officials might devise an automated refund system due to the high volume of refunds expected. However, she highlighted that blanket refunds without claims would be unlikely.

Months prior to the Supreme Court’s hearings, investment banks like Oppenheimer reached out to businesses to discuss deals where they could sell their potential tariff refunds for immediate cash. If the verdict favors the businesses, these banks would receive part of the total refunds.

According to Oppenheimer’s marketing materials, businesses could expect to receive upfront cash equivalent to 20% to 30% of their tariff payments while avoiding public disputes with the Trump administration.

Peacock Tariff Consulting principal Kyle Peacock remarked that companies aggressively sought to acquire tariff refund stakes, causing some clients to feel regret after selling their stakes for reduced gain.

The outcome of this case may significantly impact many businesses and how tariffs are managed in the future.