Business

Treasury Secretary: Recession Fears Fuelled by Media, Not Reality

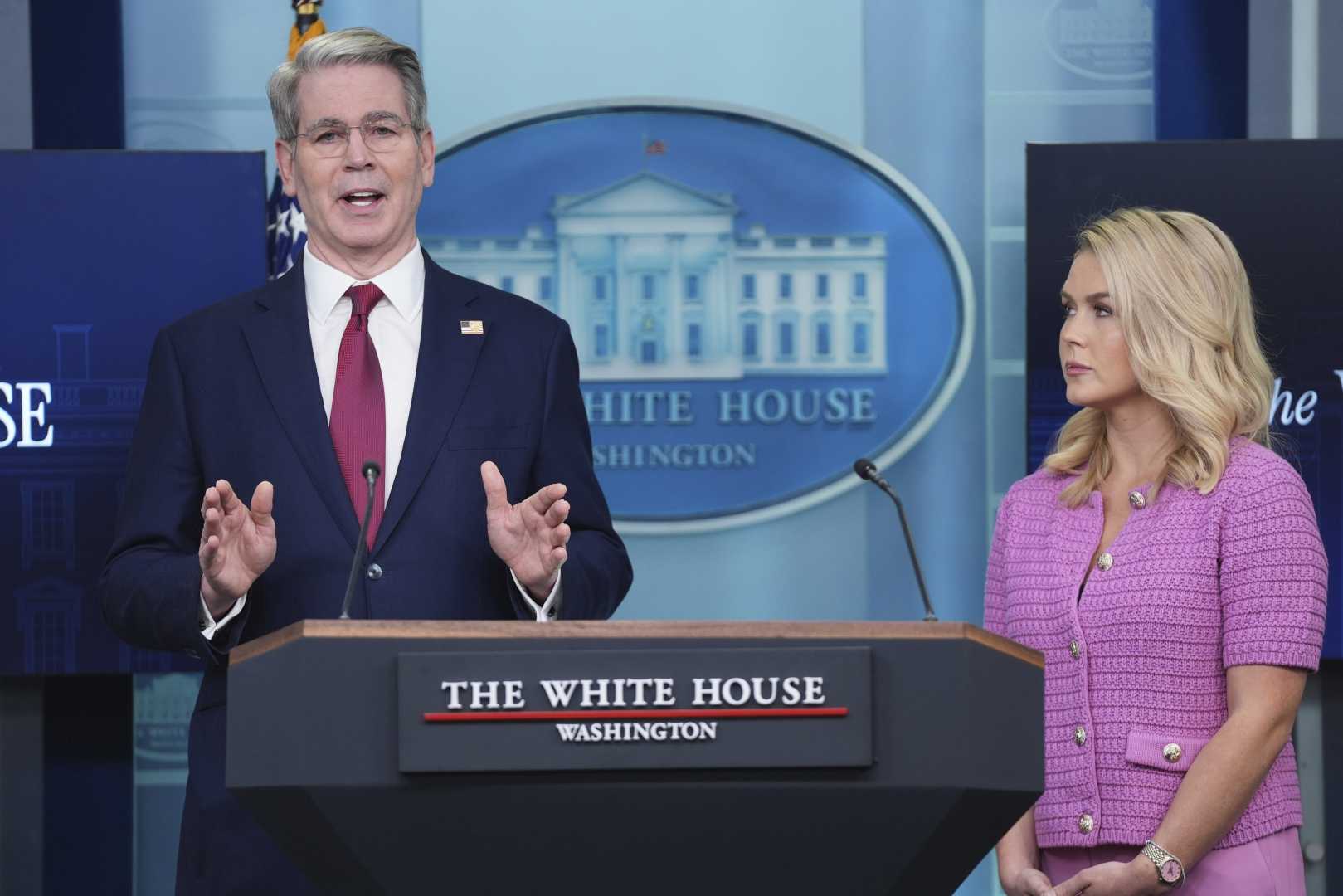

Washington, D.C. — Treasury Secretary Scott Bessent stated on Sunday that public fears of a recession are mainly driven by media reports rather than economic fundamentals. He responded to alarming headlines indicating the Dow Jones Industrial Average was facing its worst April since 1932, asserting the market is on the rise.

“When I look at some of the things that are being published, there was a story 10 days ago that said, ‘this is the worst April for the stock market since the Great Depression.’ Ten days later, the NASDAQ is now up in the month of April,” Bessent said on ABC’s ‘This Week’.

A recent poll by ABC News, The Washington Post, and Ipsos revealed that 72% of Americans think President Donald Trump‘s tariffs are likely to trigger a recession. Bessent emphasized that the market has significantly rebounded after a major decline earlier in April.

On April 21, The Wall Street Journal reported that the Dow had dropped nearly 1,000 points, fueling concerns among investors. However, following a plunge on April 21, stock markets surged the next day, with the Dow gaining 1,016.57 points, or 2.66%. The S&P 500 and NASDAQ also saw increases of 2.51% and 2.71%, respectively.

Bessent attributed part of this recovery to his announcement that there would be a “de-escalation” in the ongoing trade war between the U.S. and China. This conflict escalated after Trump implemented tariffs on various Chinese imports, leading to retaliatory actions from Beijing, resulting in tariffs as high as 245%.

On April 9, Trump indicated he would increase tariffs on China from 104% to 125%. The White House later confirmed that there would be no unilateral tariff reductions but noted that negotiations with China would continue.

Trump claimed he is negotiating over 200 trade deals with other countries, further complicating the landscape for American economic policy. Bessent’s comments come amidst ongoing discussions about the implications of these tariffs on the broader economy.