Business

Trump’s Tariffs Spark Market Turmoil and Global Trade Unrest

WASHINGTON, D.C. — U.S. President Donald Trump‘s recent announcement of sweeping tariffs has sent shockwaves through global markets, impacting stocks and consumer prices alike. The 25% tariffs on imported vehicles and 20% tariffs on various goods from the European Union and other regions are set to create ripples in the economy.

In a statement made just after the tariffs were announced on April 2, 2025, Trump expressed optimism about their long-term benefits. ‘The markets are going to boom, the stock is going to boom, the country is going to boom,’ he said as he departed the White House for a golf event.

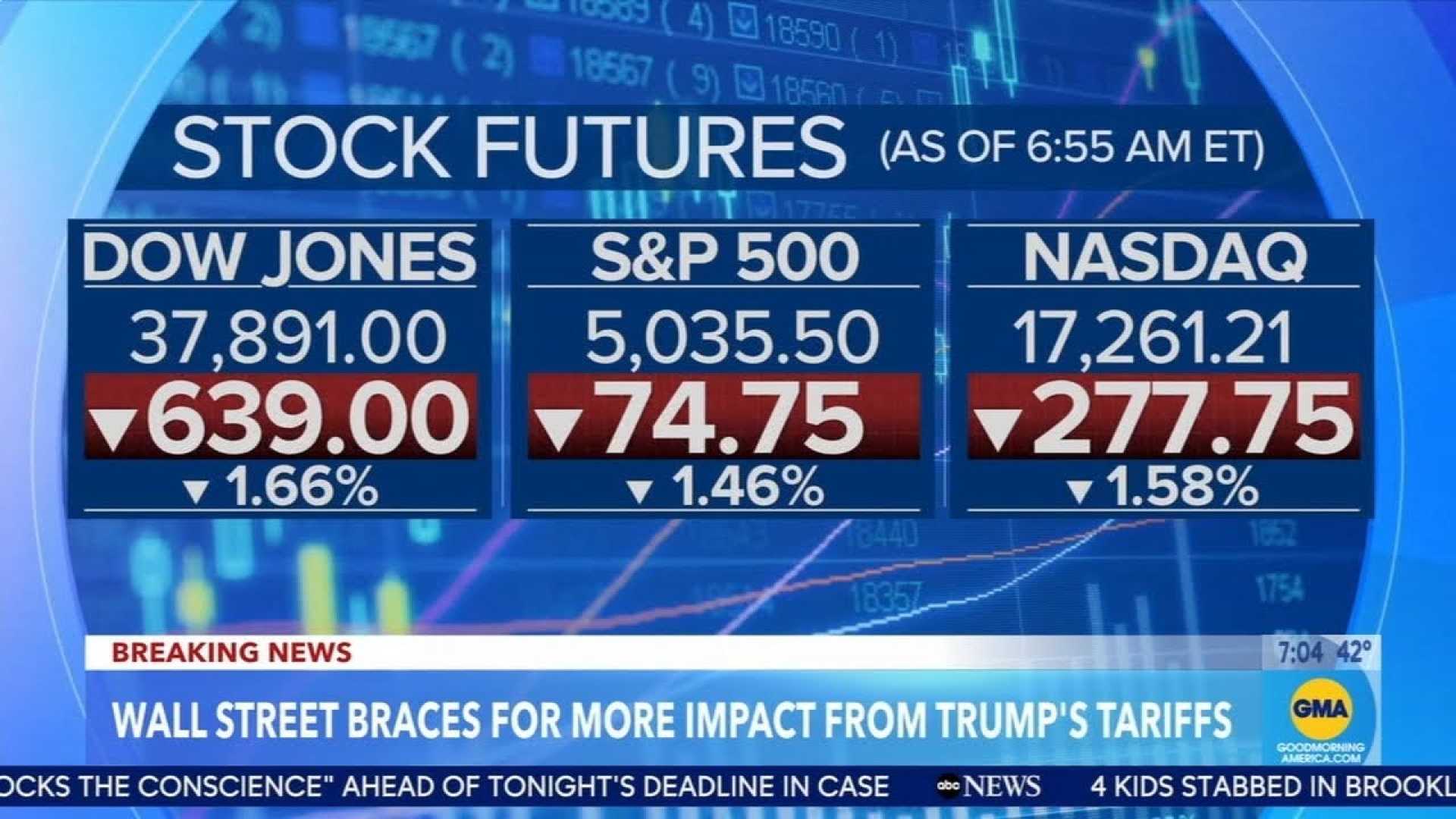

However, market reactions tell a different story. Major indices experienced significant drops, highlighting investor concerns about the economic fallout from the tariffs. Stocks of major companies, including the Ford Motor Company and GM, saw declines as automakers grappled with potential increased production costs and reduced consumer demand.

Infiniti, a luxury brand under Nissan, announced an indefinite pause on U.S. production of its QX50 and QX55 models due to the new tariffs. In a memo to retailers, Infiniti Americas Vice President Tiago Castro indicated that the halt would continue ‘until further notice’ as they restructure supply chain operations.

‘We will continue to evaluate the impact on market needs to make adjustments as necessary,’ a Nissan spokesperson confirmed. This pause comes amidst broader industry fears about how the tariffs will affect production schedules and consumer prices.

In the luxury goods sector, the European Union and Switzerland, two vital markets, faced steep tariffs of 20% and 31%, respectively. Analysts from JPMorgan noted that luxury watchmakers in these regions would be particularly vulnerable due to their thinner profit margins. Shares in companies like Swatch Group and Richemont saw significant drops, around 4% and 6.3% respectively.

The tariffs extend beyond just vehicles and luxury goods. Household staples, including coffee and bananas, are expected to see price increases as manufacturers may pass on their higher costs to consumers. The Consumer Brands Association highlighted ingredients such as tropical fruits and coffee that are now subject to substantial tariffs, which could affect the end prices for everyday items.

In response to the economic disruption, trade experts warn that rapid retaliatory measures from other countries could lead to an escalation in international trade conflicts. U.S. CEOs, particularly in industries such as medical devices and automotive, are increasingly vocal about their concerns regarding the long-term effects of these tariffs. ‘This is a national emergency,’ said top trade aide Peter Navarro, emphasizing the administration’s stance against negotiation.

Despite reassurances from Commerce Secretary Howard Lutnick that grocery prices would not dramatically rise due to tariffs, there remains skepticism among economists. Analysts from Goldman Sachs noted a potential slowdown in economic growth, highlighting the risk of stagflation—a period characterized by stagnant growth and rising inflation—as more tariffs are introduced.

As for Trump’s claims regarding successful negotiations, few analysts believe there will be swift agreements as companies continue to feel the pressure from increased material and production costs. The Federal Reserve is also being monitored closely for its response to these evolving economic conditions.

Addressing concerns from stakeholders, Trump mentioned during his remarks that investment pledges from companies have reached nearly $7 trillion, suggesting that the tariffs will lead to increased domestic investments. However, many industry leaders expressed doubts about this forecast.

As the reality of the tariffs impacts consumers and businesses alike, the stakes are growing higher with potential long-term consequences for the U.S. economy as stakeholders from various sectors prepare for significant adjustments.