Business

Trump’s Trade Policies Spark Market Rally on Inauguration Day

WASHINGTON, D.C. — U.S. stocks opened higher Tuesday as investors reacted to President Donald Trump‘s first-day executive actions, which signaled a softer approach to international trade than initially feared. The Dow Jones Industrial Average rose 170 points, or 0.39%, while the S&P 500 and Nasdaq Composite gained 0.49% and 0.52%, respectively.

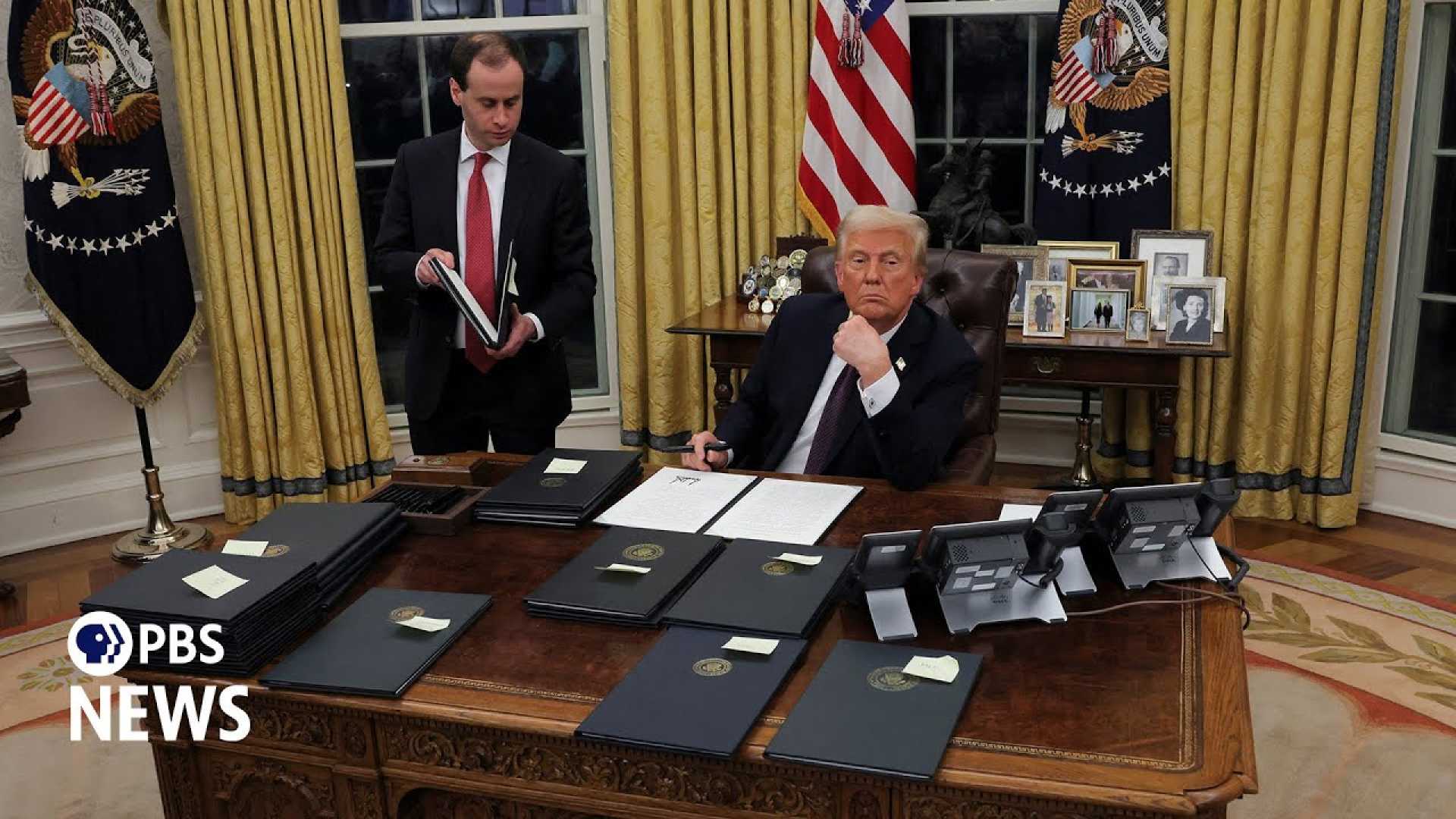

In a signing ceremony at the White House on Monday, Trump announced a 25% tariff on Mexico and Canada, effective February 1, citing border policy concerns. However, he stopped short of imposing new tariffs on China, instead hinting at potential levies if Beijing fails to approve a TikTok deal. “President Trump’s Inauguration Day policy announcements on tariffs were more benign than expected,” said Alex Phillips, chief U.S. political economist at Goldman Sachs.

Wall Street’s rally was bolstered by strong earnings reports from companies like 3M, which saw its shares jump nearly 5% after beating fourth-quarter expectations. Meanwhile, Apple shares dipped nearly 4% following downgrades from Jefferies and Loop Capital, which cited concerns over iPhone demand.

Trump’s focus on reversing regulations and boosting fossil fuel production also influenced market sentiment. WTI crude oil fell 2.5% early Tuesday, while the yield on the 10-year Treasury note declined, signaling investor optimism.

Chinese Vice Premier Ding Xuexiang warned of potential trade tensions during a speech at the World Economic Forum in Davos, Switzerland, stating that trade wars end with “no winners.” Despite these concerns, analysts remain cautiously optimistic. “Positive performance during the post-election honeymoon period has been a signal for gains during both the first 100 days of the presidency and the entire year almost 80% of the time,” said Sam Stovall, chief investment strategist at CFRA Research.

Bitcoin, which surged to a record high above $109,000 on Monday, fell nearly 3% as Trump did not address cryptocurrency in his inaugural address. Wall Street, closed Monday for Martin Luther King Jr. Day, resumed trading with a focus on Trump’s pro-business agenda and its potential impact on inflation and economic growth.