Business

In Uncertain Times, Experts Offer Guidance for Investors

NEW YORK, March 29, 2025 — As major U.S. stock indexes have recently fallen, investor sentiment is at a low not seen in months. The S&P 500 and the Nasdaq Composite are both hovering near correction territory just weeks after substantial declines, igniting fears of a potential recession.

According to a March 2025 survey by the American Association of Individual Investors, about 60% of U.S. investors report feeling “bearish” about the market over the next six months, representing a significant increase from 28% just a few months prior. In light of these developments, financial experts are recalling the advice of legendary investor Warren Buffett, who has weathered numerous economic downturns in his career.

Buffett advises investors to remain calm during turbulent times. As he famously stated in a 2008 New York Times article, “Be fearful when others are greedy, and be greedy when others are fearful.” This philosophy may now be particularly relevant, as markets experience an uptick in fear among investors.

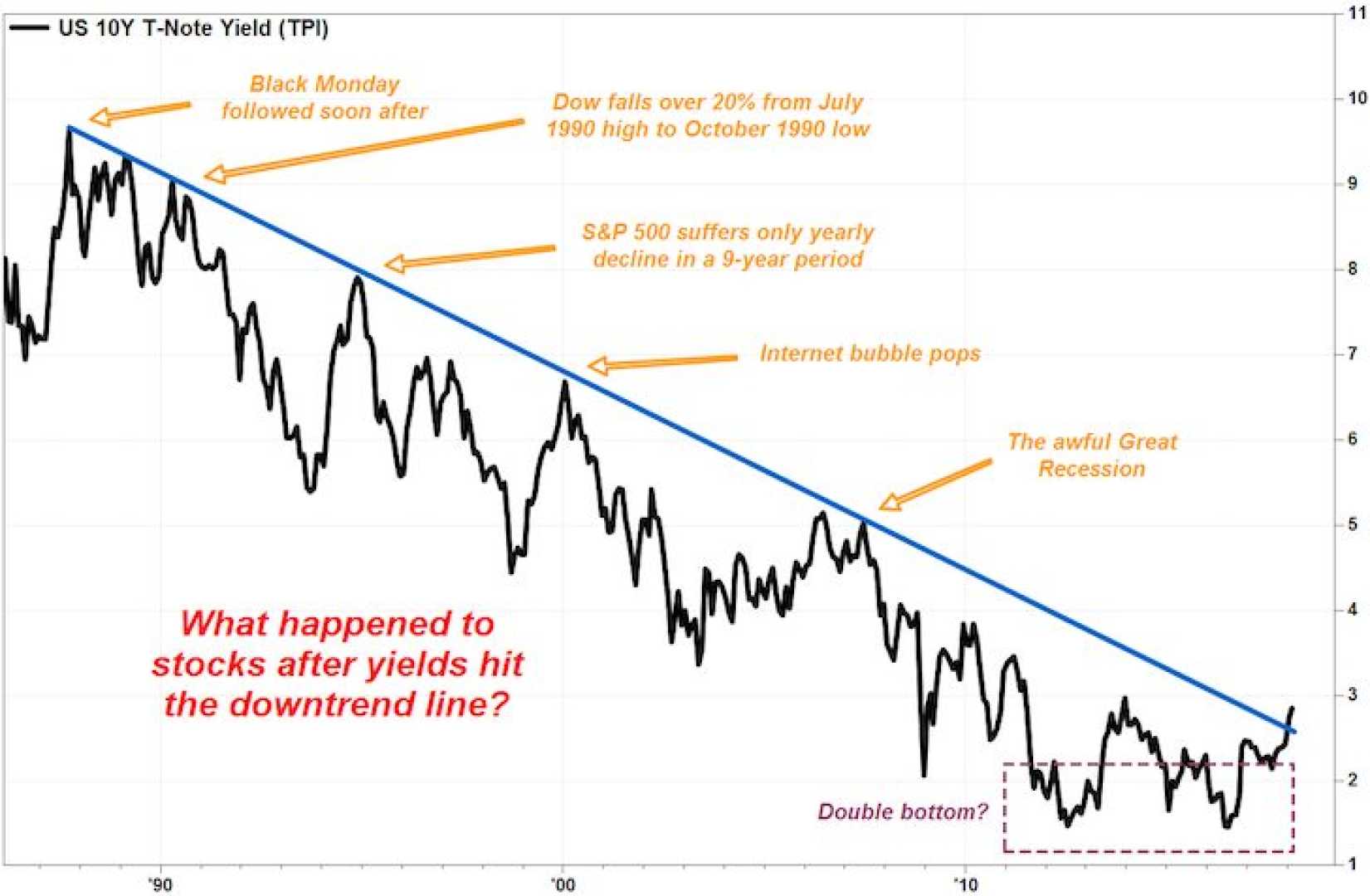

Historically, downturns often create opportunities to purchase stocks at lower prices, which can lead to significant returns when the market recovers. For example, those who invested in stocks during the depths of the Great Recession in early 2008 went on to double their investments by 2018 if they held on through the turmoil.

Furthermore, data shows that investors who continued purchasing stocks during market declines typically realized far greater gains than those who waited for a recovery. Between January 2009 and January 2018, the S&P 500 surged nearly 196%, contrasting with the approximate 45% return for investors who only started buying at market peaks in 2014.

Even now, with stock valuations apparently stretched, the Buffett Indicator—a metric comparing the market’s total value to U.S. GDP—sits at a concerning 191%, indicating potential overvaluation. However, the indicator has its limitations and does not guarantee future market movements. Investing when valuations are perceived as low can often yield rewards.

Simultaneously, a recent analysis of economic indicators suggests recession fears are rising. J.P. Morgan forecasts a recession probability of 40%, elevating concerns that U.S. trade policy may affect the economy negatively. According to J.P. Morgan’s Chief Global Strategist, David Kelly, tariffs can lead to higher prices and slow growth trends.

Additionally, the Federal Reserve Bank of Atlanta projects a possible economic contraction of 1.8% in the first quarter of 2025. Historically, the S&P 500 has averaged around a 31% decline during previous recessions, leading to concerns that a sustained downturn could have severe impacts on the market.

While these metrics signal potential challenges ahead, experts advise against panic selling. They recommend keeping a long-term perspective and making thoughtful investment decisions instead. As Buffett cautions, attempts to predict short-term market movements often lead to missed opportunities. “If you wait for the robins, spring will be over,” he said, underscoring the importance of maintaining a proactive investment strategy.

Investors facing uncertainty should consider focusing on high-quality companies that are more likely to rebound after a downturn, according to financial analysts. This approach may help build wealth over time as the market recovers.