Business

Uncertainty Looms Over Federal Reserve’s Rate Decisions Amid Global Tensions

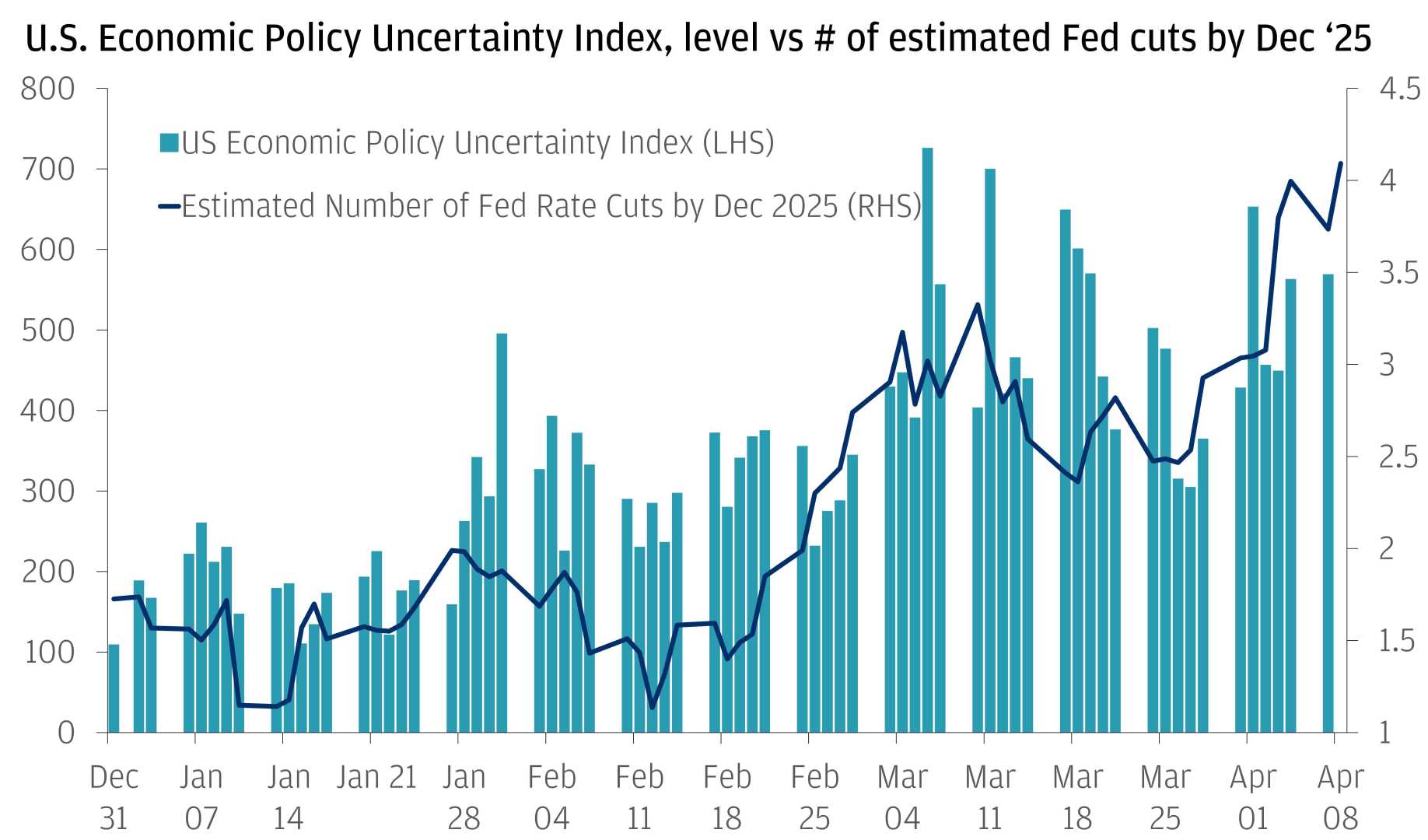

WASHINGTON, D.C. — In a tumultuous year for the economy, expectations surrounding Federal Reserve interest rate cuts remain uncertain following recent geopolitical shifts. As of June 2025, economist Jon Faust indicated that the probability of a rate cut stands at a precarious ’50/50,’ notably influenced by escalated conflict in the Middle East.

The tensions spiked when Israel launched strikes on Iran on June 13, leading to significant fluctuations in oil futures. Historically, such volatility tends to generate economic challenges for the U.S., as many recessions have followed spikes in oil prices. However, with oil prices at multi-year lows before the conflict, analysts suggest this situation may offer more economic leeway.

“The Federal Reserve’s outlook is being clouded by the prospect of intensifying conflict in the Middle East,” said Faust. The Fed has already been cautious regarding potential rate cuts due to trade-related pressures ignited by former President Trump‘s tariffs. While consumer sentiment showed signs of recovery in May, rising inflation at 2.4% raises additional concerns.

Consumer confidence dropped sharply in April, reflecting worries around ongoing trade tariffs. Despite a rebound to 60.5 in May, this represents a 20% decrease compared to the end of 2024. As tariffs traditionally inflate import costs—thereby affecting consumer spending—investors face a complex decision-making landscape.

Investors are advised to navigate through these challenging economic scenarios strategically. The obstacle posed by heightened international tensions combined with fluctuating tariffs presents a dual challenge. Stocks of significant raw material consumers may still hold value, as lower acquisition costs due to stable or declining prices can enhance profit margins even amidst high inflation zones.

As the U.S. economy braces itself against a backdrop of geopolitical conflicts and competitive pressures from Chinese innovations in technology and biotech, maintaining a focus on long-term investment strategies will be crucial. The S&P 500 index’s ability to recover post-conflict indicates there are still opportunities for astute investors ready to embrace risk, albeit with a strategic long-term outlook.