News

Upcoming Changes to Tax Brackets and Deductions as TCJA Sunsets in 2025

As the Tax Cuts and Jobs Act (TCJA) is set to expire on December 31, 2025, significant changes to the U.S. tax code are on the horizon. Enacted in 2017, the TCJA introduced substantial tax reductions for both businesses and individual taxpayers, but most of these changes are scheduled to sunset unless extended or modified by Congress.

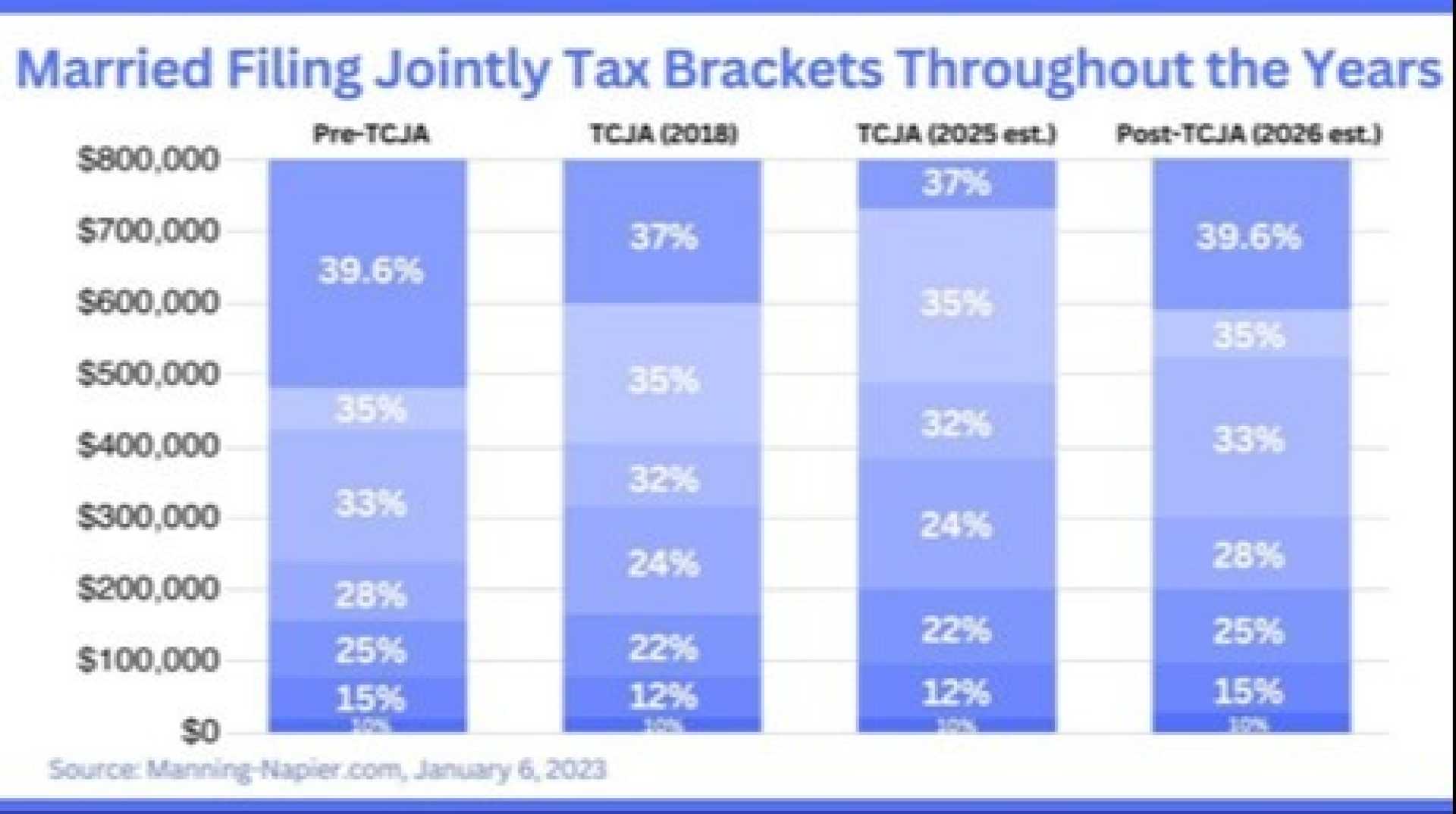

One of the key changes involves individual tax brackets. Under the TCJA, new income tax brackets were created, resulting in a three to nine percent decrease in taxes for most taxpayers. However, without Congressional action, these brackets are expected to increase, potentially leading to higher tax liabilities for many individuals.

The standard deduction, which was increased under the TCJA, will revert to pre-tax reform levels. Additionally, personal exemptions, which were eliminated under the TCJA, will be restored. This could impact taxpayers who have grown accustomed to the higher standard deductions and may need to adjust their tax strategies accordingly.

The State and Local Tax (SALT) cap, currently set at $10,000 for those who itemize, will sunset, eliminating this limitation. This change could benefit taxpayers in high-tax states who have been limited by the SALT cap.

The Alternative Minimum Tax (AMT) will also revert to its original calculation, which could pull more taxpayers into the AMT and increase their tax burden. Furthermore, the estate tax exemption will decrease from $13.61 million per individual (or $27.2 million for a married couple) to around $7 million per individual (or around $14 million for a married couple) after inflation adjustments.

Taxpayers are advised to start planning proactively for these changes. This includes adjusting estate plans, considering investment portfolio strategies such as converting taxable IRAs or 401(k) money into a Roth IRA, and engaging in tax loss harvesting and portfolio rebalancing.