Business

UPS and Whirlpool Stocks Struggle Amid Market Turmoil

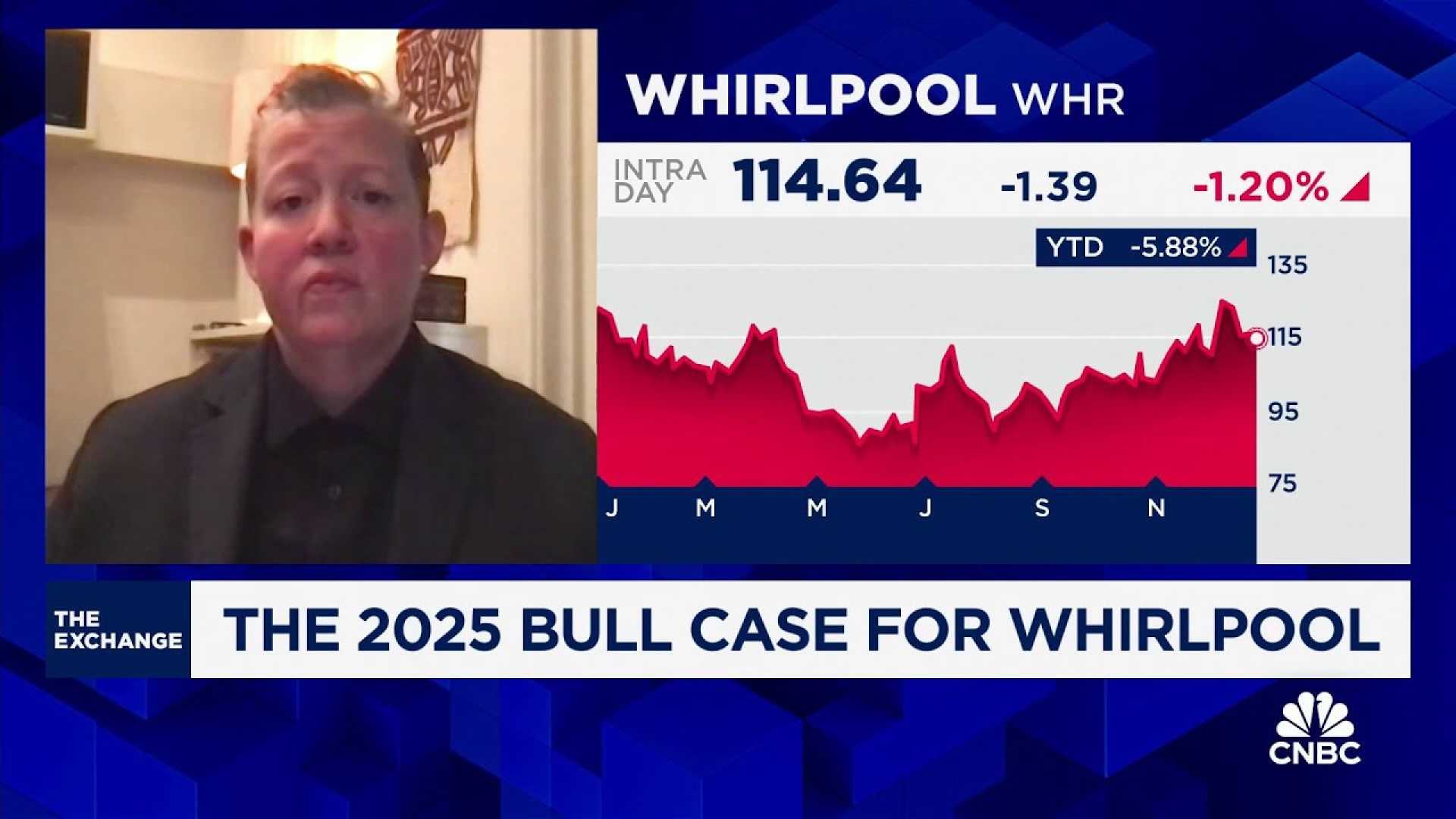

NEW YORK, NY – The stocks of iconic American companies United Parcel Service (UPS) and Whirlpool are facing significant challenges in the market, recently observed at price points down over 60% from their all-time highs.

As of August 15, 2025, UPS shares stood at $86.88, reflecting a slight decline of 0.03% for the day. Whirlpool also saw a dip of 0.99%. Both companies grappled with disappointing second-quarter earnings, leading to share price drops exceeding 15%.

Both UPS and Whirlpool have a long-standing history of paying dividends. In July, the yield for each company crossed 7%, making them attractive to income-focused investors. However, neither firm appears poised to cover these dividends with free cash flow. When companies face such circumstances, they risk dipping into their reserves or taking on debt to maintain payouts.

UPS CEO Carol Tomé expressed her commitment on the company’s earnings call, stating, ‘You have our commitment to a stable and growing dividend.’ This commitment entails over $5.5 billion in dividend payouts this year, likely surpassing its anticipated free cash flow.

In contrast, Whirlpool reduced its annual dividend from $7 to $3.50 per share, leading to a decreased yield of 4%. Although it reflects a smaller total payout of $190 million, Whirlpool’s revised dividend is viewed as more sustainable moving forward.

Both companies face increasing tariff pressures. UPS is concerned that tariffs will shrink import volumes, affecting shipping activity, particularly during the crucial holiday season. Meanwhile, Whirlpool could benefit from tariffs by gaining a competitive edge against foreign manufacturers, including LG and Samsung.

As tariffs fluctuate, Whirlpool’s U.S.-based manufacturing model may provide a pricing advantage in the marketplace. While UPS currently offers a higher yield, its economic outlook appears unstable amidst external pressures. Conversely, Whirlpool, despite its recent dividend cut, showcases both a decent yield and promising valuation.

In his analysis, John Bromels, a seasoned stock market analyst, recommends Whirlpool as a more favorable investment choice at this time.