Business

Wall Street Faces Selloff Amid Inflation Data and Tariff Anxiety

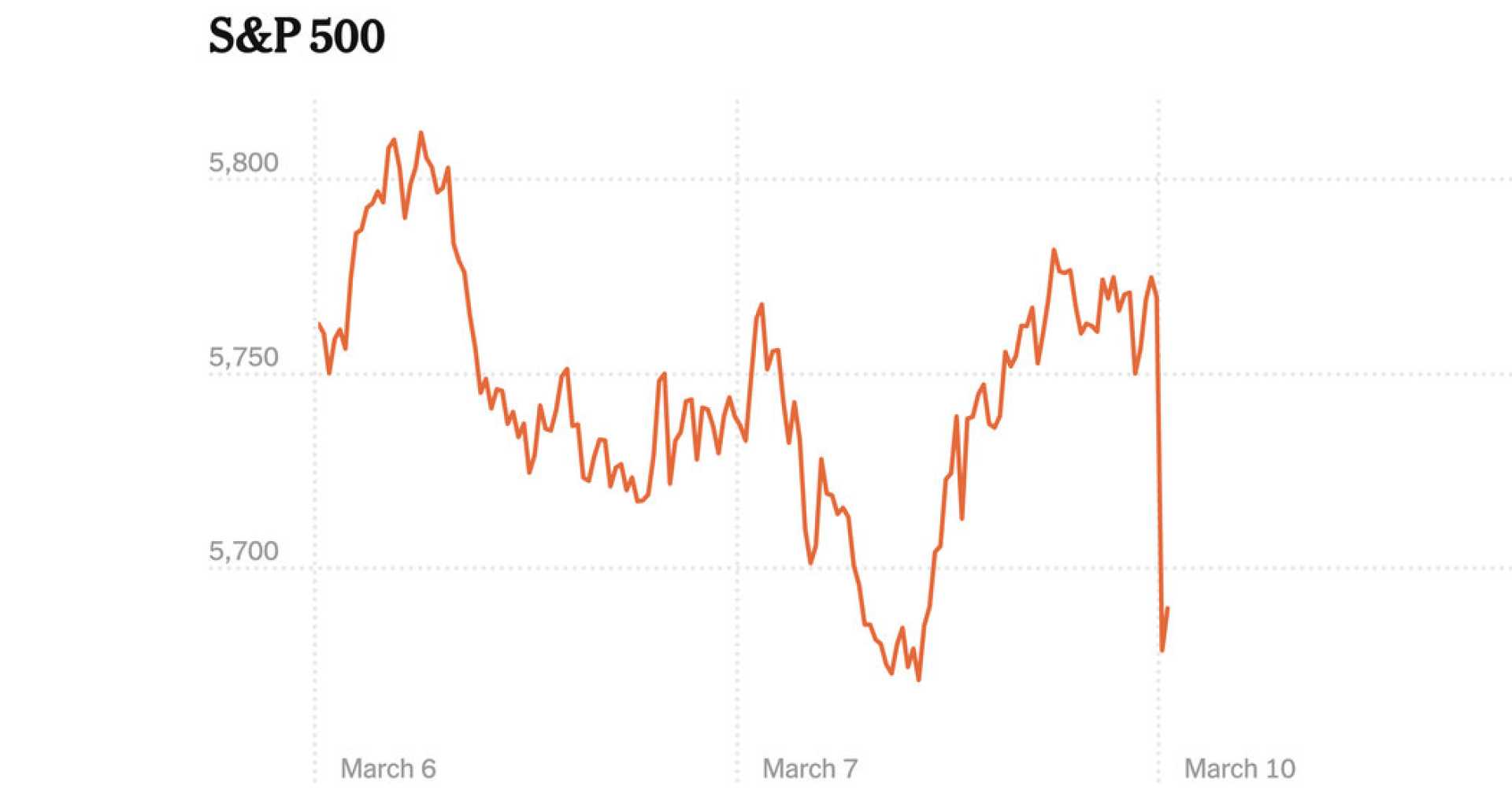

New York (CNN) — U.S. stocks plunged on Friday, leading to a broad selloff on Wall Street as investors reacted to stubborn inflation data and declining consumer sentiment, coupled with anxiety over looming tariffs. The Dow Jones Industrial Average fell by 715 points, or 1.7%, while the S&P 500 decreased by 1.9% and the Nasdaq Composite dropped by 2.6%. All three major indexes are poised to close the week in negative territory, with the S&P 500 down 5% year-to-date and on track for its first losing quarter since September 2023.

Stock trading commenced on a negative note following data from the Commerce Department, which revealed persistent inflation in February. The Personal Consumption Expenditures (PCE) index showed a 2.5% increase year-over-year, unchanged from January and aligning with forecasts. However, the core PCE index, which excludes volatile food and energy prices, rose slightly to 2.8% from 2.7% in January, signaling that inflation remains above the Federal Reserve‘s 2% target.

Moreover, consumer sentiment saw a stark decline, plummeting 12% this month according to the University of Michigan’s latest survey released Friday. This sentiment shift contributed to a growing selloff, especially in sectors such as technology, automotive, and airlines. Major stocks suffered notable losses: Google fell by 4.4%, Stellantis decreased by 4.3%, and Delta Air Lines dropped by 5.2%.

Notable declines in the Dow were attributed to major players like Amazon, Nike, and Goldman Sachs. Additionally, Lululemon saw a drastic reduction in its stock value, plummeting 15% after the company expressed concerns regarding consumer spending during its investor call. “We also believe the dynamic macro environment has contributed to a more cautious consumer,” said Calvin McDonald, Lululemon’s chief executive.

The tech sector faced more turmoil with CoreWeave, an AI venture backed by Nvidia, experiencing a disappointing Nasdaq debut. CoreWeave’s initial public offering (IPO) was set at $40, below its projected range of $47 to $55, and started trading at $39, raising concerns about the sustainability of enthusiasm for AI investments. Analysts warn that this lackluster performance points to a cooling interest in IPOs amid tariff-related uncertainties.

Investors are also grappling with President Trump’s recent announcement of 25% tariffs on all cars imported into the U.S., effective April 3, alongside tariffs on car parts, scheduled to begin “no later than May 3.” “It’s natural for people to expect higher prices because we haven’t seen a trade war like this since,” Art Hogan, chief market strategist at B. Riley Wealth Management, stated in an interview with CNN.

The implications of these tariffs have led to increased stock selloffs driven by fears of rising consumer prices and a slowdown in economic growth. As investors sold their shares, the yield on the 10-year Treasury note fell to 4.27%, indicating a flight towards government bonds amid a risk-averse environment.

The Cboe Volatility Index (VIX), often referred to as Wall Street’s “fear gauge,” increased by 10%, marking a return to “extreme fear” territory among investors. The ongoing tariff situation represents an escalation in a trade war with the U.S.’s largest trading partners, which could disrupt markets and manufacturing across North America.

<p“While the economy appears solid, business executives are adopting a cautious stance on new investments, largely due to the Trump administration’s aggressive and unpredictable tariff policy,” noted Matt Stephani, president of Cavanal Hill Investment Management.

Trump’s announcement of tariffs on autos, preceding the unveiling of reciprocal tariffs on what some term “Liberation Day,” has heightened uncertainty in the financial market. Some analysts believe the proposed tariffs could significantly harm the auto industry, leading to increased costs and a major downturn in vehicle sales. Solita Marcelli, chief investment officer for the Americas at UBS Global Wealth Management, stated, “We think the proposed tariffs as announced would deliver a big hit to the auto industry, stoking higher costs, higher prices and a sharp decline in U.S. sales.”

Reductions in market expectations for U.S. stocks have become evident amid continuing tariff announcements. Analysts at UBS have revised their year-end target for the S&P 500 down to 6,400 from 6,600. Barclays and Goldman Sachs have made similar downward adjustments to their targets.

On a more optimistic note, gold futures saw a significant surge, surpassing a record high of $3,100 as investors look toward the metal as a safe haven amid economic instability. Goldman Sachs has adjusted its year-end gold price target to $3,300, citing a prolonged rise in gold value amid ongoing economic uncertainty.

This is a developing story and will be updated as new information becomes available.