Business

Warren Buffett’s 2025 Portfolio: Key Stocks to Watch

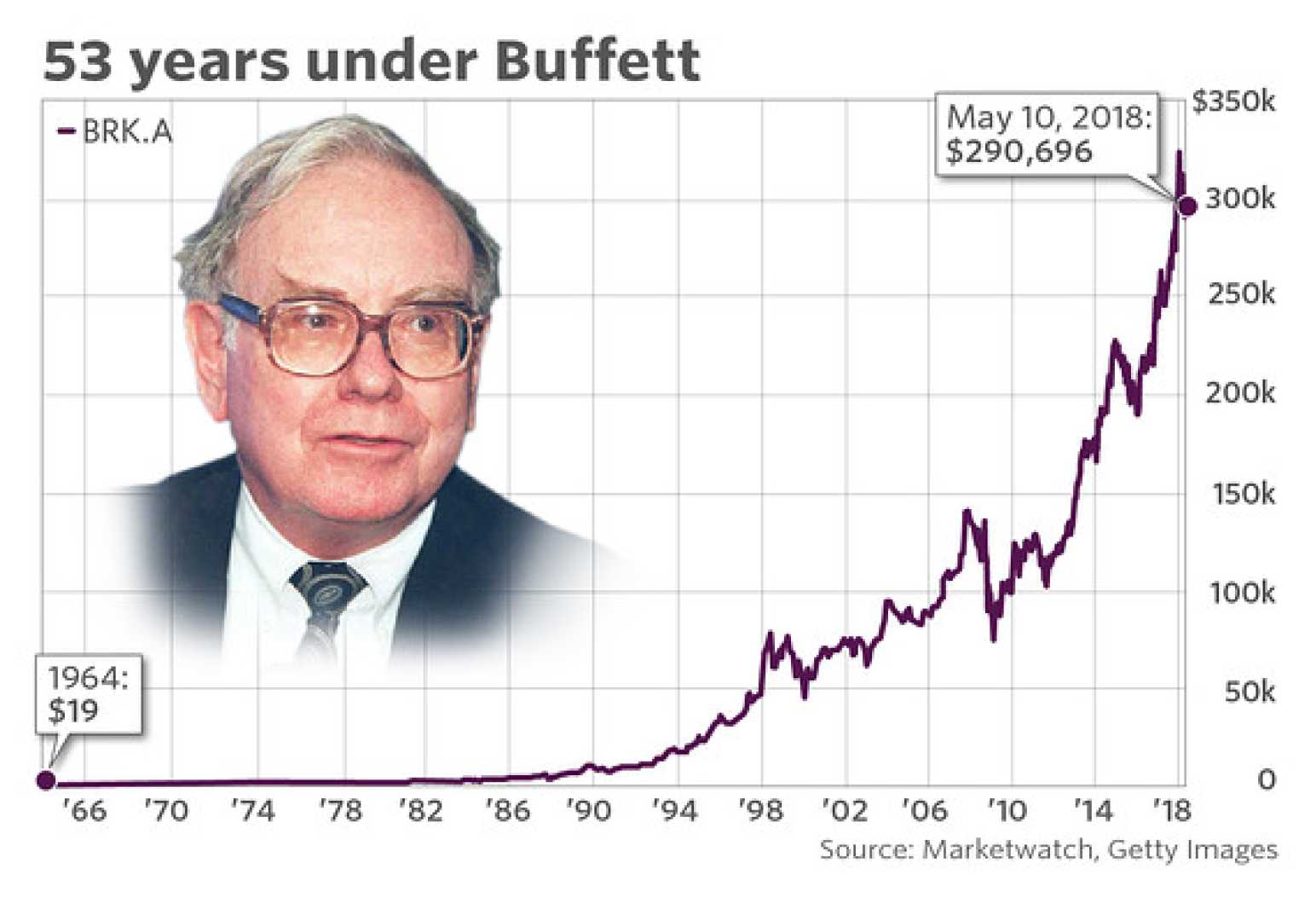

Warren Buffett, the legendary investor and CEO of Berkshire Hathaway, continues to make strategic moves in 2025, focusing on long-term value in a volatile market. His portfolio, which includes iconic names like Coca-Cola and newer additions such as VeriSign and Domino's Pizza, offers insights into his investment philosophy and market outlook.

Coca-Cola, a staple in Buffett’s portfolio since 1988, remains a cornerstone of his strategy. With a market cap of $270 billion and a dividend yield of 3.19%, Coca-Cola has raised its dividends for 63 consecutive years. Analysts predict a 4.2% increase in earnings per share (EPS) for 2025, reinforcing its status as a reliable investment.

Buffett’s recent interest in technology is evident with his increased stake in VeriSign, a domain registration services company. Despite modest stock performance, Buffett’s $2.7 billion investment reflects confidence in its long-term potential. VeriSign’s gross profit margins of 87.6% and projected 7.8% EPS growth for 2025 make it a compelling choice.

Pool Corporation, a distributor of swimming pool supplies, has also caught Buffett’s attention. With a dividend yield of 1.44% and expected EPS growth of 9.2% in 2025, the company aligns with Buffett’s focus on resilient businesses. His recent purchase of over 400,000 shares underscores his belief in its recovery potential.

Domino’s Pizza, another new addition, represents Buffett’s confidence in the fast-food sector. With a 3.7% stake valued at $549 million, Buffett is betting on Domino’s strong brand and licensing model. The company’s 5.2% revenue growth in its latest quarter and a dividend yield of 1.42% highlight its stability.

Buffett’s portfolio strategy emphasizes value, resilience, and long-term growth. While Coca-Cola and VeriSign appear to be solid buys, Pool Corporation and Domino’s Pizza offer fresh opportunities for investors seeking to align with Buffett’s approach.