Business

XRP Price Drops Ahead of SEC ETF Rulings

NEW YORK, NY — XRP saw a significant drop in price on September 5, falling 4% from $2.88 to $2.84 after struggling to find momentum in the $2.88–$2.89 resistance zone. This downturn comes as speculation builds around upcoming decisions from the U.S. Securities and Exchange Commission (SEC) regarding exchange-traded funds (ETFs) tied to XRP.

The price dip followed an intraday peak of $2.89 during which trading volume surged to 227.75 million. This figure was nearly four times higher than the 24-hour average of 58.40 million, indicating strong institutional selling pressure.

Six asset management companies, including Grayscale and Bitwise, have submitted applications for spot XRP ETFs, with the SEC expected to make decisions in October. Regulatory clarity has improved following Ripple’s recent legal settlement with the SEC, raising the probability of ETF approval to 87% according to market analysts.

“This is a pivotal moment for XRP as institutional money continues to flow into the asset amid uncertainty,” said market strategist Nate Geraci. “The consolidation we’re seeing could lead to a breakout if the SEC gives a favorable ruling.”

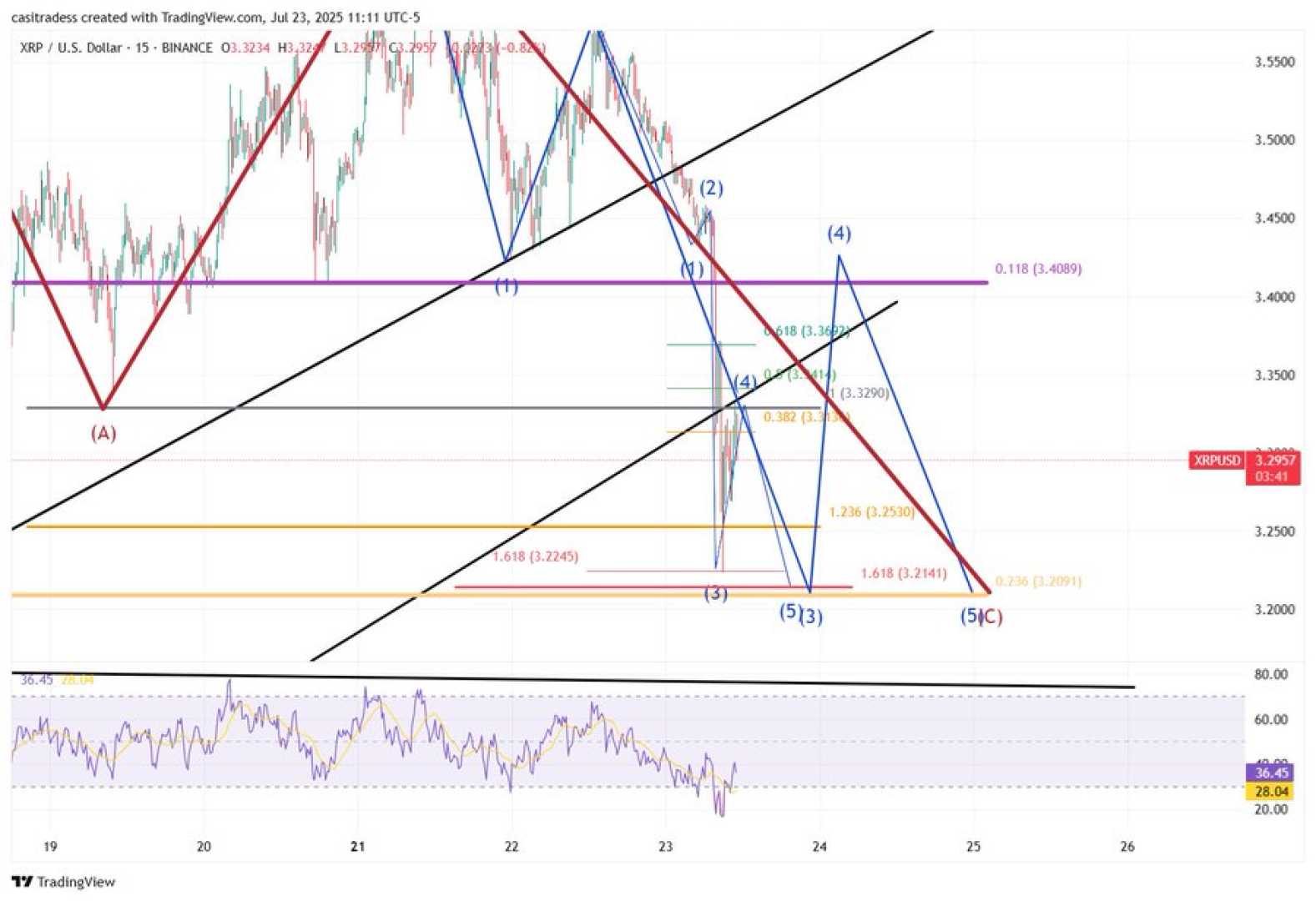

XRP traded within a narrow range of $0.10, or 3.47%, between $2.78 and $2.89 over the 24-hour period from September 4 at 3 p.m. to September 5 at 2 p.m. The asset briefly rallied from $2.84 to $2.89 on significant volume during the early afternoon, but met resistance and declined.

As the session closed, XRP ended at $2.84, just above crucial support levels near $2.77. If $2.77 holds, it may act as a decisive level for potential recovery efforts, while a sustained breakout above $3.30 could fuel further upside toward $4 and beyond.

The anticipation for ETF approvals has energised the market, with some analysts predicting inflows of over $5 billion if approved. This speculation is reminiscent of Bitcoin’s early ETF effects, which led to significant price rallies.

Investors are particularly watching the SEC’s upcoming decisions, as approval could lead to heightened liquidity and broader institutional adoption of XRP. Recent whale activity shows that large holders have continued to accumulate XRP despite recent price declines, adding 340 million tokens in the past weeks, which has helped stabilize the asset after a 23% drop in July.

The future for XRP remains uncertain as the market awaits the SEC’s next steps, but many analysts remain bullish, anticipating that a favorable ruling could serve as a catalyst for a substantial price increase.