Politics

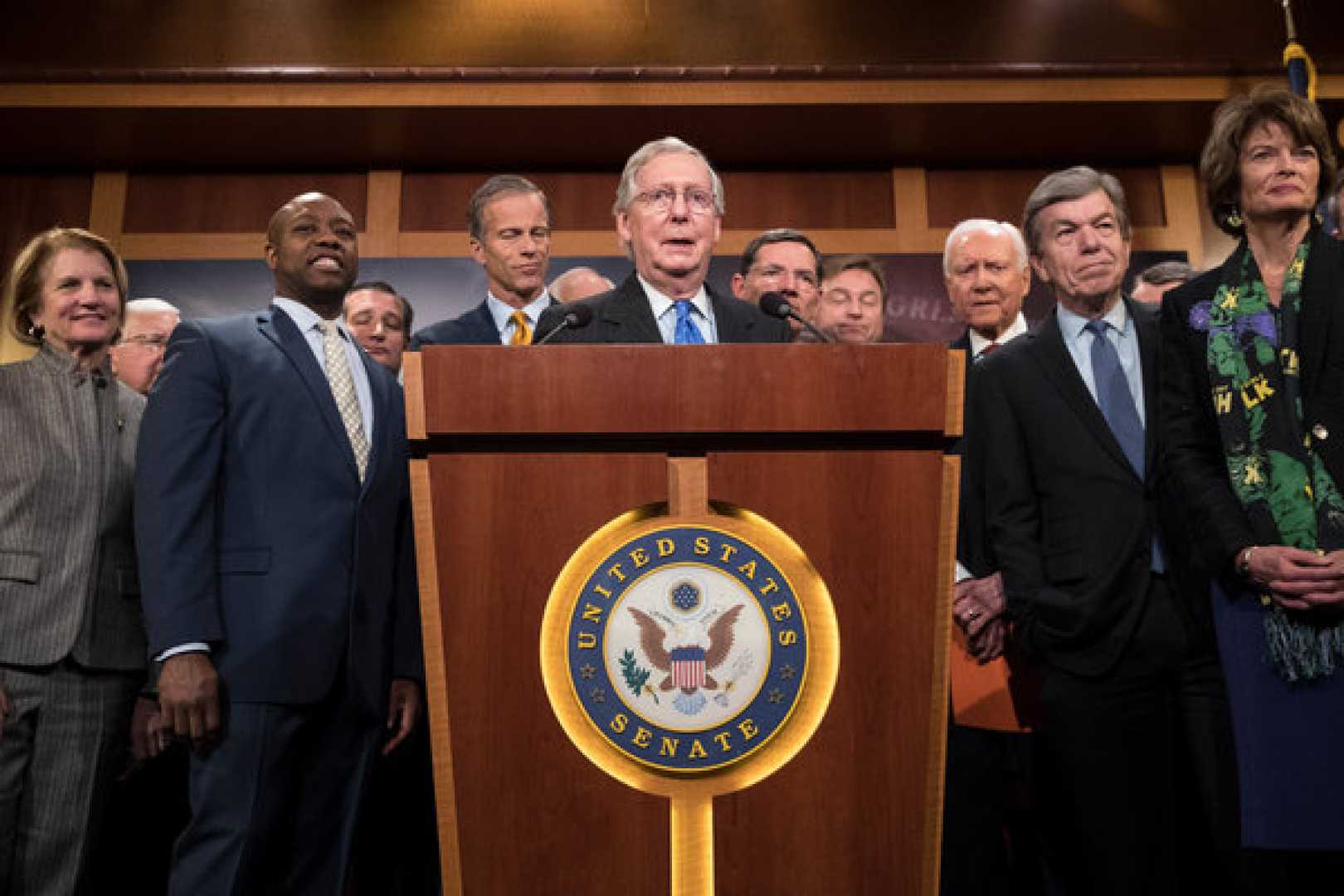

Senate GOP Moves Forward With Controversial Tax Reform Bill

WASHINGTON, June 16, 2025 — Senate Republicans are advancing a revised version of President Donald Trump’s sweeping tax reform bill, known as the “One Big Beautiful Bill Act.” The proposal aims to make certain tax cuts permanent while introducing changes to Medicaid funding, raising concerns among House Republicans.

The Senate Finance Committee Chairman, Sen. Mike Crapo, R-Idaho, announced the updated text on Monday, highlighting provisions that aim to prevent a $4 trillion tax hike and maintain the 2017 Trump tax cuts. “This bill enables families and businesses to save and plan for the future,” Crapo stated.

However, Democrats and some Republicans express apprehension regarding the impact of the proposed tax changes on lower-income Americans. Sen. Ron Wyden, D-Ore., criticized the bill, pointing out that it favors wealthy corporations with billions in tax breaks. The bill’s passage is critical as Republicans seek to align their agenda before a July 4 deadline.

The Senate’s plan retains the current $10,000 cap on state and local tax (SALT) deductions, in contrast to the House’s proposal to raise it to $40,000. This discrepancy could lead to conflict between chambers, particularly affecting Republicans representing high-tax states. Rep. Mike Lawler of New York declared, “If the Senate reduces the SALT number, I will vote NO and the bill will fail in the House.”

Changes proposed in the Senate also include substantial modifications to Medicaid funding, with a cap on provider taxes projected to affect rural healthcare providers significantly. Sen. Josh Hawley of Missouri expressed concern about the repercussions for hospitals in his state, stating, “This new system is going to defund rural hospitals effectively.”

Although Senate Republicans aim to finalize the bill swiftly, internal divisions persist, posing challenges to maintaining party unity. As negotiations continue, the tension between differing priorities, tax cuts, and social safety nets is likely to shape the legislation’s outcome.

With a narrow majority in both chambers, Republicans can afford few dissenting votes. If the Senate passes the proposal, it will return to the House for further voting, marking a critical juncture for Trump’s domestic agenda.