Business

Lululemon Struggles Amid Stiff Competition and Tariff Concerns

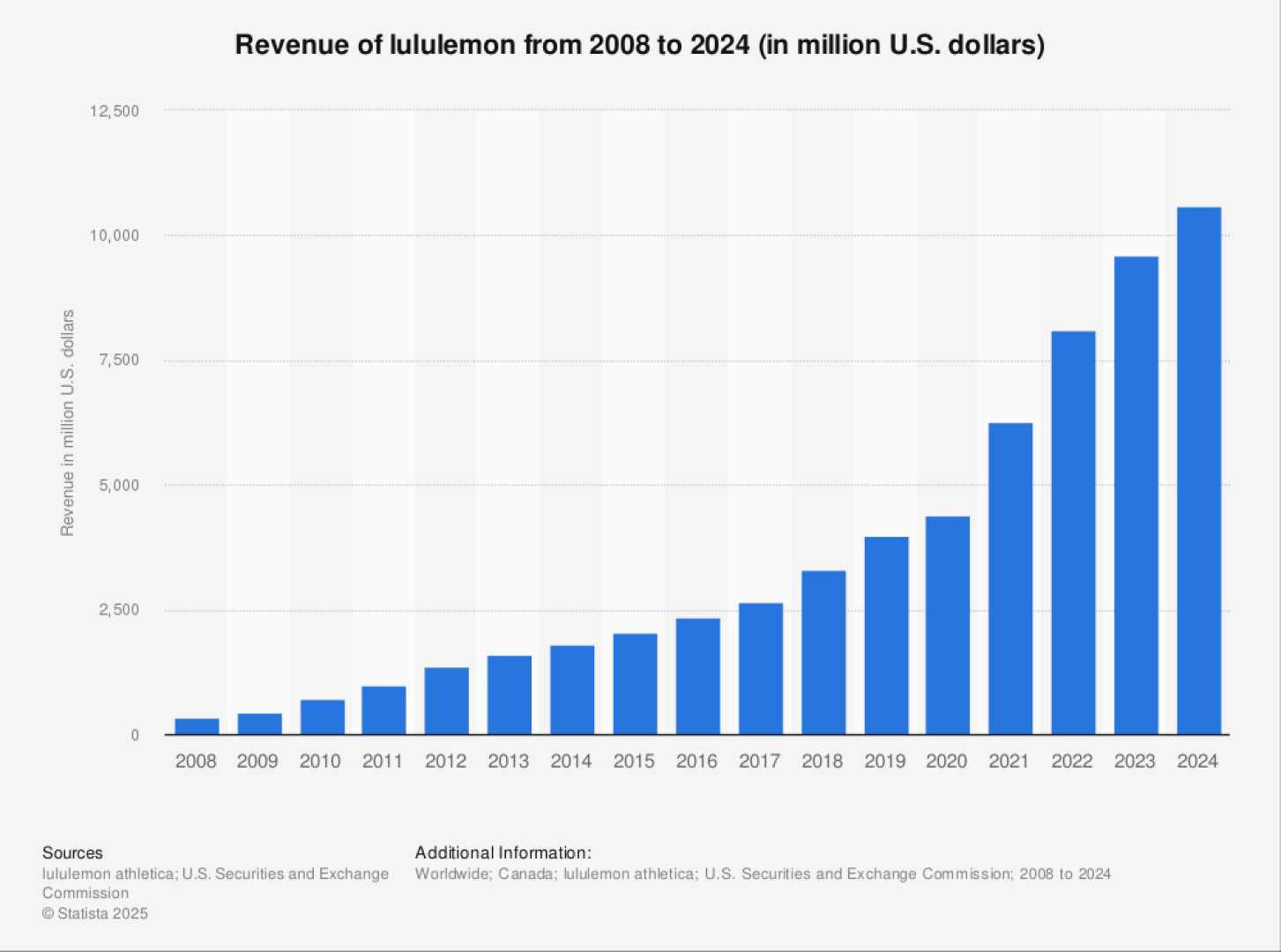

VANCOUVER, Canada — Lululemon Athletica, a leader in the athleisure market, is facing challenges as consumer preferences shift and competition grows. As of July 2, 2025, the company’s stock tumbled 54% from its peak, reflecting investor concerns over tariffs and changing market dynamics.

Once celebrated for its stylish yoga pants, Lululemon now sees rivals like Alo Yoga and Vuori capturing market share. Insiders note that while Lululemon remains a strong player, new brands are utilizing social media and capital investments to appeal to consumers.

Despite these challenges, Lululemon reported revenue growth, as its North America sales rose 4% while competitors like Nike saw a 7% decrease in the same period. However, the apparel giant had to face some pressure with its valuation dropping significantly, moving the price-to-earnings (P/E) ratio to a decade low at 16.

Analysts remain cautiously optimistic. CEO Calvin McDonald stated, “In the U.S., consumers remain cautious right now, and they are being very intentional about their buying decisions.” This sentiment is echoed by many in the industry who worry about consumer spending as tariffs loom large.

Internationally, Lululemon is flourishing, particularly in China, where sales surged 22% year over year. The brand realized $1.6 billion in annual revenue from the country and continues to see growth potential amid a population exceeding 1 billion.

To offset rising tariffs, which are likely to increase costs, Lululemon plans to adjust prices on certain items. While this strategy aims to preserve profit margins, it may further deter cautious consumers.

With continued competition and economic uncertainty, investors should tread carefully. Experts suggest that Lululemon’s future hinges on its ability to adapt to the fickle retail sector and consumer preferences.

Lululemon Athletica is facing not only immediate pressures but also long-term questions about its growth and place in a rapidly evolving market.