Business

BigBear.ai Stock Soars Amid Defense AI Excitement

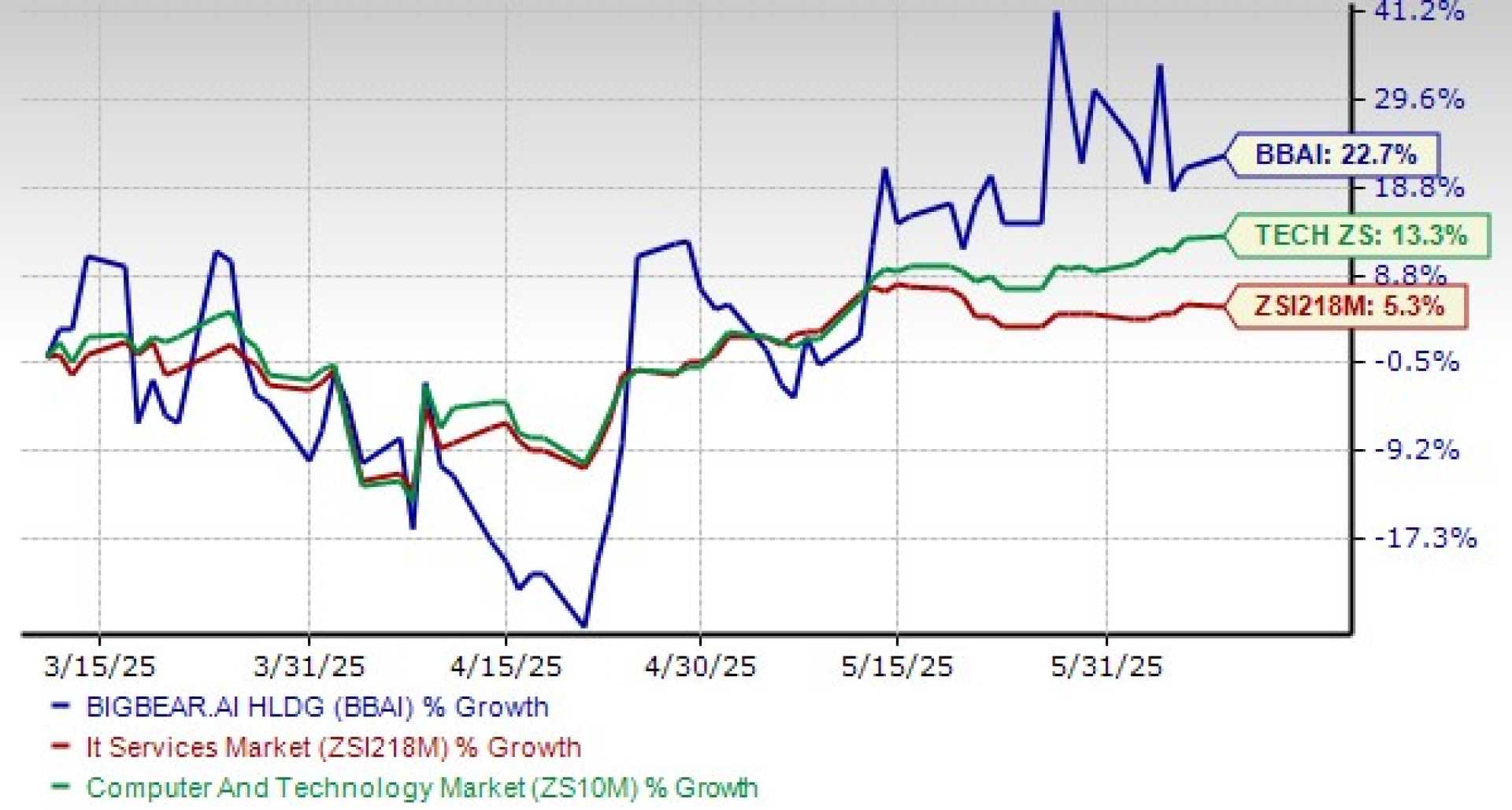

NEW YORK, NY – BigBear.ai‘s stock surged over 14.7% in Wednesday’s trading, continuing a strong upward trend for defense artificial intelligence stocks. As of 1:30 p.m. ET, BigBear.ai’s share price hovered around $7.95, following a recent rally that has positioned its stock up 82% in the last month alone.

The rise in BigBear.ai’s stock is part of a broader excitement surrounding technology companies focused on defense. According to industry analysts, the stock’s bullish momentum this week may be attributed to positive coverage from H.C. Wainwright, which raised its one-year price target from $6 to $9 per share, suggesting a potential upside of about 21% even after recent gains.

In addition to positive analyst sentiments, broader market movements are also influencing BigBear.ai. The S&P 500 and Nasdaq Composite saw increases of 0.3% and 0.8%, respectively, bolstered by President Trump’s recent announcement of a trade deal with Vietnam and expectations of an interest rate cut by the Federal Reserve. These developments in the economic landscape provide further support for tech stock valuations, including BigBear.ai.

Despite recent gains, analysts caution that BigBear.ai’s business performance has been inconsistent. The company reported only 5% revenue growth in the last quarter, raising questions about its long-term sustainability. While its pipeline remains promising, it will need to demonstrate consistent performance to maintain investor confidence.

The volatility of BigBear.ai’s stock, which has been highly subject to the dynamics of meme-stock momentum and external market factors, suggests that investors should proceed with caution. As the defense AI market continues to grow, all eyes will be on BigBear.ai to see if it can deliver on its ambitions.