Business

CoreWeave to Announce Q2 Results Amid Mixed Analyst Outlook

New York, NY – CoreWeave, an AI-powered cloud computing company, is set to report its second-quarter results after the market closes on Tuesday, August 12. Wall Street analysts express cautious optimism as CRWV stock has surged 224% since its initial public offering (IPO) price of $40, driven by positive sentiment towards infrastructure companies.

Despite the stock’s recent gains, analysts expect CoreWeave to report a loss per share of $0.23 on revenue of $1.08 billion. “Investors will be looking for insights into demand conditions and any updates regarding the Core Scientific acquisition,” said a financial analyst.

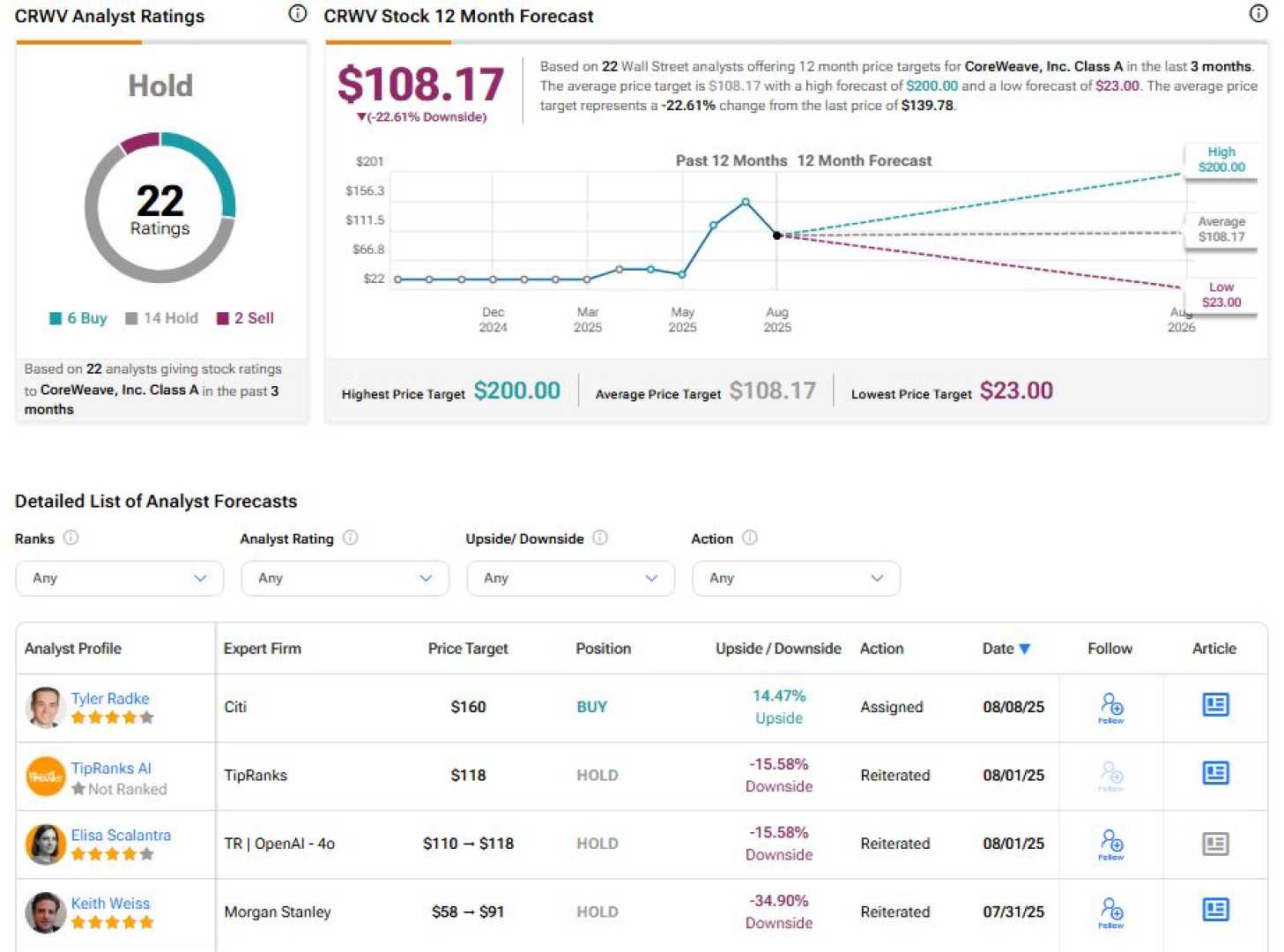

While Citi analyst has rated the stock as a Buy, many others remain cautious due to high debt levels and reliance on Microsoft as a major customer. Additionally, the expiration of CRWV’s IPO lockup is approaching in late September, which could allow insiders to sell shares, affecting stock performance.

Heading into the earnings report, Morgan Stanley has increased its price target for CoreWeave from $58 to $91 while maintaining a Hold rating. The analyst highlighted strong execution in the first quarter and continued demand from customers. However, concerns regarding the lockup expiration may have a negative impact on CRWV in the short term.

Meanwhile, Goldman Sachs has also raised its price target from $61 to $120, reaffirming a Hold rating. Analysts anticipate CoreWeave reporting 173% revenue growth for Q2 compared to a consensus estimate of 174%. Despite the positive indicators, the risk of customer concentration remains considerable, especially following the recent $4 billion deal with OpenAI.

As CRWV prepares for the earnings report, analysts note that depreciation costs are putting pressure on margins, and high debt levels are likely to continue. Rangan, a noted analyst, mentioned that he is awaiting stronger evidence of revenue sustainability before becoming bullish on the stock.

Utilizing TipRanks’ Options tool, traders anticipate large movements in CRWV stock following the earnings announcement, reflecting uncertainty in the market. Currently, Wall Street holds a Hold consensus rating on CoreWeave based on a total of six Buy, 13 Hold, and two Sell recommendations. The average price target of $107.59 suggests a potential downside of about 17% from current levels.