Business

Mortgage Rates Drop to Lowest Level This Year, Boosting Homebuyer Confidence

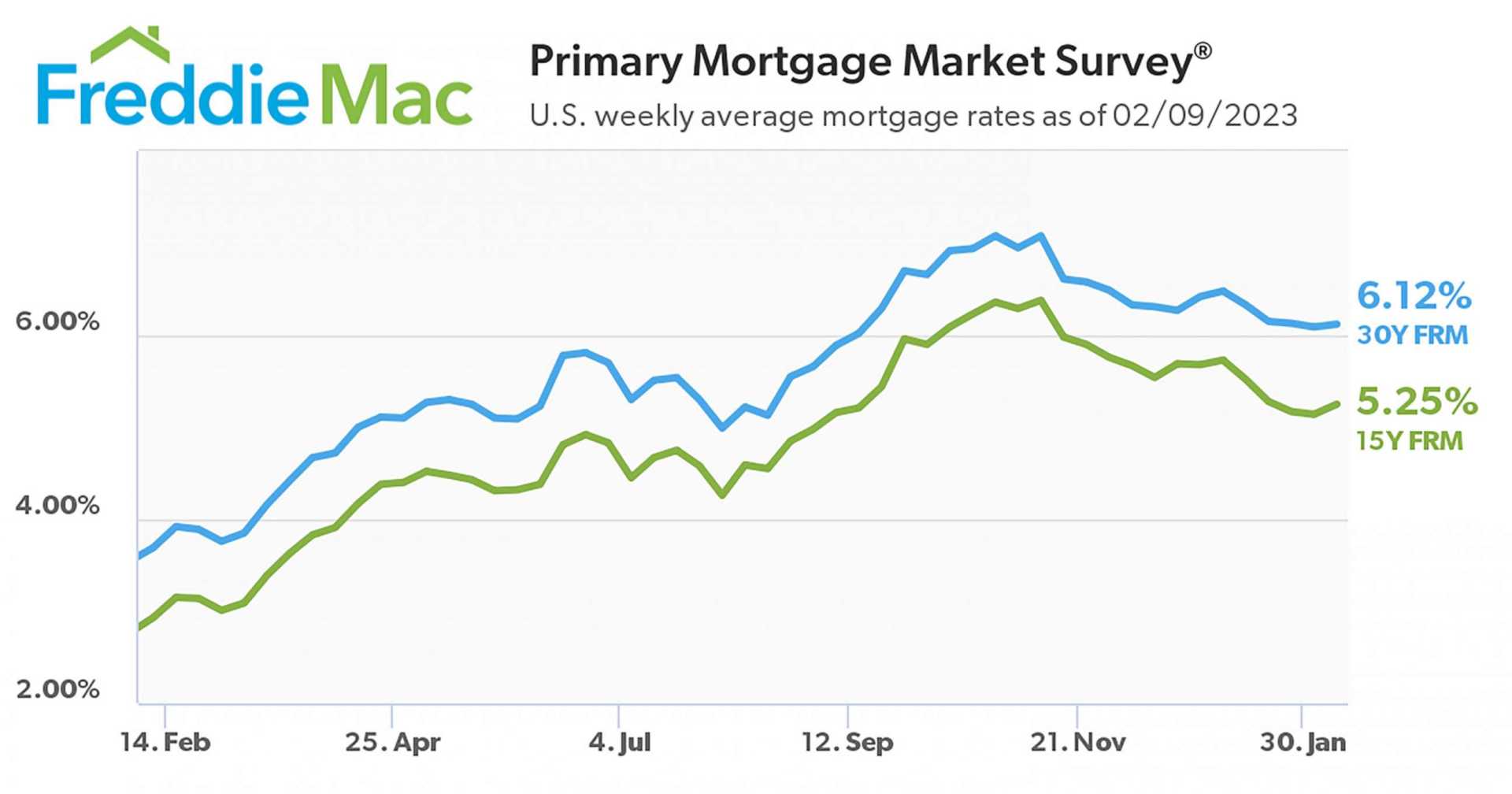

WASHINGTON, D.C. – U.S. mortgage rates have plunged to their lowest point this year, providing a much-needed boost for potential homebuyers. According to Freddie Mac‘s latest Primary Mortgage Market Survey, the average rate for a 30-year fixed mortgage fell to 6.58% for the week ending August 14, down from 6.63% the previous week.

Freddie Mac’s chief economist, Sam Khater, noted that the decline in rates offers encouragement to borrowers. “Purchase application activity is improving as borrowers take advantage of the decline in mortgage rates,” Khater said.

A year ago, the average rate for a 30-year mortgage was 6.49%. The new data suggests that consumers may finally be responding to the lower borrowing costs, potentially reigniting interest in the housing market, which experienced sluggish activity for most of the summer.

The 15-year fixed mortgage rate also dropped to 5.71%, down from 5.75% last week. This places it slightly above last year’s average rate of 5.66%.

The ongoing housing affordability crisis, exacerbated by high home prices and persistent interest rates, remains a challenge for many buyers. According to a report from Harvard University‘s Joint Center for Housing Studies, housing affordability is at a crisis level, significantly affecting home sales.

Treasury Secretary Scott Bessent expressed his commitment to tackling this issue. “We are really going to work on this housing affordability crisis. That’s one of my big projects for the fall,” Bessent stated during an interview.

Real estate experts predict that the traditionally busy summer season for home buying has been slower this year. Realtor.com’s senior economist Joel Berner emphasized, “While some homebuyers have found recent mortgage rate drops encouraging, it may take longer for many to return to the market.”

With the current economic climate, many homeowners are also looking to refinance their mortgages. Applications for refinancing surged 10.9% last week as borrowers seek to take advantage of the lower rates.

Current trends indicate that less competition and more favorable conditions for buyers may emerge if the decline in mortgage rates continues.