Business

Analysts Share Insights on DTE Energy’s Market Performance

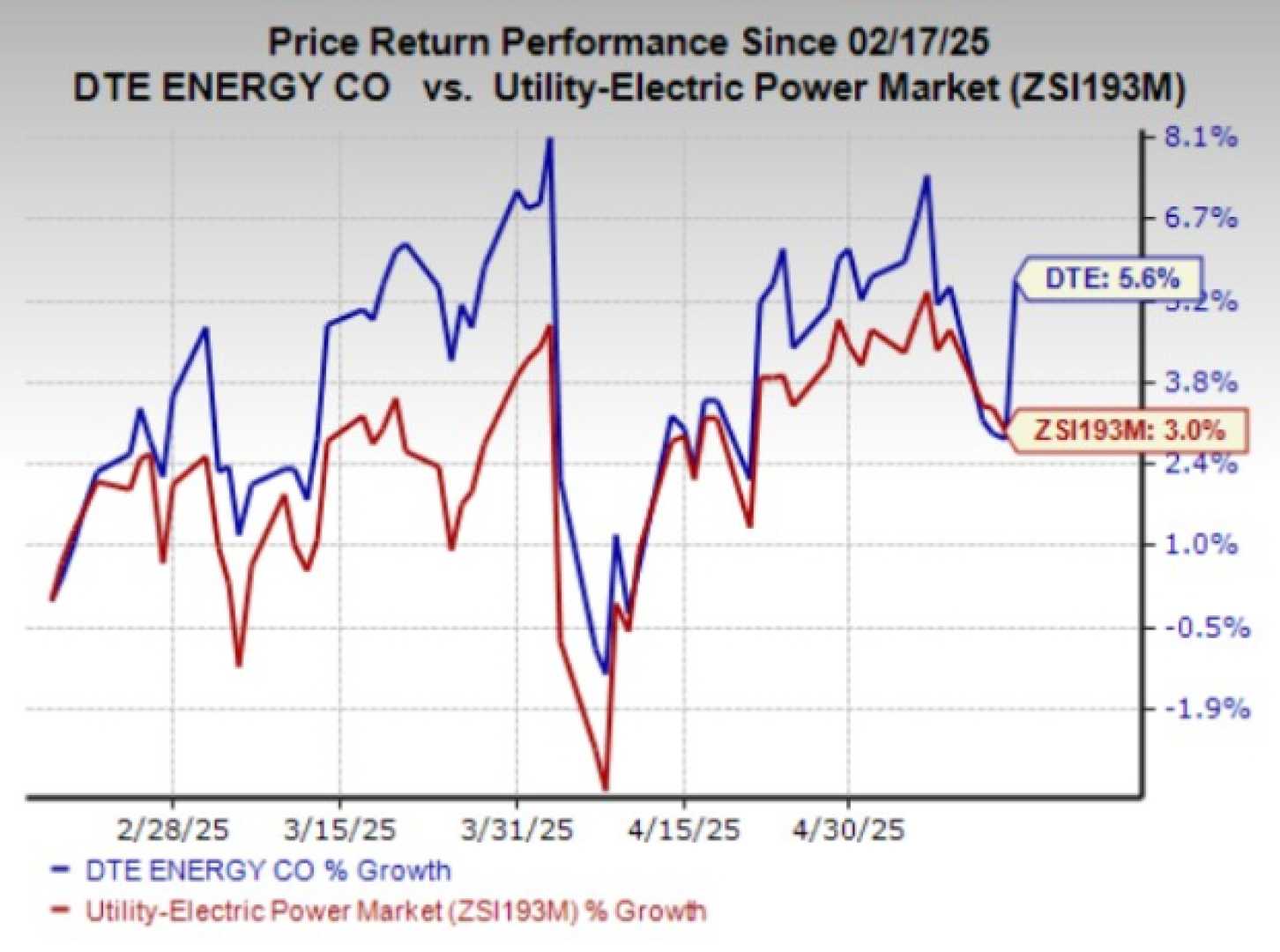

DETROIT, Mich. — Analysts have recently shared varied opinions on DTE Energy‘s stock performance. Over the past three months, a total of six analysts provided ratings, revealing a mix of bullish and bearish sentiments.

The 12-month price targets for DTE Energy (DTE) average $143.00, with estimates ranging from a low of $134.00 to a high of $154.00. This average shows a 4.38% increase from the previous target of $137.00, indicating a positive trend in analyst perspectives.

DTE Energy operates two regulated utilities in Michigan, holding a dominant position in the state’s energy sector. DTE Electric caters to around 2.3 million customers in southeastern Michigan, while DTE Gas services approximately 1.3 million customers statewide. The company also engages in nonutility ventures like energy marketing, renewable natural gas facilities, and industrial energy projects.

Recent performance highlights show DTE achieving a significant revenue growth rate of approximately 37.04% as of March 31, 2025. This growth rate surpasses that of its peers in the Utilities sector, indicating a robust expansion in earnings.

However, DTE’s financial metrics reveal some challenges. The company’s net margin stands at 10.0%, below industry standards, which may signal issues with profitability. In contrast, DTE’s return on equity (ROE) is favorable at 3.76%, indicating effective use of shareholder capital.

Additionally, DTE Energy’s debt-to-equity ratio of 1.97 is lower than the industry average, suggesting a more conservative approach to financing. These factors combine to provide a comprehensive view of DTE’s financial health.

Analysts emphasize the importance of their ratings as indicators of potential stock performance, based on thorough evaluations of the company’s financial statements and market conditions. Investors are reminded that these ratings reflect the analysts’ professional opinions and should be interpreted as such.