Health

Average ACA Premiums Set to Rise 26% Amid Subsidy Uncertainty

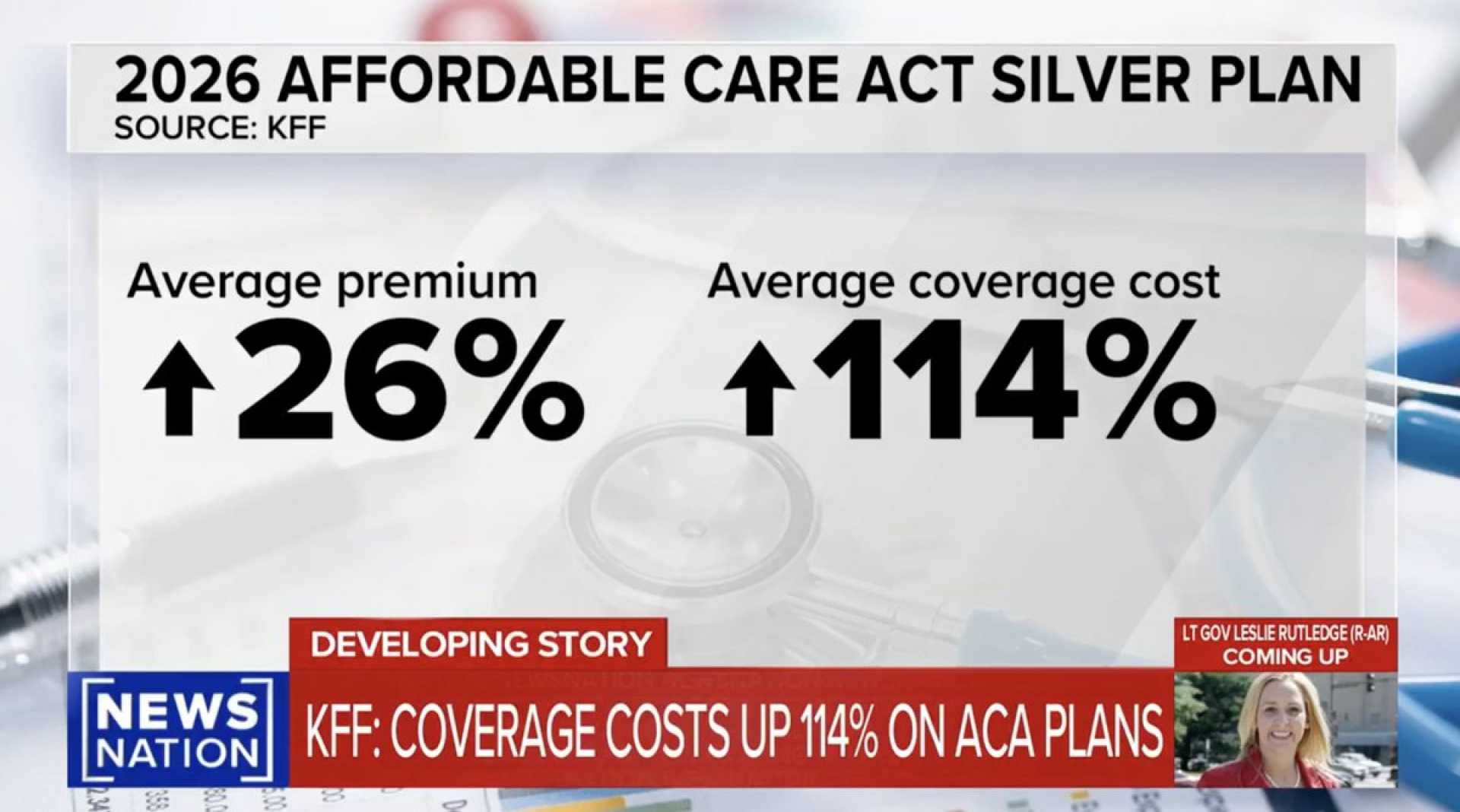

Washington, D.C. — Health insurance premiums for coverage on the Affordable Care Act (ACA) marketplaces are expected to rise by an average of 26% in 2026, according to a recent analysis by the Kaiser Family Foundation (KFF). The proposed increases follow a turbulent political backdrop that includes the expiration of enhanced financial assistance for enrollees.

The data, released on October 28, shows that in states utilizing the federal Healthcare.gov platform, premiums for benchmark silver plans will increase an average of 30%. In contrast, states managing their own marketplaces are looking at a 17% rise, which contributes to the overall increase in costs.

Roughly 22 million out of 24 million marketplace enrollees currently benefit from subsidies that offset premium costs based on household income. If Congress fails to extend the enhanced premium tax credits, KFF estimates that those receiving financial assistance could see their monthly premiums more than double.

Many lower-income enrollees may downgrade to bronze plans with much higher deductibles, potentially over $7,000, even if they find premiums that remain low. The expected increases stem not only from hospital costs and more frequent use of expensive medications like GLP-1 drugs but also from the anticipated exit of healthier individuals from marketplace coverage if subsidies are discontinued.

“Consumers will soon be shopping and comparing health plans, and without these enhanced tax credits, they will be confronted by startlingly higher prices for coverage,” said Justin Zimmerman, New Jersey‘s Commissioner of Banking and Insurance.

As November 1 approaches, insurers encourage younger and healthier individuals to maintain coverage amidst these premium hikes. Experts warn that a potential lapse in subsidies could lead to about 4 million additional uninsured Americans over the next decade if financial assistance ends.

Despite these concerns, plans remain to allow enrollees qualifying for lower premium levels to retain access during the upcoming open enrollment period. The deadline for enrollment close is set for mid-December, allowing potential recalibrations depending on legislative outcomes.