Business

Copper Prices Surge Amid Tariff Speculation

New York, NY — Copper prices in New York soared to record levels on March 26, 2025, spurred by speculation that President Donald Trump may impose tariffs on copper imports in the near future. The most actively traded copper futures contract reached a peak of $5.374 per pound before settling at $5.24 per pound.

n

This remarkable surge marks a 30% increase in copper prices for the year, dramatically outpacing the 16% rise in gold. Traders rushed to stockpile copper, driven by anxiety over potential tariffs that Wall Street had originally anticipated would come later this year.

n

While no formal announcement has been made regarding tariffs, Trump initiated an investigation in February to explore the national security implications of copper imports. “Copper, a key industrial metal, continues to rally on the assumption that it’s just a matter of time before tariffs are imposed,” said Ole Hansen, head of commodity strategy at Saxo Bank.

n

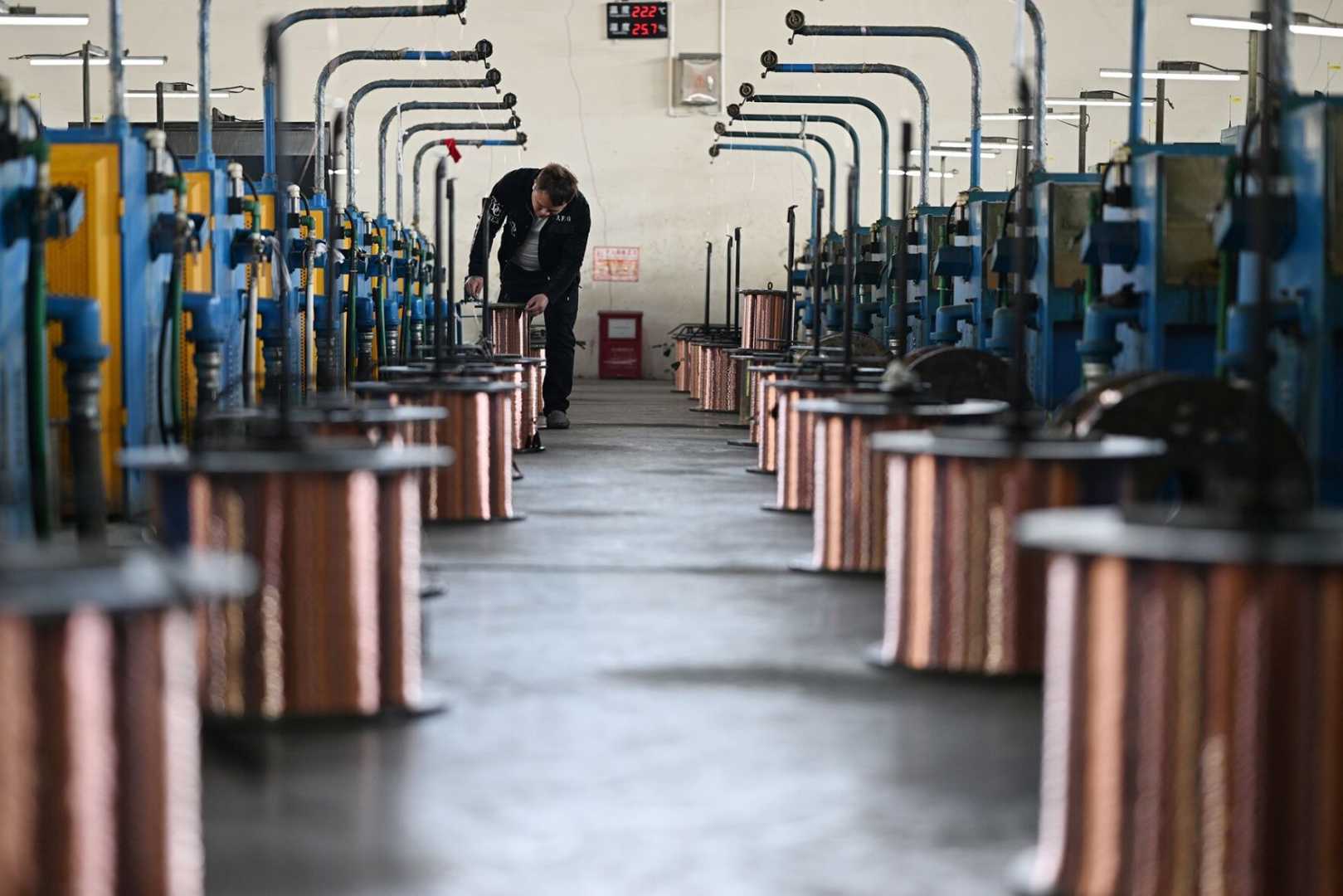

Although not classified as a rare earth mineral, copper is considered critical for energy infrastructure. The malleable metal plays an essential role in various sectors, including construction, manufacturing, electronics, and defense.

n

According to Hansen, the recent price spike is primarily tied to stockpile movements rather than underlying consumer demand. He noted that trading patterns have shifted since January, with New York copper futures now commanding a 17% premium over those traded in London.

n

Commodities giant Mercuria estimates that approximately 500,000 tons of copper are being shipped to the U.S. this month, significantly higher than the standard monthly import of 70,000 tons. “The front-running of potential tariffs has unleashed a wave of near-term demand for copper housed in the U.S.,” said Adam Turnquist, chief technical strategist at LPL Financial.

n

Analysts at Goldman Sachs indicated that shipments of copper to the U.S. could be fast-tracked, projecting an increase of 200,000 tons in April alone. Initial expectations had anticipated tariffs to take effect between September and November.

n

In addition to tariff concerns, other market dynamics are contributing to the rising copper prices. Global demand for copper is increasing, particularly in the energy sector and technology related to electric vehicles, alongside consistent demand from China. Meanwhile, a recent suspension of production at a major copper smelter in Chile by Glencore has exacerbated the supply constraints.

n

Experts warn that the excess demand in the U.S. could lead to diminished reserves for the rest of the world, with projections suggesting that only 70% of global copper demand will be met by 2035, according to the International Energy Agency.

n

Despite the ongoing speculation regarding tariffs, the market remains on edge awaiting Trump’s policy decisions. Analysts at Commerzbank cautioned against overreaction, stating that a price correction could occur as the initial surge in demand stabilizes.